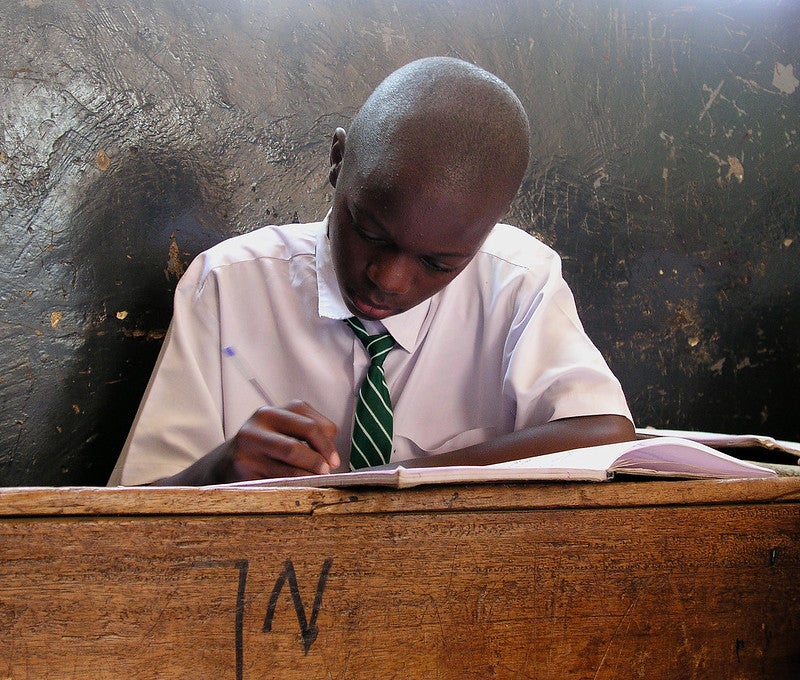

Photo: Arne Hoel / World Bank

Photo: Arne Hoel / World Bank

The Essential Role of Finance in Education, Housing and Health Care

The past two years led many of us to rethink what we consider essential to our lives and livelihoods. As the COVID-19 pandemic gripped the world, many services that we took for granted were suddenly out of reach. Of course, for many wealthy nations the disruption to essential services like education, housing and health care is likely temporary – the result of a once-in-a-generation pandemic. But for millions of the world’s poorest and most vulnerable households, inability to access essential services is the norm.

Even before the pandemic, an estimated 260 million school age children remained out of the classroom. One billion people in urban slums lived in sub-standard housing. At least half of the world’s population lacked access to full health care coverage, with out-of-pocket health expenses pushing around 100 million people into extreme poverty each year. These statistics are especially grim for women and girls, who face even deeper disparities in access to education, safe housing, and sexual and reproductive health services.

Recognizing the enormity of this challenge, CGAP believes that financial services can play a role in closing the essential services access gap. CGAP has spent the last decade exploring how financial services can advance access to essential services like education, energy and clean water for the world’s poor. Building on this experience, we examined recent evidence to identify further opportunities for financial services to play a role in essential service provision.

Our findings suggest that financial services are important tools for advancing equitable access to quality essential services like education, housing and health care. Financial services are especially effective when combined with public- and private-sector efforts to address the market failures that often constrain access to essential services among the poorest and most vulnerable.

Evidence suggests that financial services can promote access to high-quality education, housing and health care services

Our research and discussions with experts led us to conclude that there are three essential service sectors where financial services can have an outsize impact on expanding equitable access: education, housing and health care.

The importance of these services in people’s well-being is highlighted in the Sustainable Development Goals. SDG 4 calls for “inclusive and equitable quality education for all.” SDG 11.1 seeks to “ensure access for all to adequate, safe and affordable housing.” And SDG 3 aims to “ensure healthy lives and promote well-being for all at all ages.”

As we detail below, financial services can help low-income households mobilize the resources necessary to invest in these essential services, while also improving the coverage and quality of services provided by the private sector. Importantly, emerging examples from across the globe suggest that advances in digital financial services are increasingly enabling governments to increase the uptake, quality and efficiency of publicly provided services.

Financial services can unlock household investments in education, housing and health

In the absence of robust government programs for universal access, low-income households often struggle to invest in education, housing and health care. Faced with irregular incomes and high costs, they require financial tools to meet education expenses, provide children with nutritious food, improve housing conditions, and pay for preventative and emergency health services.

Financial services can help parents invest in their children’s education and ensure children are prepared to learn

The 2018 World Development Report highlights deep inequities in learning outcomes for children in developing countries. In many countries, parents’ inability to afford school expenses keeps children out of the classroom. And even when students are able to attend school, poor nutrition often means they are ill-prepared to learn.

Research shows that financial inclusion allows parents to fund large expenditures like education. For example, in Bangladesh household participation in microcredit increased school enrollment for girls. Additionally, access to financial services can improve child nutrition outcomes, which are correlated with learning outcomes in the classroom. In India, women’s participation in self-help groups led to reductions in wasting and stunting among children, which suggests that financial services can also help households better prepare their children to learn.

