Advancing Financial Inclusion Through P2G Payment Digitization

Today, global person-to-government (P2G) payment flows, estimated at US$7.7 trillion, are a “significant feature of the global payment landscape.” Despite the value in digitizing these payment flows, only a small proportion have been fully digitized in emerging markets. In an effort to map the current state of digital P2G payments globally, in January 2016 CGAP and Karandaaz Pakistan embarked on a joint effort with the help of Dalberg Global Development Advisors. We identified and examined some of the most interesting and informative digital P2G payment efforts from across the globe. It is the first time that a systematic review of P2G payments has been conducted and that the potential to digitize this payments type has been assessed.

An examination of over 60 initiatives, conversations with almost 200 experts and users, and in-country research in three nations helped shape the findings of the report. The report focuses on (1) exploring the link between digitizing P2G payments and increased financial inclusion for bottom-of-the-pyramid customers and (2) highlighting the ingredients needed to set up efficient and sustainable digital P2G solutions on a country level.

What we mean by digital P2G payments

The definition of P2G payments is generally accepted as “those payments made by individuals (payers) to government agencies or public sector organizations (payees).” This includes mandatory payments like taxes and fines, payments for government services like utility payments or passport fees, and co-payments for social benefits such as insurance. Until recently, no organization had put forth a definition of digital P2G payments.

The team recognized this lack of a common definition as problematic, not least because it caused confusion around the basic questions of which payments initiatives were already digital, and what digitizing a P2G payment would entail. In addition to creating clarity around these questions, the team felt that from a financial inclusion perspective, the definition should account for the maximum number of payer types (i.e., not only citizens, but also other residents such as migrants or refugees) and recognize the importance of both opening and continually using accounts. Thus the research uses the following definition: “Digital P2G payments are the transfer of funds directly from an account of an individual or business to an account of the government, making use of a digital payment method.”

Unlike the traditional definition, in the proposed characterization of a digital P2G payment, the payer must make the payment through his or her own account – though agent-assisted digital transactions are permitted. In addition, the entire payment process must be digital end-to-end, including the channel (e.g., mobile phones, PCs, ATMs), instrument (e.g., debit card, electronic fund transfer), and store-of-value (e.g., bank account, electronic money account). The emphasis on a fully digital system is important as it allows both the system and customers to accrue the full benefits of a digital payment, including decreased leakages, increased transparency and significant cost and time savings.

Any number of digital channels/instruments/stores-of-value fall under this definition. But from a financial inclusion perspective, it is worth noting that those with the greatest overall reach, including geographical scope and market penetration, are preferable to those with lower reach.

Discussing the global landscape of digital P2G payments

Digital P2G initiatives tend to be one-offs and not well-integrated into the wider national payments infrastructure or national payments strategy of developing countries. Given the absolute and relative value of P2G payments, as well as their uniquely wide reach, the report finds that digitizing these payments can positively impact financial inclusion when approached properly and can hold considerable benefits for governments, businesses and consumers, alike, in the form of alleviated costs and new prospects. In emerging markets alone, digitizing P2G payments is an estimated US$375 billion opportunity.

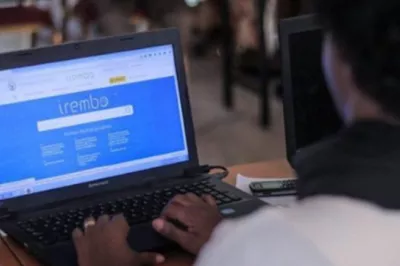

Over the coming weeks CGAP will publish a series of blogs looking at some of the results of the report in greater detail. We hope it will spark some conversation around the importance of digitizing P2G payments alongside other payment types, and how best to approach P2G digitization in light of financial inclusion challenges. The series will look at some of the best practices for digitizing payments to expand reach to bottom-of-the-pyramid customers, examine in detail Rwanda’s Tap and Go digitized transport payment system, compare the digital government payment platforms of Jordan and India, and explore a single P2G use case end to end. We invite you to read, share and add your comments.

Add new comment