Digital Finance in Cote d’Ivoire: Ready, Set, Go!

When talking about digital finance in Sub-Saharan Africa, investors’ attention and interest automatically drifts towards East Africa, and more specifically Kenya. On the surface, Cote d’Ivoire may seem like an unlikely contender to challenge this immediate mental connection with digital financial success and East Africa. However, given that six of the 25 WAEMU mobile money deployments are in Cote d’Ivoire, the country has great potential to be the next digital finance success story.

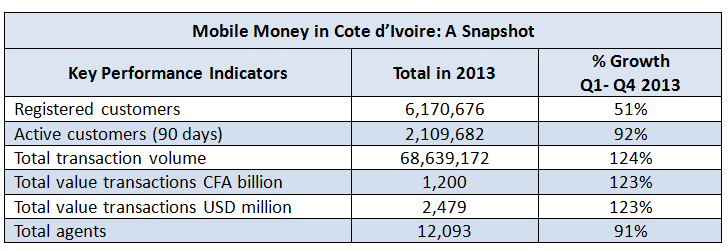

Data show that Cote d’Ivoire is one of the fastest growing digital finance markets in the world. A recent IFC study, published in collaboration with the BCEAO and The MasterCard Foundation, analyzed data from live mobile money deployments in Cote d’Ivoire and confirmed that registered digital financial service customers in the country had increased from 2.6 million in 2012 to more than six million in 2013. Two million of these customers were active, having completed at least one transaction in a 90-day period.

Furthermore, both transaction volume and value more than doubled between 2012-2013. The fact that growth in transaction volume and value is outpacing the growth in customers suggests that not only are more people starting to use digital finance, but existing customers are starting to transact more frequently.

What are Ivoirians doing with e-money?

