Finding “Win-Win” in Digitally-Delivered Consumer Credit

Digital credit products are expanding rapidly in several leading digital financial services (DFS) markets. These products offer a fast, convenient way for many consumers to access hard-to-obtain emergency liquidity for their personal and business expenses.

Given the rapid pace of innovation in digital credit, it is not surprising that so far there has been little discussion of potential consumer protection concerns such as transparency or ability to repay. In particular, it is timely and important to ask “what may be different in consumer borrowing behavior and associated risks now that credit is literally in the palm of their hands via a few keystrokes?”

There is a need for more evidence and experimentation to develop responsible practices for digital credit. This evidence will, among other things help identify where the interests of providers and consumers may align to promote responsible delivery and usage of digital credit.

It was with this goal of learning more about how consumers behave in a digital borrowing environment that CGAP partnered with Busara Center for Behavioral Economics and Jumo (www.jumo.world)—a mobile money marketplace that offers digitally-delivered credit in Kenya, Tanzania and Zambia—to design a series of experiments in Kenya to measure consumer response to different types of communications linked to a digital credit offer. The research sought to explore two important opportunities in digital credit:

- Are there ways in which the communication channel (SMS) impacts borrower behavior that could benefit both borrower and lender?

- Can insights from behavioral economics help to develop communications that drive borrower behavior in preferred directions, such as on-time repayment?

The team focused on two key opportunities:

- Increasing consumers’ likelihood to read—and understand—key product features, to test the hypothesis that. positive correlations may exist between time spent on product terms screens during the loan application process and repayment rates .

- Crafting repayment reminder messages that were goal-based or aspirational, to help consumers not “freeze” when they get a collections notice and instead see the long-term value of timely repayment.

To test these hypotheses, we built both lab-based and field-based messaging platforms for a hypothetical digital credit product we named “Top Cash” and tested these messages with consumers. In the lab consumers participated in a series of tasks where they could earn money, but first had to borrow funds to play the game, allowing us to test how different disclosure messages impacted borrowing choices. In the field experiment participants received actual, zero- cost loans via mobile money, and were instructed to pay them back after one week to receive a larger loan amount. A series of messages were then sent to borrowers to measure how these different messages performed in ensuring consumers paid back their loans after one week.

Out of these two testing environments several promising results emerged for how to integrate consumer protection principles into digital credit products:

Promising result 1: Making consumers actively choose to view or to skip summary Terms & Conditions (T&Cs) screens increases the likelihood they will actually read them. Further, doing so improves repayment performance.

The lab testing found that a choice-based approach to summary T&Cs screens led to an increase in the likelihood a consumer would review them from 9.5% to 23.8%, and that reviewing this summary then led to a 7% absolute drop in delinquency rates in the experiment. This supports the hypothesis that people who spend more time on product term screens were less likely to default. It also shows that with effective prompting, we can increase consumers’ attention to product terms and costs up front for a more informed borrowing decision.

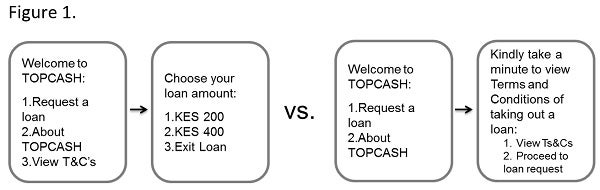

The control versus treatment screens designed for the “Top Cash” loan used in the experiment are shown below:

Consumers can still skip the T&Cs if they want, but the simple act of having to choose to do so makes them more likely to stop and read them.

Promising result 2: Separating finance charges to make them more salient led to lower default rates

In the lab, participants played a game where they earned actual money by completing various simple tasks on a computer screen. However, they had to borrow funds first to “buy in” to the game, which they would later pay back with their earnings from completing the tasks. In each round of the game participants had to choose the amount they wanted to borrow. Each loan amount had different costs and repayment periods, which the participants considered when making their decisions on how much to borrow.

We found that separating finance costs helped reduce default rates in the game from 29.1% to 20% across the entire sample, regardless of whether consumers chose the higher or lower loan amounts. (The two screens tested are shown in figure 2, with the second screen separating the loan amount from the related finance charges.) This seems to suggest that by making the finance charges stand out more, consumers could make a better choice on loan size preference.

Promising result 3: Segmenting reminder messages by user type, where possible, improved repayment performance

In the field experiment portion of this research consumers were given actual interest-free loans via mobile money, then asked to repay them after a week to access a larger future loan amount. To measure how different messages impact probability of repayment, we tested several reminder messages and different framings of these messages to increase likelihood to repay.

One of the findings from the field experiment was that respondents who received evening reminders were 8% more likely to repay their loan than those who were sent reminders in the morning. We believe that strategic timing of reminders by time of day merits further testing.

The field experiment also tested several different types of reminder messages which varied by how they framed the benefits of repayment. Some of these variations emphasized ability to access higher future loan amounts, or the long-term benefits for your future self of repayment.

These treatments had quite mixed effects by demographic segments, including positive effects on repayment across the board for male borrowers, but negative impact on repayment across the board for female borrowers. This leads the research team to believe that while certain behavioral messaging treatments can have positive impact on repayment for sub-segments of borrowers, they will need to be rigorously tested and targeted first. Where possible, digital lenders should use available demographic information to create customized reminder messages that speak to the personal traits and ambitions of the user.

Digital credit is a powerful tool for providing much-needed liquidity to consumers in a simple, nearly-instant manner. However, it is important to understand the possible consumer protection risks such as lack of upfront understanding of costs, repercussion of loan delinquency—in particular the associated penalty fees and loss of future access to credit. We believe there is much that can be learned from tweaking how messaging is delivered to consumers to find more “win-wins” for borrower and lender.

Comments

This is very important.I

This is very important.I wonder in what ways Digital Credit can be linked to Credit Reference and what effect it would have .

Dickson, that is a great

Dickson, that is a great point. One idea I would like to see is a discussion of what a credit reference bureau for the digital age looks like. For example, can we agree on ways to share mobile money history (at least at summary level) in a way that benefits consumers and allows them to receive more--and more competitive--product offers?

Very interesting and useful

Very interesting and useful article . Digital credit ( upto certain amount) is the way forward with Big data , CIBIL , Mobile (smartphones ) coming together.

Thanks Anil, I am glad you

Thanks Anil, I am glad you enjoyed this. Be on the lookout for more similar research coming soon...

Very relevant issues you

Very relevant issues you raise in the article. I am thinking about a market like Rwanda, where the use of mobile financial services is just picking up, what kind of financial education programs would be relevant to promote the uptake and use of DSF in a safe and sustainable way. I think, providers of DFS might not give this the priority it deserves and so some one else needs to do this.

Add new comment