All about Where the Curves Meet

There’s been some on-line argument lately in the list-serves about the relative development merits of microcredit and small/medium enterprise (SME) credit. Some have complained that all the resources devoted to microfinance have starved SME finance of the support it deserves.

I know something about microfinance but much less about SME finance, and certainly am not qualified to opine on which does more for poor people. But I’d like to point out one factor that may help explain why microfinance gets so much more airtime than SME finance with most donors. I’m speaking on the basis of impressions, not hard data, and would welcome correction from anyone who has more of the latter to add to the discussion.

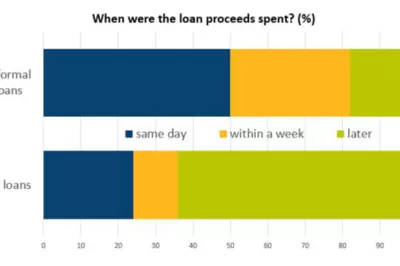

It seems to me that the basic challenge in both micro and SME finance is that it costs more in absolute terms to lend a given amount in a number of small loans rather than one big loan, especially when it comes to those household and enterprise loans where approval decisions can’t be based on automatic scoring. Higher expenses for smaller loans mean higher interest rates. On the other hand, smaller borrowers tend to have less cash, and the more cash-constrained the borrowers are, the more productively they can use additional cash and the higher a price they can pay for borrowing–within limits, of course. (This law of diminishing returns applies to loans used for business, but I think it also applies to some extent for loans made for household purposes, many of which have an investment dimension.) Anyway, the issue is all about where these two curves meet.

The so-called “microfinance revolution” spread around the world, not because someone finally got interested in the poor and their enterprises, but because pioneers discovered new lending techniques that permitted large cost reductions, not least of all by lending to microentrepreneurs without the necessity of detailed analysis of their business plans and balance sheets. That got costs down to a level where a lot of poor and near-poor people could pay them and still come out ahead. In other words, someone discovered a new trick or two.

When we turn to small and medium enterprise lending, two things strike me. The first, the diminishing-returns curve would seem to be a lot flatter for SMEs, so as loans get smaller in that range, the enterprises’ profits from the borrowed funds don’t rise as fast as the costs of smaller loans rises; accordingly, most SMEs can’t pay interest rates nearly as high as microborrowers can. The second one, there haven’t been many great new tricks developed to lower the cost of SME lending. I think these two factors may pose a basic challenge for SME finance. Nilesh Khare adds a third: analysis of SME project lending requires access to reliable financial reporting and other systems that tend to be weak in developing markets.

Of course, it is possible to do profitable SME lending in developing countries. We’ve seen it done. But my impression is that management needs to be particularly competent to pull it off, and that the competence bar is higher for SME finance than for microfinance. If this is true, then donors who concentrate more on micro- than on SME finance may have at least one reason that is more substantial than just dismissing the economic and distributional benefits of SME. I think it’s probably easier to make microlending work, and easier to scale it up. My impression of the relevant history is that past donor forays into SME finance (there have been many, over a long period of time) have been less effective than the donors’ support to microfinance. And what new SME lending techniques do we have that will change that result?

As a thought experiment, I picture a loan officer analyzing one $250,000 SME project loan in Bangladesh. The project analysis skills s/he needs to do that may not be a great deal less than the skill needed to underwrite loans of that size in the US. But I’d guess that the per capita supply of such skills is an order of magnitude lower in Bangladesh. If I substitute $250,000 of microloans, it’s obvious that Bangladesh has plenty of the skill needed to analyze and manage that kind of portfolio.

I don’t know ProCredit’s SME lending techniques very well. It’s possible that they provide a counter-example to my no-new-SME-tricks argument above, by applying some new microcredit methods in their SME loan underwriting. But they’re an exceptionally competent bunch; how easy has it been to transfer their skills to bankers and make them stick?

Comments

Richard,

Richard,

Very interesting argument you pose here, but I have a couple of questions and observation.

I think to have a valid argument you need to define microfinance and SME. What is the difference in your opinion? Are you referring to loan sizes or the difference in lending methodology? Until such definition it’s hard to answer questions on cost structure and benefits. For my argument I will separate the two concept into group lending (microfinance)and individual lending (SME).

Unfortunately in most developing countries reliable scoring models have not been developed to effectively assist with credit decisioning. It is possible to have a sustainable SME lending practice without reliable financial reporting or credit scoring system. I know many MFI’s that do it every day as long as they are clear on risk management.

Transferring microcredit methods into SME lending might not be the best solution, but the reverse instead. In order to maintain a sustainable micro lending practice (and I mean group lending here) we need to borrow some ideas, like basic business and cash flow analysis from individual lending.

Thanks,

Tom

Hi Richard,

Hi Richard,

I thought this might be of your interest. Japan Finance Corporation (JFC)’s Micro Business and Individual Unit (JFC-Micro) has been aware that there is a financial gap between microfinance and traditional SME finance in the developing countries. They have been making loans to Micro and Small Enterprises (MSEs) and individuals in Japan and realized that their credit analysis techniques could be applied to fill in this gap. Now they offer technical Cooperation to transfer the skills to MSE finance in the developing countries.

For more information please see: http://www.k.jfc.go.jp/pfce/international/01_airpocket.html

Akiko

JBIC (day job)

Living in Peace (lifework) *We are preparing for the first microfinance fund in Japan.

Dear Richard,

Dear Richard,

You raise an interesting question about ProCredit and its success (and its high abilities). Is it transferable? From my understanding, EBRD was effectively trying to do just this with a number of projects with banks in Central & Eastern Europe and the Former Soviet Union. How are those banks doing now?

Shannon

Add new comment