Daily Energy Payments Powering Digital Finance in Ghana

Much has been written about the potential of pay-as-you-go solar to advance financial inclusion while expanding access to energy among the poor. One of the biggest challenges in promoting digital payments is that often there is not a strong value proposition for customers; people don’t want to switch from cash payments unless there is a good reason. The excitement around pay-as-you-go (PAYGo) solar is that by linking digital payments to useful everyday products or services, like reliable energy, customers have more attractive reasons to adopt and use digital payments. But does the data show this actually happening? New CGAP research in Ghana, carried out in partnership with PEG Africa and Tigo Cash, indicates yes.

To date, there has been isolated evidence that solar payments could drive mobile money use. Fenix International reported that at least 13 percent of their customers registered for mobile money in order to purchase a ReadyPay product, while in Rwanda, Mobisol estimated that 20 percent of their users were newly registered to mobile money services. But there has also been a long-held hypothesis in the industry that PAYGo customers are better active mobile money customers — that by making mobile bill payments on a regular basis, they become more comfortable and active users of additional mobile financial services. Increased usage means higher revenue per active user, making digital finance a more sustainable model for reaching the poor.

Testing this assumption required the right partners. Tigo Ghana is one of the leading DFS providers in Ghana. Its mobile wallet offering, Tigo Cash, has over 3.5 million registered subscribers. Converting them into active users remains an issue, as it does throughout the industry. PEG Africa is a financier of life-changing assets and a leading pay-as-you-go solar company in West Africa. PEG has installed over 20,000 solar home systems, bringing reliable lighting to over 100,000 people in a country where half the population lives off the grid and the other half suffers from unreliable electricity service. And as a business that relies on digital payments, PEG has been actively working with mobile money operators like Tigo Ghana to innovate in the mobile money arena.

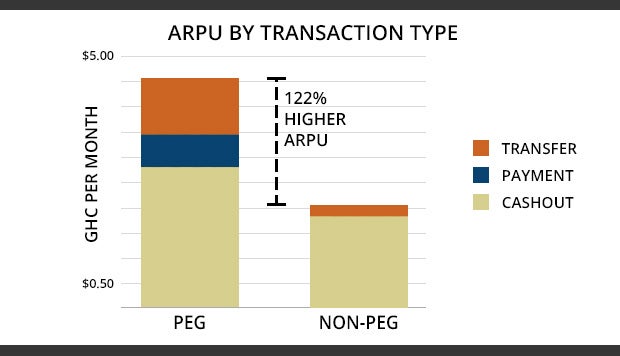

CGAP worked with both organizations to compare active Tigo Cash users who are PEG customers with a sample of active Tigo Cash users who are not. The goal was to measure the average revenue per user (or ARPU) generated for Tigo within each sample, giving us a better idea of whether pay-as-you-go solar was really driving uptake of digital payments.

The difference in average revenue per customer was illuminating: PEG customers generated 122 percent more revenue per active user for Tigo Cash than did non-PEG customers in the sample. A significant piece of the added revenue comes from bill payments, which in Ghana are still relatively rare. The last Financial Inclusion Insights Survey, done in partnership with CGAP, revealed that only 5 percent of active mobile money users had made a bill payment, compared with 12 percent in Uganda and 20 percent in Kenya. But within the group of active mobile money PEG customers in Ghana, 34 percent had made a mobile bill payment: much higher than average.

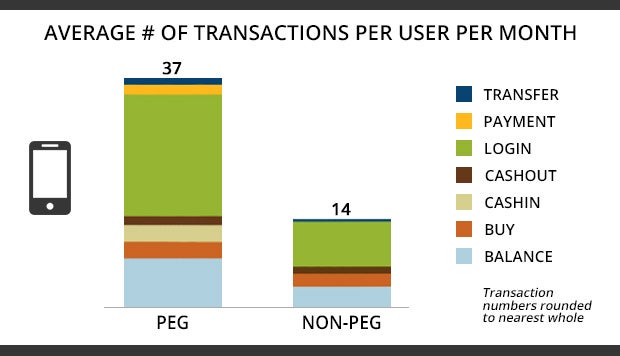

In addition to bill payments, average PEG users had a more varied use history. They checked their balances more frequently, cashed in and out more frequently, and made over three times as many person-to-person transfers per user. All told, 54 percent of active PEG users had made a bill payment or P2P transfer within the study period, against only 18 percent of non-PEG customers.

There are important caveats to these statistics. Only 16 percent of PEG users in the sample were active, compared to 40 percent of Tigo Cash users. CGAP has worked with PEG to develop easier ways for customers to pay digitally, which will hopefully lead to increased active use. And it is certainly possible that outside factors, such as age and income, played a role in creating the ARPU difference, although controlling for those was not possible given the data available.

More research is needed, but it is clear that when PAYGo solar customers use mobile money, they use it a lot. According to Carl Pomeyie, the acting head of Mobile Financial Services at Tigo Cash: “The results reiterate the need to build an ecosystem that allows Tigo Cash customers to pay for services beyond just withdrawals from their wallets. As we [at Tigo Cash] look to build a digital ecosystem throughout Ghana, providers like PEG who provide essential services will be invaluable in stimulating demand and providing a value proposition to the rural customer.”

So what can other operators learn from this example? When building out mobile money infrastructure, it is essential to think about the value for the customer and to partner with someone who offers that “hook.” PEG has become one of the largest bill-pay recipients in Ghana, despite being a relatively new company. In Uganda, Fenix International and MTN are working together to distribute co-branded PAYGo solar units, offering ReadyPay as a dedicated USSD menu option for mobile payments. In Kenya, M-KOPA products are sold out of SafariCom shops, and both organizations recently signed an agreement to facilitate advanced knowledge exchange. Partnerships like these offer tangible value that can only be acquired digitally, giving customers users a reason to not only register for mobile money, but to actively use it.

On a broader level, partnerships between digital finance platforms and more traditional service providers could produce considerable synergies. In 2009, SafariCom and Kenya Power partnered to shift electricity bill payments to mobile channels. Kenya Power is now one of the largest bill-pay recipients on M-Pesa by value. In Cote d’Ivoire, shifting school registration payments to mobile channels helped to develop the digital finance infrastructure. These partnerships do not need to happen on a bilateral basis. Opening up payment and data APIs to external developers could produce a slew of new use cases, each of which may bring more active subscribers onto the payment rails. New and improved service models that leverage digital finance may not be beneficiaries of digital ecosystems, but the cornerstone on which they are built.

Add new comment