Digital Credit: Consumer Protection for M-Shwari and M-Pawa Users

The popularity of M-Shwari, a digital savings and loan product in Kenya, demonstrates how fast, private shots of short-term liquidity can benefit customers. M-Shwari’s success has also inspired a number of similar mobile-based, small-value, short-term loan products in Kenya, Tanzania, Senegal, and the Philippines, just to name a few of the recent deployments.

Digital credit products are only going to become a more important element of financial services in emerging markets where expansion of mobile money platforms has created potential borrower segments of millions of consumers that are only an SMS away. Instant loans bring numerous benefits to consumers, they can also be risky. Because of this, digital credit products need to designed and delivered in a responsible manner to ensure transparency and avoid over-indebtedness or credit market saturation. In 2014 CGAP conducted interviews with a range of users of M-Shwari in Kenya, and M-Pawa in Tanzania, to understand the potential pitfalls that could arise with digital credit products.

Borrowing Digitally May “Feel” Different

In our conversations with M-Shwari borrowers, several of them described taking their first loan without an intentional purpose for it, and sometimes spending the money on airtime top-up because they had no other use in mind for the loan at the time. Customers also borrowed in attempts to “game” the algorithm and increase their loan limits: they borrow, repay, then immediately borrow again, as they believe that the more you borrow and repay in time, the higher your loan amount increases. While this may in fact help build their creditworthiness in the current algorithms, it can also rack up unnecessary finance costs. Customers using a more conventional lending process are very unlikely to take out loans out of mere curiosity; something about borrowing digitally feels less serious to some users.

There is also evidence that consumers may experience the loss and gain of digital money in different ways than when using cash. For example, research shows that people perceive $1 in mobile money differently than $1 in cash, and that these different perceptions influence spending habits. Similarly, the immediacy of the opportunity may change borrowing behavior compared to the process of applying for a loan in person. This difference in perception makes it difficult for some customers to resist the chance to borrow when an SMS pops up on their phone, and may create a feeling of loss aversion where the consumer does not want to miss out on the opportunity to access easy money.

Digital Loans Increase Privacy

One of the most consistent insights from M-Shwari and M-Pawa users was how they valued the private, impersonal nature of the loans, in contrast to previous borrowing experiences, whether formal or informal. Consider these perspectives of two M-Pawa users in Arusha, Tanzania:

“I cannot trust a fellow human being…my wife used to steal from me and that is why till now she cannot know my account details…I also go for a product that I know she cannot easily access.”

“Most of the loan officers from financial institutions are the ones that ask for bribe in order to process loans…I don’t trust them…others harass us a lot when we go to the branch…”

By shifting the borrowing (and savings) experience to a private, digital channel, users are able to avoid some of the inter-personal issues they may experience in other borrowing environments, such as harassment, corruption and social pressure. At the same time, this fast and private loan process may in some cases limit the ability of borrowers to check their borrowing decisions either with experts, or against the context of their broader financial life.

More interesting still, several consumers seemed to feel that M-Shwari funds were safer than M-PESA funds, even though M-Shwari runs via the M-PESA channel. As one male M-Shwari user in Kakamega noted, “It is very easy to lose money on M-PESA to fraudsters but you will never hear someone lost money on M-Shwari.”

Photo Credit: C. Schubert (CCAFS)