Financial services can enable investments in housing quality, including access to energy, water and sanitation

Rapid urbanization is driving up demand for housing, even as a lack of affordable housing stock and financing options put homes out of reach for many of the poorest and most vulnerable. Meanwhile, climate change is not only contributing to migration and urbanization; it is also exposing the vulnerability of many homes to severe weather and putting stress on critical services like energy and drinking water.

Evidence demonstrates that access to formal financial services enables households to invest in home improvements. For example, home improvement loans provided to customers in India resulted in better housing conditions and increased borrowers health, safety and security. Financial services can also help households to invest in electricity, clean water and sanitation facilities. Pay-as-you-go (PAYGo) solar home system financing has provided an estimated 27 million people with access to off-grid energy. Other examples include Water.org, which facilitates access to small loans that have helped 40 million people bring clean drinking water and sanitation facilities like latrines into their homes.

Financial services improve household resilience to health shocks

Because many low-income households must pay out of pocket for health care, an accident or illness can easily push them into poverty. However, evidence from Pakistan shows that providing even limited health insurance to poor households helped them address health shocks without being pushed further into poverty.

Financial services can empower women to increase household investments in education, housing and health care

Women and girls are disproportionately impacted by whether they have access to education, housing and health care. Fewer than 40% of countries provide girls with equal access to education, despite the fact that keeping girls in school has been shown to reduce gender-based violence, child marriage and early pregnancy. Housing inequality results in many women and girls living in unhealthy and unsafe conditions, putting them at increased risk of homelessness and violence. Meanwhile, 810 women die every day due to preventable pregnancy and childbirth causes, and 111 million unintended pregnancies occur each year in low- and middle-income countries.

Financial services can play an important role in improving essential service outcomes for women and their households. This is especially true in contexts where social norms limit women’s control over economic resources and leave them with little or no control over household spending priorities. Providing women with access to affordable and appropriately designed financial services — while also addressing the underlying social norms that restrict their agency — can empower them to exert greater control over financial resources and household spending.

Moreover, the evidence clearly shows that when women are empowered to have a say in household spending decisions, they choose to invest in what matters most: education, safe housing, and health care. This, in turn, has an especially positive impact on improving the lives of women and children.

Improving women’s access to savings accounts can increase household investments in education, health and nutrition

In Nepal, women who opened no-fee savings accounts increased household spending on education and nutritious foods. Additional research found that their daughters stayed in school. Findings also suggested that households in which women opened accounts invested more in preventive health care, improving their resilience to health shocks. Evidence from the Philippines suggests that commitment savings accounts are particularly powerful in the hands of women. Commitment savings are associated with higher account balances, greater household bargaining power and increased resource allocation in favor of women.

Access to mobile money can empower women to increase investments in health and nutrition

A study in Uganda found that women who used mobile money were more likely to seek prenatal care, improving health outcomes for both mother and child. The researchers hypothesize that the use of mobile money facilitated access to remittances, increasing women’s financial resources and encouraging them to seek out preventative care.

Mobile money also helps women to obtain and direct the spending of cash transfers. Evidence suggests that cash transfers targeted to women can improve children’s nutrition outcomes. In South Africa, providing cash transfers to women had a large effect on nutrition indicators for children in their household. The same effect was not found in households where men received the transfers.

Microfinance enables women to invest in home improvements

Habitat for Humanity finds that social norms have a significant influence over how households choose to build or improve their homes. They also argue that financial services can improve women’s bargaining power when it comes to home improvement decisions.

In Kenya, a study revealed that women who borrowed for home improvements saw a nearly 15% increase in overall housing satisfaction. Women used loans from Kenya Women’s Microfinance Bank to invest in water and sanitation upgrades like flushing toilets and installation of safe water sources. The study also found that the borrowers added more rooms to their homes and made improvements to their roofing and walls.

Financial services can improve the coverage and quality of essential services offered by the private sector

Financial services can help education, housing and health care providers to unlock investments in service provision, especially at the last mile.

Digital payments and access to credit can help schools to better manage their finances and improve the quality of instruction

Private schools serving poor students often struggle with unpredictable cash flows when parents are unable to pay school fees on time. As a result, these schools are unable to plan investments in facilities and lack funds to pay for salaries and teaching materials. In response, Mastercard designed Kupaa, a digital platform for schools in East Africa. Kupaa eases the burden of school fees by enabling parents to pay digitally in installments, while also equipping schools with financial management software to track payments and expenses. The platform leverages the data collected to connect schools with working capital loans that can be used to cover immediate needs.

Access to financing can empower micro-developers to improve the stock of affordable housing

With affordable housing in short supply, “micro-developers” play a critical role in meeting demand for affordable home purchases and rentals. But the capacity of micro-developers to deliver at scale is often constrained by a lack of access to financing. In response, lenders like TUFH in South Africa provide financing to micro-developers to support the construction of quality housing in low-income urban areas.

