Do Poor People Use Branchless Banking Services?

Proponents of financial inclusion have eagerly anticipated the development of branchless banking services as a new approach to provide the unbanked – and especially the poor – with access to financial services. Statistics such as the 1.7 billion unbanked people with mobile phones have led to a great deal of interest in the potential of handheld technology, especially phones, to provide new channels with which low-income people can access financial services.

The hypothesis is that even the ability to send, receive and store money securely and easily from anywhere with a basic mobile wallet will enable the poor to better manage shocks and seize opportunities. Jake Kendall’s recent blog makes an excellent case for the strong demand poor households have for better payment services. As branchless banking infrastructure and products develop, this will lead to more formal financial services such as savings, credit and insurance – or so the thinking goes. Yet the poor are usually not early adopters of new technology. What evidence do we have at this point that branchless banking is reaching poor people and, more importantly, that poor people are actively using and finding value from these services?

Recently, increasing evidence has begun showing that branchless banking does indeed reach poor and unbanked people. Some highlights include:

The iconic mobile banking service, M-PESA, brings us the clearest indication yet that very poor and unbanked people are adopting branchless banking services. New evidence just out reveals that among the Kenyan population outside Nairobi, the share of people with very low incomes (below $1.25 a day) using M-PESA has increased from fewer than 20% in 2008 to 72% by 2011. Similarly, the share of non-Nairobi unbanked people who used M-PESA rose from about 21 % in 2008 to 75 % in 2011.

In Tanzania, nearly a third of those who said they’ve used mobile money are poor (measured against $2 a day poverty line) and use by this demographic is increasing.

CGAP analysis of eight branchless banking providers revealed that on average 37% of active users were previously unbanked.

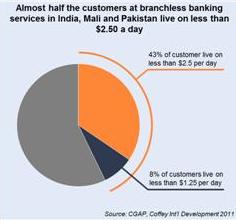

CGAP commissioned Coffey International Development to carry out studies of almost 2,000 branchless banking customers in Pakistan (with easypaisa), India (EKO) and Mali (Orange Money). In each of the three countries over two-fifths of customers were living on less than $2.50 per day. 14% of EKO customers were living on less than $1.25 a day. In all three services over half did not have a bank account. In addition, about three-fourths of poor users reported the services to be highly effective and a similar proportion felt the services had a positive impact on their lives.

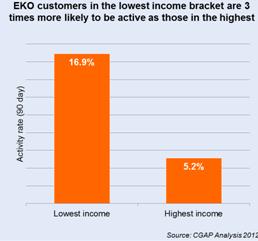

At the same time, there is widespread acknowledgment that most branchless banking services struggle with very low levels of customer activity. CGAP just completed a study focused on low customer activity. Of the four providers we worked with, just one – EKO in India – collected data on the income level of customers. EKO customers in the lowest 25% income bracket (earning under $60 a month) were three times as likely to be active users as those in the highest 25% income bracket! Regression analysis revealed that there is a statistically significant inverse correlation between income and likelihood of activity. We should be cautious about making general claims on the impact of income on activity levels based on just one service but we hope that more providers will begin to collect income data and validate this initial finding.

In a field with so much hype, it is easy to become skeptical about claims that branchless banking is a useful pathway to financial inclusion for the poor. More evidence is needed, but data so far gives us a good indication that while the poor may not be the first adopters, they are increasingly jumping on board. It took five years before M-PESA, the most successful mobile banking service in the world, was used by a large majority of very low-income and unbanked people in Kenya. It may take other services longer but early evidence suggests that low-income, unbanked customers will actively use and find value in these services. Stay tuned for the next few blogs in this series where we’ll explore specific aspects of branchless banking and the poor, including government-to-person payments and product development.

Comments

As the branchless banking

As the branchless banking growing in india day by day but the service providers are not getting desired value for their work. as i also provinding the branchless banking service in india but i got only near about 500 INR. this amount is so low for our work. can u get any decission for our future. as our future is not safe if it dwells like this. hope is always there………….

It is very interesting to

It is very interesting to read about M-PESA and how it has become one of the most trusted way of trasacting in East Africa.

I feel it is a very convinient way of branchless banking in the African set-up.

Im my Country this has and is still being tried, but looks like the challenge is on trusting Technology.

We wait to see.

Looking forward to more…

Branchless banking is the

Branchless banking is the need of the day as it enables both banks and poor people to avail banking facilities with less cost and least hassle. In fact inclusive growth is feasibleonly thru baranchless banking.

Add new comment