On Transparency, Digital Loans Can Cut Both Ways

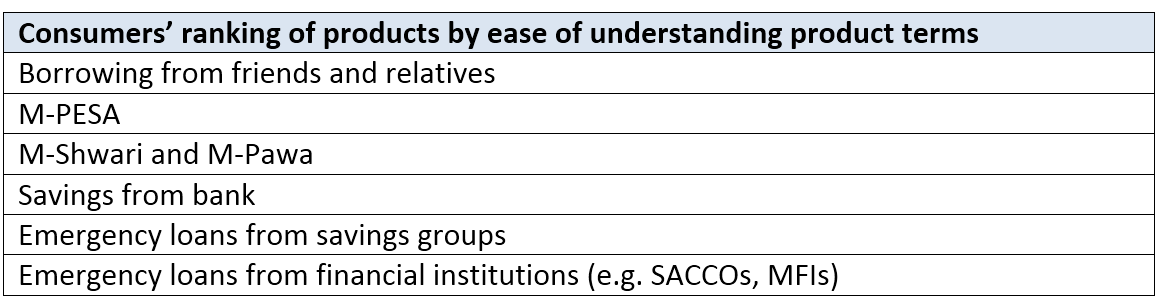

Both M-Pawa and M-Shwari utilize simple price structures, where there is one fee for the loan, payable at 30 days, and then the same fee is charged again on the outstanding balance if the borrower does not repay on time. This contrasts with the often obfuscated assortment of fees, tie-in products and “other charges” that can occur with traditional consumer credit and microcredit products. This has helped consumers to understand the general cost of these loans. When asked to rank products based on how easy it was to understand the terms and conditions, M-PESA, MShwari and M-Pawa all ranked high compared to services from banks or other institutions.

However, there are still elements that can be improved upon. First, if the customer wanted to review the product terms and conditions prior to purchasing the loan, he must exit the USSD session and visit a page on the Commercial Bank of Africa (CBA) website. This pre-purchase disclosure introduces a hassle factor that many customers admit not trying to overcome, even if they are curious about the specific terms and conditions of the loan. In our interviews only one consumer in either market had accessed these terms and conditions, and only three M-Shwari borrowers could explain well the terms and conditions related to the loan fee and repayment period.

This means that borrowers may not know the cost or conditions of their product before they accept these conditions and become obligated to pay. The consequences of this can be seen in the limited ability of consumers to explain what will happen (or has happened) when they do not repay the loan on time; many noted that there is increased interest assessed but were not able to state the penalty amount.

Despite these deficiencies in transparency, there could be opportunities to make digital credit disclosure clearer and more consumer-friendly than other channels. The ability to send instant SMS’ with summary product information can offer simple, easy to understand disclosure right at the point of purchase. Consumers’ familiarity with the SMS channel for communication also opens up opportunities to engage consumers after loan origination to further their understanding on features like repayment requirements. It is our hope that these opportunities could make digital loans market leaders in understandable disclosure for consumers. This is an area where providers, regulators and research organizations such as CGAP should continue to test and refine content -- including through testing with typical consumers -- to identify best practices for disclosure via digital channels.

Recourse is in the Eye of the User

Both M-Shwari and M-Pawa accounts are held at CBA. However, none of the M-Shwari users interviewed, and only two of the M-Pawa users, knew that CBA was involved in the product. This is perhaps not surprising given the high trust consumers noted in M-PESA - which was also a driver for trust in M-Pawa/M-Shwari. However, this multi institution arrangement can have down sides in terms of customers understanding how and where to seek out further information or file complaints. Effective recourse will necessitate a well-coordinated plan across partners for handling this, since consumers will most likely reach out to the brand they know rather than the bank that holds the accounts.

For M-Shwari, a dedicated complaints team has been created within Safaricom’s impressive call center, and they handle all inquiries regarding the product, coordinating on the back-end with CBA staff so that consumers only need contact Safaricom to resolve issues. This team also handles outreach to borrowers that are approaching the repayment date, and has been credited within Safaricom for reducing non-performing loans through proactive support to and consultation with delinquent borrowers. As noted above, some borrowers did not understand the late payment consequences of M-Shwari when borrowing, so this phone outreach offers a second chance to inform consumers of the consequences of late payment and help them avoid further penalties. As more providers enter the digital credit space, it will be important for authorities to set minimum standards for hotlines and other points of access, staff qualifications, turnaround time and coordination by partners in addressing problems raised by consumers.

Digital credit is an exciting opportunity to address the constant problem of limited short-term liquidity many low-income households face. This opportunity also brings new consumer protection risks and borrower dynamics that should be adequately addressed via improved disclosure, consumer engagement, recourse and collections practices. As more providers enter the digital credit space, it will be interesting to observe what distinct product features and consumer protection measures they adopt, and whether we can develop global standards for responsible digital credit delivery

Comments

Thanks - nice article. As

Thanks - nice article. As digital transfers march forwards (p2p; g2p; c2b etc.) and market players step up their advertising campaigns - consumer protection and education becomes important. I think unbiased mass media campaigns are needed to raise financial literacy and provide a platform for consumer dialogue. Happy to explore further. Thanks again. Tom.

Add new comment