Five Lessons about Agent Networks in Peru

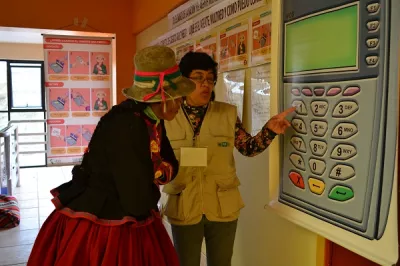

Financial inclusion in Peru has a long road ahead as measured by the Global Findex – just 20% of adults had accounts at formal financial institutions in 2011. But excellent progress is being made in the form of agent networks. Taking advantage of mobile technology, agent networks allow financial service providers to leverage existing retail infrastructure to expand rapidly into areas where traditional bank branches would be too expensive to build. For many low-income customers, agents bring access to a whole portfolio of financial services, and are sometimes their primary – or only – interaction with the formal financial system.

Agent networks in Peru have expanded rapidly since their inception in 2005, when regulations changed to allow banks to offer financial services through third-party agents. Since then the number of agents rose rapidly across the country, reaching more than 38,000 today. Other types of payments networks have also flourished, processing millions of monthly bill payments and airtime transactions through similar agent arrangement with thousands of mom & pop shops.

CGAP recently completed a study of five agent networks in Peru comprising more than 26,000 agents and 24 million monthly transactions to identify key success factors in reaching poor and rural areas. We found that network design choices heavily influence their ability to operate viably in more remote areas of the country. Specifically, there are five lessons from this research that can contribute to global financial inclusion work.

- Agent network managers have strong incentives to aggregate services. Offering transactions through multiple service providers on their platforms introduces minimal additional costs for network managers and greatly expands the potential number of transactions they can complete.

- “Cashy” OTCs comprise 40-90% of total network transaction volume. These transactions are essential for sustaining network viability because they are profitable, although their financial inclusion impact is lower.

- Networks with low cost structures can recruit more agents who operate with less transaction volume, especially in sparsely populated areas. We observed in Peru that networks with overall lower costs structures reach higher agent density (number of viable agents per locality), which increases their proximity to customers.

- A key challenge moving forward is increasing the variety of services agents can offer while still keeping costs down. This increases the importance of technology and electronic services. Looking forward, more providers are likely to offer electronic services, and the demand for a broader range of transactions is likely to increase.

- Shared agents can bring effective interoperability while agent exclusivity can negatively impact growth. Agent networks that establish exclusive relationships with service providers sometimes achieve a powerful competitive edge, but exclusivity narrows down the number of transactions that can be offered. This ultimately reduces value to customers. Agents can be effectively “interoperable” – although not technically so – simply by opening accounts with multiple providers. They can then act as a recipient on one platform and a sender on another. While this increases convenience for customers, it also encourages “over the counter” transactions which are ultimately less efficient for everyone.

The range of services offered by agents, the complexity of agent operations, and the overall network operating model are key choices for network managers to make, and decisions around one aspect imply tradeoffs across others. CGAP’s study looks at how these design decisions impact the overall capacity to reach poor and sparsely populated areas.

Add new comment