Can Equity Investors Contribute to Building Inclusive Markets?

CGAP has written extensively in recent years on why and how funders should shift from an institution-building approach to a market-building one. The shift for many funders is still a work in progress, and CGAP is working on developing tools to operationalize the approach. As part of this effort to build more inclusive financial markets, it is important to consider the kind of funding instruments that are being used.

Different funders are equipped with varying instruments, such as grant or debt, that determine the way they support the development of inclusive financial markets. One instrument that has caught our attention is equity.

Why equity, you might ask? Isn’t equity investing about building institutions instead of markets?

By purchasing shares in individual businesses, the nature of equity investing may indeed appear to contradict this broader perspective. However, a new CGAP paper argues it can play a broader role in building inclusive financial markets. It also acknowledges some of the internal challenges equity investors face to achieve this end goal and possible solutions to explore further.

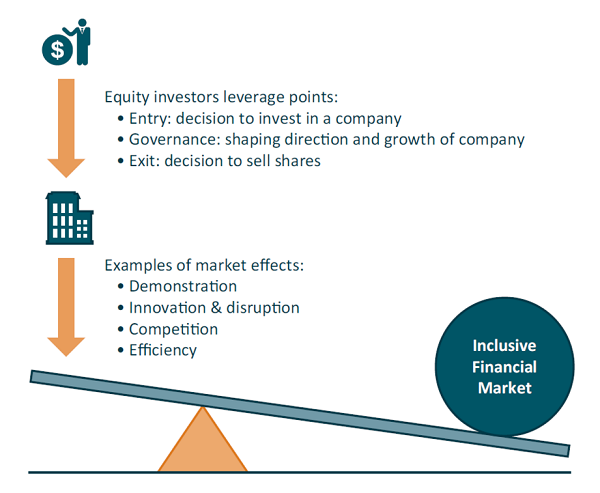

Development finance institutions (DFIs) and social investors have three distinct opportunities, through equity, to shape market players and in turn influence how markets develop by potentially driving competition, promoting innovation, improving market efficiencies, creating demonstration to crowd-in others, and ultimately better serving customers. This is especially important, if they want to have maximum impact.

These opportunities relate to three leverage points – entry, governance, and exit – which equity investors can use to engage with their investees to act in ways that develop the market:

Entry

At the outset equity investors can have a substantially wide choice of investees. The higher returns potentially available to equity investors enable them to take more risks. In addition, a loss on one investment can, at least theoretically, be offset by the gain on another so long as there is a sizeable investment portfolio.

Depending on the type of business, investments can have a different impact on the market. For example, an investment in a company with a business model that has not yet been fully tested, such as a fintech, may have the potential to disrupt the market. But beyond innovative startups, investments in scaling businesses that are well-positioned for significant expansion in underserved markets and/or lower-income segments can develop markets. In addition, investments in companies that engage in providing market infrastructure services such as information platforms and credit bureaus could contribute to improving the market’s overall efficiency.

However, to date the majority of DFI and microfinance investment vehicles (MIV) funding is going to financial service providers serving the lower-income segment and whose business model was proven a long time ago. There is a mismatch between the capital most needed for market development and what is being offered, which is linked to the equity investors’ structures.

The private equity model often used in financial inclusion is more suitable for large investments, contrasting with the needs of innovative or market infrastructure businesses that require relatively small investments and considerable hands-on support. DFIs also have limited appetite for risk, despite their mandate to provide patient capital and invest where private investors fail to invest sufficiently because of real or perceived risks.

Governance

Equity investors also contribute to these returns by being actively involved in the development and governance of the investee. Careful selection, participation, and strategic guidance of board members in the business can influence market development. Their support and guidance to develop an innovative business model or scale a proven business one can create a demonstration effect in the market, crowding in others – including new investors – and/or influencing the competitive environment.

Although equity investors have dedicated substantial resources to improving governance, recent evidence in microfinance suggests that DFIs and social investors are not fully capitalizing on the opportunity to use this key leverage point and strengthen financial services providers’ governance. Additionally, integrating market development considerations into the governance process is even more challenging than the challenges of corporate governance more generally; shareholders and the board need to agree on objectives, appropriate metrics, and assessing progress.

Effects on the market are also more likely to take place if the successes (and failures) are well documented with relevant information and widely shared, which is not yet common practice among the investor community.

Exit

Equity investors’ exit decision results in a change of ownership that can potentially change a business’s strategy and how markets develop. The optimal exit from a market development perspective is one in which the new investor is committed to the investee’s mission and contributes new resources, such as funding, experience, and ideas, to the next stage of the investee’s development. Yet, this is the leverage point over which investors have the least control.

An investor’s exit can send important signals to other market players if, when exiting, there are careful considerations around four key strategic decisions: (i) when to sell, as the timing can result in exits that are not optimal for the investor, the investee, and/or the market.; (ii) who to sell to, as investors need to weigh on the commitment of the potential buyer to a business’ stated mission and how it can add value to the company; (iii) with what conditions and mechanisms, as conditions shareholder agreements might help reinforce the business’s mission and social commitment but they can also putt off potential buyers; and (iv) at what price, as unprofitable exits create warning signals for other investors as well as extraordinarily profitable exits risk creating unrealistic expectations.

The potential for DFIs and social investors to use their leverage in ways that result in more inclusive financial markets is exciting and capitalizes on their experience working with individual investees. The shift to focus on market does not mean that investors need to compromise on their investment goals; rather, they can pursue their interests in ways that also benefit the market as a whole.

As impact investing continues to gain traction, it is imperative that investors focus more on how they can engage with their investees to act in ways that develop the market, use their leverage points more effectively and achieve sustainable impact. The paper explores further the opportunities for equity investors to contribute to building inclusive financial markets as well as challenges to overcome and specific areas that warrant further efforts.

Add new comment