Another example is iBuild, a digital platform operating in Africa and Asia that connects homebuilders, contractors, workers and suppliers to facilitate the housing construction process. iBuild offers developers secure digital payments with escrow that only releases payments to contractors and suppliers once a job or milestone is completed. The platform also unlocks financing for developers by connecting them with lenders, who can use iBuild to disburse loan disbursements remotely based on verifiable milestones.

Small and medium enterprise financing can help clinics and pharmacies deliver high-quality health care at the last-mile

Many health care providers in rural and impoverished communities rely on unpredictable cashflows from uninsured patients to finance their operations. As a result, they struggle to invest in better facilities, diagnostic equipment and supplies like lifesaving drugs. Innovative financing approaches are increasingly emerging to address these challenges. For example, PharmAccess offers financing to small clinics across seven countries in Africa, allowing them to improve service quality and purchase important supplies. Likewise, mPharma expands access to high-quality medicines in several African nations by offering financing and inventory management services to hospitals and pharmacies.

Digital financial services can support public provision of essential services

Advances in digital financial services are opening up new opportunities for governments to improve the uptake, quality and efficiency of essential services.

Digital financial services can promote uptake of publicly provided services

Digital payments allow governments and donors to target subsidies for publicly provided essential services directly to the most vulnerable. For example, digital cash transfers covering school expenses like tuition and uniforms for girls in Bangladesh increased female secondary school enrollment from 41% to 72%. In India, the government introduced the e-RUPI, a digital voucher provided to citizens that can be redeemed for health services like COVID-19 vaccination at hospitals and clinics. Additionally, the government of Kenya partnered with mobile health savings wallet provider M-TIBA to enable 35,000 uninsured women of reproductive age to save and pay digitally for subsidized medical coverage under the National Health Insurance Fund.

Digital credit can help households finance expenses for public services like education. Many public education systems still rely on households to finance operations. But tuition is not the only expense that prevents children from attending school. Even when countries have universal public education, the cost of uniforms and textbooks can still be a burden. In Uganda, digital education loans allowed parents with irregular incomes to spread the cost of education expenses over the course of the school term. Among households who received the loans, the share of children out of school declined by 50%.

Digital payments can improve the quality of public service provision

Many public services rely on frontline staff like community health care workers and teachers. Evidence shows that digitizing salary payments for frontline workers can ensure that they show up for the job by reducing the time and costs associated with cash payments. Digitizing health worker salary payments in Sierra Leone during the Ebola crisis reduced the time it took to receive payments from one month to one week, preventing the loss of an estimated 800 working days and saving over 2,000 lives by eliminating worker strikes. In Liberia, digitizing teacher salary payments reduced absenteeism 94% by minimizing the time required to collect their earnings.

Digital payments can improve the efficiency of public service provision

Many public services remain cash based. Reliance on cash increases the cost of operations, contributes to theft and leakage of funds, and makes it more difficult for users to pay their bills. For example, Côte d’Ivoire allows parents and students to pay school fees using mobile money. By eliminating the need to pay in person, digital payments saved students and parents time and money. Furthermore, digital payments led to an increase in overall fee collection and larger budgets for schools. Digitization also contributed to the collection of more reliable data on students and schools, allowing the government to better allocate resources.

Public utilities can likewise benefit from payments digitization. One experiment in Kenya showed that digital payments reduced the time required to pay a water bill by 82 percent. Similarly, the Dar es Salaam Water Service Company saved millions of dollars and generated significant new revenue by allowing users to pay using mobile money, while reducing opportunities for corruption. Importantly, when utilities increase revenue collection and cut costs they can invest more in the quality and coverage of their services.

Similar benefits have been found in countries that have digitized premiums for national health insurance programs. In Rwanda, digitizing premium payments for the national Community-Based Health Insurance program led to cost savings and improved revenue collection by eliminating the need for staff to collect cash and reducing the time it takes for payments to be received.

An opportunity to drive global impact

Despite steady progress over the years, millions of people still lack access to education, decent housing and affordable health care. Confronting these challenges will require every tool in our toolbox, including financial services.

Many of us are already working to improve essential services outcomes through financial inclusion. This is certainly true at CGAP, where we have already embedded essential services throughout our global work. In recent years, we have explored ways to help platform workers access health insurance, designed digital credit products for education expenses, supported the digitization of social safety net payments, and worked with PAYGo solar financing providers to expand access to off-grid energy. Our conversations with our members and other stakeholders in the financial inclusion community suggest that we’re not alone in recognizing the role financial services can play in essential service provision. In the coming months, we hope that you will reach out to us to share your knowledge and experience. We also encourage you to partner with us to identify and scale innovative approaches that can drive impact for the world’s poor.

Add new comment