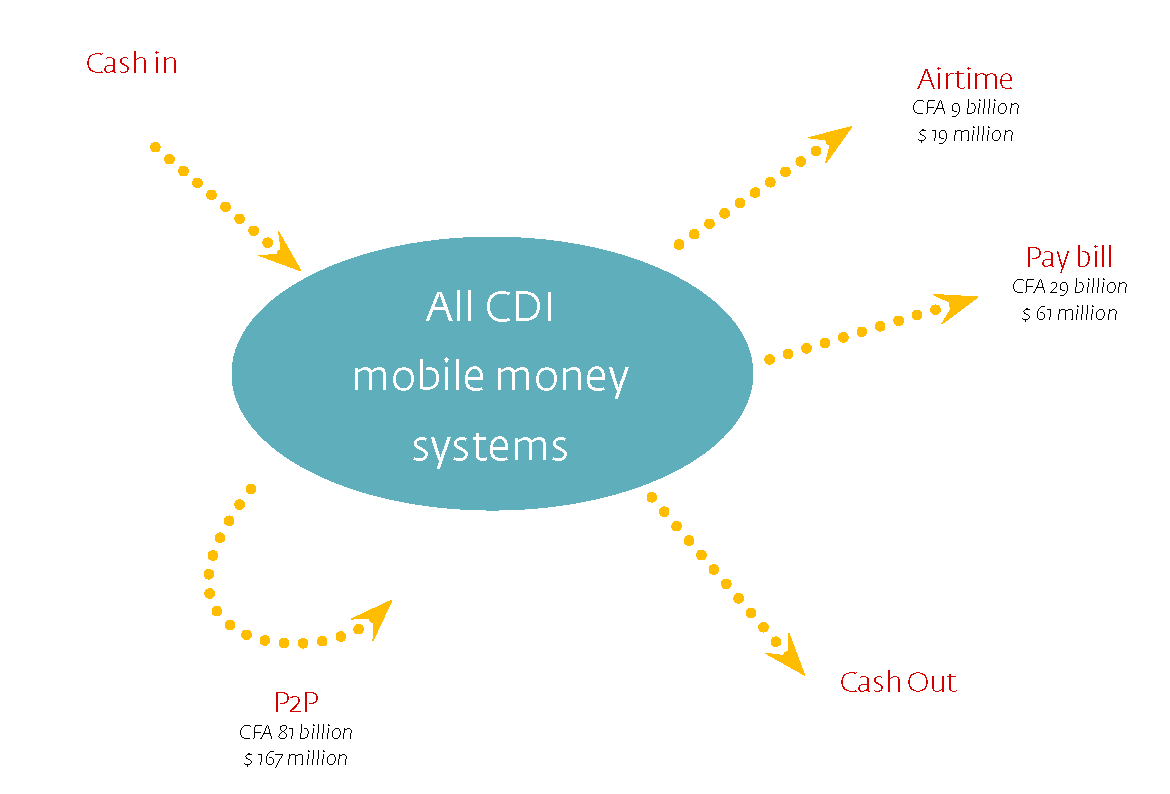

In 2013, the most common transactions were cash-in and cash-out. Nearly $2.5 billion were transacted during that year. Out of that amount only about 6% were person-to-person (P2P) transfers and a further 3% were bill payments and airtime purchases (Figure 1). This data suggests that the way Ivoirians are using mobile money is quite different from East Africans.

Banks currently cater to a small minority of the population: only 11.6% of Ivoirians have a bank account. When microfinance and mobile money accounts are included, that percentage increases to 44% (BCEAO data). Today, there are more e-money accounts in Cote d’Ivoire than bank and MFI accounts combined, and people in Cote d’Ivoire appear to be using their e-wallets primarily as a safe-storage tool. This supports IFC analysis of findings from various parts of the country through quantitative surveys with over 1,500 farmers and deep dive diagnostics. The political and economic crises in the last 15 years have affected Ivoirians’ trust in the banking and the financial cooperative system and partly explain their need for secure storage of money.

What’s next for Cote d’Ivoire?

Quantity is not quality when it comes to mobile money accounts, and account dormancy is a challenge providers need to take seriously. Critics would rightly say that e-money providers in Cote d’Ivoire are still not offering (remunerated) savings and loan products, but this might change soon. According to industry players participating in a recent roundtable to discuss these findings, banks are gradually getting more interested in digital finance. This is both because opening physical branches remains an expensive proposition and the BCEAO recently mandated the elimination of a set of fees that financial institutions can charge on bank accounts. MFIs have also started establishing partnerships with mobile network operators: Advans Cote d’Ivoire, one of IFC’s microfinance investments, just launched a partnership with an MNO that will allow their clients to cash money in their Advans’ savings accounts via an e-wallet. In addition, agricultural commodity players across the contry are starting to think how e-money could help improve the financial lives of rural populations who represent 75% of the labor force in Cote d’Ivoire, and manage the risks of dealing with relatively large and irregular amounts of cash. These are all interesting developments heading in the right direction: increasing usage and product diversification to build a digital finance ecosystem in Cote d’Ivoire.

Some aspects need the attention and action by the providers. Agents are spreading across the country; there were over 12,000 in 2013 (banks and MFIs have together around 1,000 branches). However, there is no available data about the activity rate of those agents. A health check to ensure there is sufficient liquidity across the country is needed. Another aspect that requires attention is the pricing of services. Initial evidence shows that for an equivalent $10 P2P transaction, Cote d’Ivoire is more expensive than Kenya, Mali, Ghana or Tanzania. The phenomenon of direct deposits seems to be still very prominent, putting the financial sustainability of providers at risk and challenging KYC rules. Finally, account inactivity is an issue relevant in Cote d’Ivoire as it is elsewhere.

The WAEMU region has not yet caught the attention of investors, innovators or digital finance gurus, but if the e-money market keeps making progress, Cote d’Ivoire, and hopefully the rest of WAEMU, could go from being a young sprinter to a mobile money marathon runner.

Add new comment