East And Southern Africa: A Region On The Move

“There is need for financial service providers and other stakeholders to listen to clients, more research is required on who is left out with more focus on unserved segments of the market,” said Dr. Jennifer Riria, Board Chair- Kenya Women Holding Company and Board Chair of Women's World Banking at the just concluded East and Southern Africa funders meeting held in Nairobi, Kenya.

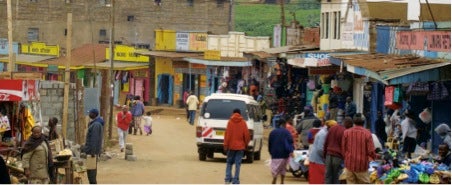

A main street lined with vendors in Kenya

A main street lined with vendors in Kenya

East and Southern Africa comprises 18 countries organized into two main trading and customs blocks: East Africa Community and Southern Africa Development Cooperation. Financial inclusion in East and Southern Africa remains somewhat uneven with account penetration ranging from a high of 51% in Southern Africa to 28% in East Africa (Global Findex, 2012). Mirroring this, it is not surprising that clients predominantly save informally and rely on more community-based savings mechanisms (23% in East Africa and 10% in Southern Africa). However, branchless banking deployment in the region has been significant with East Africa having three providers reaching over 1 million wallets (Safaricom- 12 million; Vodacom Tanzania- 3 million; MTN Uganda- 1 million).

As we commented last year, 2012 was a year of optimism and disappointment. The main highlight of 2012 was the launch of M-Shwari in October in Kenya - a savings-led product through a partnership between Commercial Bank of Africa and M-Pesa. Although there have been a number of small pilots conducted in the past, this is the first big push for an interest-bearing savings product that rides on the existing M-Pesa infrastructure linked to a real bank account. From launch to date, the product has already attracted over 1.6 million customers and raked in approximately $35 million as at February 2013.

Regarding the threat of interest rate caps, the Ministry of Finance in Kenya successfully convinced legislators to withdraw a bill that would have capped interest rates. Similarly, political activism on interest rate cap in Uganda seems to have lost momentum. However, this threat manifested itself in an unexpected country - Zambia- with the government issuing a directive on the interest rate cap which took effect in January 2013. This was surprising considering the relatively less dynamic nature of the microfinance sector. Although the cap is applicable to all financial sector providers, it will make a bad situation worse by making serving low income clients unattractive particularly to commercial banks who may have wanted to ‘down-scale’.

The important role that credit reference bureaus (CRBs) in financial sector development in the East Africa region have played continued to gain attention of policy makers and regulators with the latest being the licensing of Dan and Bradsheet by the Bank of Tanzania in December 2012. Kenya has two private CRBs serving regulated financial institutions with ongoing discussions of expanding it to include SACCOs, MFIs and other financial service providers. During the year, the Reserve Bank of Zimbabwe started the process that will lead to the establishment of a credit reference bureau that serves both banks and MFIs. Although South Africa has the most advanced and mature credit reference market in the region, Southern Africa generally has more credit reference bureaus in operation than East Africa.

Looking forward in 2013

Standard Bank in its January 2013 publication titled ‘African Markets Revealed’ makes bullish projections with 2013/2014 GDP growth levels for most countries in the region over 6%. Although countries are starting from a lower base, these projections point at a trend of an emerging regional ‘growth axis’ with important implications for poverty reduction and financial inclusion. Given that the EAC already has a more dynamic access to finance activities compared with the rest of the region (larger MFIs and world class money transfer providers), we expect GDP growth to signal larger providers to expand regionally therefore stimulating competition and increasing consumer choice. Another key factor linked to GDP growth that is preoccupying the minds of policymakers, is job creation particularly with the emerging “youth bulge” in many countries. This is going to be an important policy area in 2013 which will require stakeholders to explore the link between financial inclusion and job creation.

------- The author is CGAP's regional representative based in Nairobi, Kenya.

Comments

CBK along with 18 other

CBK along with 18 other institutions from Africa officially launched the African Mobile Phone Financial Services Policy Initiative (AMPI) at the end of February 2013. (http://www.afi-global.org/african-mobile-phone-financial-services-polic…) Already a world leader in MFS, this initiative makes it clear that Africa is determined remain at the forefront of the field. By using the AFI peer learning model, these institutions will help MFS's more effective and possibly develop policies that can serve the financial inclusion needs around the world.

2012 was also significant for South Africa as the South African Treasury played host for the 2012 Global Policy Forum in Cape Town. (http://www.afi-global.org/gpf-2012-cape-town) The gathering of over 350 financial inclusion policymakers from developing and emerging countries was a great opportunity for the continent to highlight its many financial inclusion successes as well as set some ambitious targets for 2013 and beyond.

Add new comment