Can User-Friendly Payment Methods Improve Repayment Rates?

The idea that digital payments should be enjoyable, or at least stress free, is not new in the smartphone world: Venmo, Davivienda and Apple Pay have each developed fun or intuitive payments services to help transition their apps from the hands of early adopters to the broader public. Companies doing business in countries where smartphones have become the norm benefit from the ease with which customers can make digital payments. Unfortunately, USSD-based phones still dominate most low-income countries, and the user experiences they offer can create real problems for businesses.

Making mobile money payments on USSD is still really, really hard. The menu is text-based, which excludes illiterate and older customers. Depending on the carrier, making a payment requires users to complete up to a dozen steps and remember long numbers, such as bill pay, account or PIN numbers. The whole process is timed, so a user who takes too long must start over. Even payments that are sent correctly sometimes fail to arrive due to network coverage and system issues. Half of all mobile money bill payments take place in just two countries (Kenya and Tanzania), and frictions in the payment process are one of the primary reasons mobile money has not spread further and faster.

PEG Africa is one of the many companies to appreciate the importance of a good USSD user experience. An asset financing company that offers pay-as-you-go solar loans, PEG hopes to see its customers in Ghana and Cote d’Ivoire pay their bills via mobile wallets. Yet too often, customers who do not understand how to use their wallets end up relying on mobile money agents or pay-as-you-go company staff to make payments for them. Visiting an agent brings another actor into the equation with his or her own schedule and incentives. This reduces the reliability and frequency of paying with a mobile wallet, which in turn leads to slower repayment and higher default rates.

In late 2016, CGAP partnered with PEG Africa in Ghana to demonstrate that creating a better USSD user experience could boost customers’ uptake of mobile money.

Paying with a dash, dialing to send cash

In Ghana, we piloted two alternative payment methods that we thought would encourage customers to use their own mobile money accounts. These methods were developed in response to a human-centred design process (covered in a previous blog post), which among other things suggested that any new solutions would need to simplify the process for customers not accustomed to playing an active role in their payments.

- Pay-over-phone (POP). Customer-centric research indicated that people were used to passive payments that involved human interactions. It also showed that customers were often skeptical of mobile money and regularly called PEG to confirm their payments. We figured: If customers are going to call every time they make a payment, why not create a way for them to pay over the phone? With POP, a customer simply calls PEG to indicate that he or she is ready to make a mobile wallet payment. PEG then initiates the “pull” transaction, and the customer approves using a PIN.

- STAR payments. Working with mobile network operators, PEG also developed a generic USSD string that any customer can enter and save as a contact. They can then “call” this number, which is a numeric equivalent of the USSD menu, and enter the amount they want to pay and their PIN to execute a payment.

Both of these approaches turn a complicated process into two simple steps.

Results

The results from the pilots and subsequent scale-up were encouraging:

- Initial pilots of POP payments showed that users paid 13 percent more often and 23 percent more per payment than a control group.

- Encouraged by the results, PEG rolled out both payment methods in the spring of 2017 with a grant from the Scaling Off-Grid Energy Challenge supported by USAID, the U.K. Department for International Development (DFID) and Shell. In May 2017 alone, more than 20 percent of PEG’s users paid using the POP or STAR method, up from approximately 5 percent in December 2016.

- 79 percent of own-wallet payments are now paid over the phone, and adoption continues to grow rapidly.

These findings underscore the importance of user-friendly mobile money interfaces, but they also present an intriguing question. The aim of the pilots was to increase mobile money usage, but the piloted innovations propose a move away from the conventional mobile money menu. Is it necessary for users to become comfortable with the underlying product? Or is it sufficient that they can carry out the key functions they need? The slow adoption of advanced services suggests that we may need to think beyond the conventional menu to drive adoption.

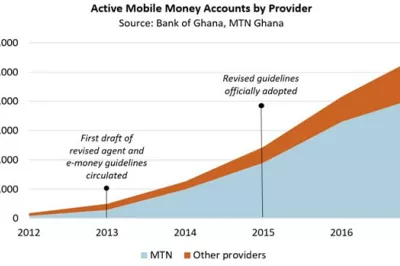

Despite this work, Ghana remains a slow-growing market for mobile payments. PEG is pursuing other initiatives, such as offering health insurance. They are also guaranteeing payments in an effort to build trust in the overall mobile money experience. Such solutions, along with others like NFC “tap” payments and easy-to-use biometric apps, can help build digital financial services that everyone can use. For new business models to be built on digital payments, customers must want to pay digitally.

Add new comment