Can Voice Corridors be Used to Predict Mobile Money Hotspots?

Are mobile phone customers likely to send money to the same people they call? CGAP recently commissioned Real Impact Analytics to explore this idea and, more specifically, to find out whether voice corridors are a good predictor for mobile money corridors.

We found that mobile money providers cannot automatically assume voice corridors will be popular for mobile money transactions. The reason is that the majority of phone calls placed in our sample are over relatively short distances – 76% of calls were within 100 kilometers. By contrast, over 67% of person-to-person mobile money transfers were sent to people more than 100 kilometers away.

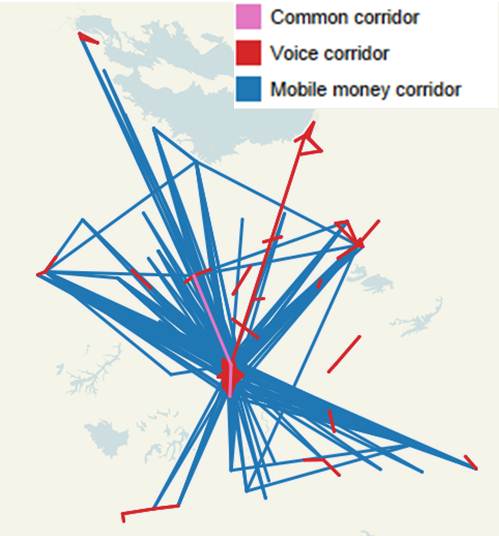

There is little overlap between the top voice and mobile money corridors in our sample countries.

Voice corridors don't overlap with mobile money corridors

Voice corridors don't overlap with mobile money corridors

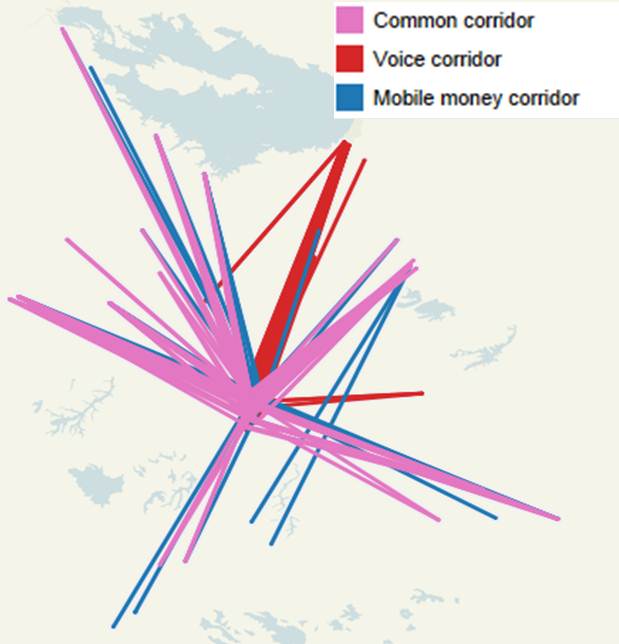

This data, based on calls and mobile money transactions performed by over 10 million MTN customers across Cote d’Ivoire, Rwanda and Zambia, suggests that in order to predict a high-use area for mobile money, providers might be better off filtering their analysis to focus on calls that are over longer distances. These longer distance calls should be helpful in identifying a meaningful proportion of the main mobile money corridors. For example, if you look at MTN in Cote d’Ivoire, Rwanda, and Zambia, 45%-60% of the top long distance voice corridors are also top mobile money corridors.

When longer distances are considered, there is more overlap between voice and mobile money corridors.

We hoped this correlation would be stronger, which would have given mobile money providers (with access to voice data) even clearer direction on where to focus investment in agents, marketing and education campaigns. However we still think that voice corridors are useful for providers, and can be used as part of a broader strategy to predict the top mobile money corridors, particularly for those MNOs launching new services. In fact, the overlap between voice and mobile money corridors was higher in the country which had a lower level of mobile money activity. This suggests a higher relevance for newer providers. A potential explanation is that as mobile money is more widely adopted, customers become more comfortable using it to send payments to a broader range of people beyond their immediate friends and family, thereby decreasing the overlap with top voice corridors.

The research we completed reveals several unanswered questions. For example, in cases where popular voice corridors are not also leading mobile money corridors, what’s driving the lack of mobile money usage? Is it a lack of demand (opportunity), or perhaps lack of investment on the part of providers? Further research is necessary on this.

More research is also required to explain the reverse – why some of the top mobile money corridors are not also top voice corridors. For example, we found that some international borders see disproportionately high transaction volumes. Perhaps, in the absence of an attractive international mobile money transfer service between neighboring countries, customers send money to the border which then gets cash out and physically carried into neighboring countries . There could well be other use cases or country specific characteristics which explain the other major corridors.

The report deck also highlights how this type of analysis can be used to identify weaknesses in agent networks - we found that a number of the areas in most need of cash often have fewer agents per 1,000 mobile money users. Have a read through the brief report and let us know if you have done similar analysis and how your results compare.

Can Voice Corridors be used to Predict Mobile Money Hotspots?

Michel Hanouch is part of the Technology and Business Model Innovation Team at CGAP.

Add new comment