Financial Inclusion-Friendly G2P: Recommendations for Stakeholders

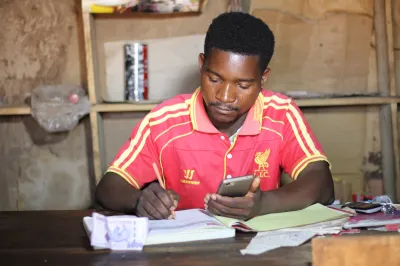

The recent COVID-19 pandemic saw an unprecedented response to the expansion of government-to-person payment programs (G2P) as countries adopted new ways to quickly transfer funds to their citizens. The World Bank estimates that roughly 760 million people have received G2P payments digitally since the beginning of the COVID-19 pandemic and that digital payment programs on average paid more quickly than those that relied on cash. G2P programs generally target the poor and marginalized – the same groups that are often also financially excluded. In Brazil, for example, over 70 million people opened digital savings accounts to receive social protection payments during the pandemic through the Auxilio Emergencial program. It is estimated that 40% of these beneficiaries, around 28 million Brazilians, did not have an account before the pandemic.

While these gains are significant, it is less clear that improved access has led to the potential increases in benefits that come with consistent long-term usage. For many in the financial inclusion community, one of the major motivations for investing in digitizing government cash transfers was the prospect of G2P as an onramp to consistent usage for millions of financially excluded individuals, as well as a use case that could spur greater provision of financial services in rural areas and low-income populations more generally.

In many contexts, these new accounts remain dormant except for the occasional cash out following a transfer. In the Philippines, for example, only 6% of surveyed COVID-19 emergency subsidy recipients used their accounts beyond cashing out, and only 16% were even aware that a financial account had been created for them. In Brazil, on the other hand, 75% of the value received was used digitally and only 25% was cashed out in the Auxilio Emergencial program. There were explicit efforts from this program to increase the use of funds digitally, including limiting cash outs immediately after payments by introducing a period during which funds could only be used for digital transfers and payments.

The massive G2P transfer experiments that took place during the COVID-19 pandemic, some of which resulted in higher usage of digital accounts, collectively demonstrate the importance of what we call “financial inclusion (FI)-friendly” G2P. That is, intentional architecting and implementation that seek to support active digital financial services (DFS) usage beyond an initial payment. Our work in a recent report from Limestone Analytics looks at FI-friendly G2P in depth. It shows that for FI-friendly digitization to work, there must be alignment between the government program and financial service providers, as well as sufficient and ongoing support for recipients. Unless a financial inclusion objective is baked into the program design from the beginning, it can be challenging to fold it in later. This is particularly true for the many programs that target women recipients, who in general face additional barriers to digital financial inclusion such as limited access to mobile phones that facilitate onboarding to G2P programs, and the digital receipt of payments.

Unsurprisingly, the costs of FI-friendly programming can be higher than the cheapest path to digitization, particularly in markets where the financial ecosystem is still maturing and expanding. One common cost is onboarding program participants into new accounts effectively. Providing financial services to program participants in remote and rural places can also be costly to providers, who may need to set up new access points or special cash-out events. As the example from the Philippines illustrates, communication is often required to ensure that recipients of transfers understand the various features of their accounts.

Therefore, the metrics evaluating program success must expand beyond greater accuracy of payments and reduced transaction costs to include usage. Because of program cost and time implications, this will require some strong advocacy from thought leaders and development partners in the financial inclusion community, as well as a willingness to invest in ecosystem building when needed. It will also require the engagement and alignment of a greater variety of stakeholders, from different governmental ministries to payment service providers.

Our report lays out detailed recommendations for a variety of stakeholders, some of which we’ve included below:

1) Align audit strategies with financial inclusion goals

In several markets, audit requirements limit what type of accounts can receive G2P payments. Though these policies have merits, from a financial inclusion point of view, they impede account usage and erode trust in maintaining funds digitally. In the case of Kenya’s Inua Jami program, these requirements also precluded the participation of mobile money providers, which have the greatest reach among low-income users. These policies need to be re-examined from an FI-friendly lens to find ways to balance audit compliance with the benefits of deeper financial inclusion.

2) Expand the types of regulated financial service providers (FSPs) that can participate in G2P

In many markets, banks continue to be the sole providers of G2P. This is despite the existence of other types of financial service providers who already reach low-income clients at scale. The selection of financial service providers for G2P transfers can also be highly political, and influenced by strong industry associations rather than a consideration of what is best for the beneficiaries.

Indonesia’s experiment with including e-wallet providers for the Kartu Prakerja G2P program during the COVID-19 pandemic illustrates the power of expanding participant choice to other types of providers. About 87% of recipients chose e-wallets for their transfer, citing factors like: e-wallets are easier to access via smartphone (47%), banks were too far away (22%), and opening an e-wallet account does not require a first deposit (10%). In Colombia, the state-owned bank, Banco de las Oportunidades, leveraged a data-sharing agreement with a credit information registry to identify if targeted households had a member with an account. All banks in the country reported to this registry. From this exercise, they were able to identify accounts for over a third of the targeted households to which payments could be made. For the remaining households, a strategy was deployed in partnership with FSPs to open mobile wallets through remote onboarding. These experiments indicate the potential benefits of a wider bench of FSPs, particularly for the underserved.

3) Align the procurement of FSPs with beneficiary needs and a compelling business case

Previous posts by CGAP have emphasized that beneficiary choice should be a key part of any solution, particularly in driving women’s financial inclusion. Yet in markets where financial ecosystems are still developing, choice needs to be accompanied (or even preceded) by investments in distribution networks, onboarding new customers, and providing adequate customer support. However, this does not often happen. Our research indicates G2P programs often expect banks to provide this service for free; in many countries, such as Bangladesh, historically public banks distributed G2P payments as part of their mandate. In India, financial service providers receive a nominal commission – for example, 8 INR for a transfer of 540 INR – which is less than the actual costs in many cases (in Kenya the average commission is 3.5% but higher in the most remote areas).

When G2P programs fail to adequately compensate FSPs, there are risks of limited or poor service provision, particularly for clients who need intensive support. Procurement strategies need to acknowledge the real costs of serving new DFS users and support financial service providers to provide sufficient services. Over time, as participants evolve into savvy DFS users and distribution networks are more robust, commissions can be adjusted downwards, but early on they are an important driver of rural access and user support.

G2P has provided an important gateway for financial inclusion, and, particularly throughout the COVID-19 pandemic, supported people with lifesaving payments as well as their first financial account. The financial inclusion community can build on this momentum to accelerate FI-friendly programs and policies. The current opportunity is especially ripe, as countries are once again scaling social protection programs to help low-income individuals deal with increasing costs of food, housing and energy due to soaring rates of inflation. Through more engagement and alignment between G2P and financial inclusion communities, we can work to ensure that an FI-friendly approach is the norm, rather than the exception, to any G2P digitization program.

Add new comment