Fixing the Hidden Charges in Lipa na M-Pesa

On August 13, 2015, using M-Pesa in Kenya got a little bit more transparent for consumers.

The Competition Authority of Kenya (CAK) issued an order for Safaricom to improve transparency on their Lipa na M-Pesa merchant payment service.

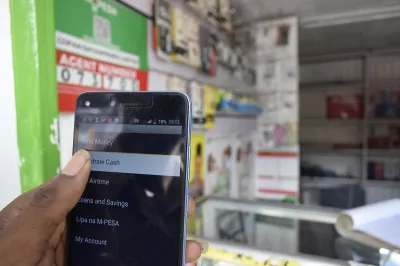

Lipa na M-Pesa allows consumers to buy goods at stores and pay bills with their M-Pesa account. In a country with limited card network penetration, Lipa na M-Pesa makes it easier to go cashless as a consumer.

However, Lipa na M-Pesa has a secret: Hidden charges. While Lipa na M-Pesa is marketed as free to the consumer (with merchants paying 1% of transaction value to Safaricom), the truth is Safaricom allows merchants to charge .5% of the transaction value to consumers if they want—and many merchants do so.

Photo credit: Emil Sjöblom/Flickr

So the CAK’s announcement is much needed to disclose Lipa na M-Pesa’s pricing structure. It also highlights a growing problem as digital financial services expand: existing financial consumer protection rules are not being enforced consistently on these delivery channels.

Questions of jurisdiction may play a part in the enforcement gap: who has authority on this issue? Is it the telecommunications regulator, financial sector regulator, or any other party that has authority to enforce transparency rules? As more countries issue electronic payments and e-money regulations, the jurisdictional and authority gaps should be reduced. In Ghana, for example, the new Guidelines for E-Money Issuers states, “E-money issuers are under strict obligation to fully adhere to any rules issued by the Bank of Ghana pertaining to consumer protection,” ensuring equal application of consumer protection rules across provider types. They also specify requirements for consumer protection in the areas of transparency and recourse, including standardized disclosure formats for all providers that will be developed by the Bank of Ghana—a best practice in disclosure.

Although some transparency gaps in Kenya’s mobile money ecosystem persist (for example, the Pay Bill function of Lipa na M-Pesa still has hidden fees; and we have also documented issues specific to M-Shwari loan products here), CAK’s announcement is a crucial first step. The transparency is important for promoting competition, since consumers must first understand how much they are paying before they can place competitive pressures on providers to provide value for money. It also highlights the important role competition authorities can play in protecting consumers. Specifically, the role of competition authorities in digital financial service markets is a line of research CGAP is undertaking and will be publishing more research on in the coming months.

The CAK cited Section 56(4) of the Competition Act, “a consumer shall be entitled to be informed by a Service Provider of all charges and fees, by whatever name called or described, intended to be imposed for the provision of a service” as providing authority for their action. This example may be useful in other markets where the question of jurisdiction is not yet clear (i.e. authority of the communications or financial sector regulators is ill-defined in digital financial services). The CAK has Memorandums of Understanding with both the Communications Authority and Central Bank of Kenya – a good model of effective coordination across authorities in regards to digital financial services. Let’s hope that other competition authorities will be inspired by CAK and start to play a more active role in digital financial services markets, as there is much that could be improved to ensure fair treatment for consumers. Furthermore, promoting transparency will help support more effective competition, to the benefit of financial inclusion.

Comments

This is true i also

This is true i also experience the same,paid for TV services and was charged kshs.12/=that left me wondering were there charges? please be transparent always just as they do with Mpesa.

Safaricom is on the verge of

Safaricom is on the verge of being declared a dominant player which gives them undue advantage over other players hence they can arbitrarily increase there costs without necessarily caring about the end user. This negates further the moral objective financial inclusion

Add new comment