Building Payment Rails in Frontier Areas Through Off-Grid Solar

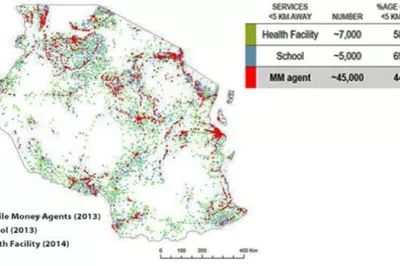

Every day, hundreds of thousands of customers in East and West Africa keep their lights on by making digital payments. Off-grid, or pay-as-you-go (PAYGo), solar companies serve energy-poor customers, most of whom are widely distributed in rural areas. Because few customers can afford to buy solar equipment upfront, these companies use digital payment channels to accept small but regular payments over time. However, as highlighted in a recent CGAP blog post, the rural distribution of off-grid electricity can quickly become a challenge. For customers, the lack of financial access points, mostly mobile money agents, means that they cannot top-up their electricity, resulting in periods of darkness. For solar companies, this translates into delays or even outright loss of revenue from customers who are willing and financially able to pay.

For these reasons, PAYGo solar companies have had to invest heavily in building parts of the digital payments rails themselves: registering customers for mobile money, teaching them how to pay their energy bills digitally and helping them locate the nearest agent or payment point. But that’s still not enough in many cases. The nearest agent is simply too far away from customers, and PAYGo solar demand suffers as a result. In response, some companies are setting up their own physical payment points where customers can pay in cash. In some ways, this is counter to their business models.

These burdensome workarounds got us at CGAP wondering: What if, instead of absorbing the cost of performing agent-like duties, PAYGo companies actually became master agents? There are many master agent models, but what they all have in common is that master agents (also called “agent network managers”) recruit and manage a network of mobile money agents, taking responsibility for liquidity rebalancing. Some choose to buy and resell float. By becoming master agents, PAYGo companies would continue to help their customers pay in cash or digitally but with a big difference: They would generate revenue from cash in/cash out fees, including on transactions unrelated to the solar business. Providing more agents to underserved areas might help unlock the broader use of mobile money, increasing fee revenue over time while promoting financial inclusion.

To get a deeper sense of PAYGo companies’ payment challenges and whether this could be a solution, we spoke with four companies in East and West Africa. Here’s what they had to say.

Payment frictions are a significant drag on revenue

Providers in East Africa indicated that close to 30 percent of their customers experience significant frictions during their payment journeys. In emerging PAYGo markets in West Africa, providers point to rates of 50 percent or higher. At the most basic level, the limited reach of mobile money agents in rural areas makes it harder for customers to pay their bills on time and reduces PAYGo providers’ monthly revenues. These delays can increase by up to 40 percent the time required for remote customers to pay off solar leases. They can also raise the cost of running a PAYGo call center, because company representatives must spend time to follow up with customers who are behind on payments and help others find an agent or complete a transaction.

Payment workarounds are costly

The lack of rural agents has forced PAYGo providers to devise sometimes expensive workarounds, but little has been done to rigorously document their effectiveness and evaluate their potential for scale.

A common strategy is to build flexibility into PAYGo lease terms for customers who have trouble reaching an agent or who experience other difficulties. Some providers allow customers to stop using and paying for their solar systems for a few days without incurring a penalty, while others permit repayment periods that are longer than those originally communicated in the lease term. Another popular approach is to integrate the PAYGo platform with all major mobile money providers to ensure customers have multiple cash-in or direct over-the-counter bill pay options. Many providers have also established call centers or agent field forces to educate consumers on the proper use of mobile money, assist with payments and help customers find the nearest agent.

Though less common, some PAYGo providers have equipped roving service or customer care agents with either solar unit float accounts or mobile money agent accounts. These agents travel from village to village, enrolling new customers in PAYGo and facilitating electricity top-ups for a commission paid by the PAYGo provider. They can also conduct cash-in transactions if a customer lacks easy access to a mobile money agent. We also learned that some providers are offering fixed agent points an extra commission — 1 to 5 percent of the transaction value — to facilitate payments on behalf of rural PAYGo customers. This approach saddles PAYGo providers with costs in addition to the normal bill pay transaction fees.

PAYGo companies as master agents?

The idea of becoming a master agent resonated with many PAYGo providers. From their perspective, not only would it help customers pay, but over time it could potentially generate revenues from nonsolar-related transactions. By providing an agent presence in underserved areas, providers saw that they could encourage the broader use of mobile money and that the master agent business might become an additional source of revenue. Of course, from a financial inclusion perspective, all of this extends poor people’s access to financial services in remote areas, where it has proven difficult for other financial services providers to build mobile money agent networks.

This idea sounds nice in theory, but would it work in practice? CGAP partnered with Zola Electric (née Off Grid Electric), a leading PAYGo provider in Tanzania, Rwanda and Côte d’Ivoire to find out. In the next post in our “Frontier Agents” blog series, we share Zola Electric’s experience along with a financial model that other providers can use to see whether the master agent approach makes sense for them.

Add new comment