Focus on Product, Pricing and Agents to Drive Adoption

CGAP’s Branchless Banking Database synthesizes a mass of data into a short 12-image “story” about what branchless banking is and the key hurdles we face in 2011. We’ve converted that into a three-part series, which we conclude today. The first part in the series is available here. In the last installment we showed that achieving large scale volume of transactions still eludes most branchless banking services.

Today’s post points to three levers for driving steeper customer adoption: product, pricing, and agents.

PRODUCTS: Most BBIs focus on payment services which reduce the time, cost, and risk of loss with moving money over distance, e.g. a remittance to family in the countryside or a bill payment. Low-income consumers also have major pain points moving money over time, i.e. putting aside money now to use later, or the converse, borrowing now and repaying later. The informal options poor people have are often poor quality: preliminary results from a revisit of the Portfolios of the Poor households in S. Africa found 27% have lost money through an informal saving or credit instrument: on average US$ 113.

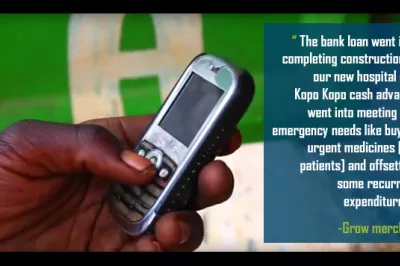

This presents an opportunity for BBIs to accelerate client usage via a diversified set of products including savings. Arguably, it was when Kenyans began leaving balances in their M-PESA wallet that the service vaulted beyond the initial target segment of 3 million urban, mostly male remitters and began marching toward serving more than 13 million Kenyans using it for a range of financial needs. In other words, savings may have been the “stickiness” factor — a kind of loss-leader which bridges clients to a more active relationship.

PRICING: There is still room to experiment with pricing. CGAP analyzed 26 branchless banking services and traditional banks to understand how their prices vary across 8 bundles of savings and payment transactions. On average, branchless banking was 38% cheaper than similar services offered via traditional bank channels. The analysis also revealed multiple pricing strategies in play, but no clear best approach, suggesting opportunities to experiment, even departing from traditional pay-as-you-go to a freemium model which could drive uptake and usage faster.

AGENTS: Having a dependable network of agents is key: branchless banking is still very much a business of having cash when and where customers want it. But agents are not ATMs, built, deployed and operated in identical fashion. CGAP research in Brazil, India and Kenya found as many different agent network configurations as providers. For example, the Brazilian post office is able to command US$ 122/day for its involvement in Banco Postal because of the instant nationwide coverage it gives to its partner, Bradesco. Meanwhile, individually-owned small stores earned less than US$ 1/day, in part due to their lack of bargaining power. CGAP’s Agent Management Toolkit provides in-depth analysis.

BBIs must understand the business case from the agent’s point of view and craft an “ask” (time, risks and costs the agent is required to bear) matched by an adequate “offer” (the benefit an agent derives). Vincent is an M-PESA agent in Kenya. He earns US$ 4.11/day in commissions for being an agent. But do not assume compensation needs to be this high globally, or only comes from mobile money commissions. Denise (Brazil) operates a coffee shop. Though she only earns US$ 0.32 in direct commissions for being an agent, people who come to pay bills often also purchase food or drink, making the benefit to her core cafe business her main rationale. Hasita (India) is a rural school librarian who finds US$ 0.91 to be a welcome, sizeable addition to her low wages, and she enjoys the status of being an agent serving her community.

CGAP is turning its attention on these, and other, challenges in 2011.

CGAP’s Branchless Banking Database is available here. It marshals data from our 2010 field work on agents, business models, customer adoption, and regulation, and combines it with data on banking access, mobile penetration, population, and income in 168 countries. Graphics are easily imported into your own presentations, and the data is presented in Excel, enabling you to manipulate it for your needs.

- Mark Pickens

Comments

Thanks for your comments, Ali

Thanks for your comments, Ali. I completely agree: data on airtime lending would be IMMENSELY valuable in terms of gauging appetite for micro-micro-loans.

Nice collection of articles

Nice collection of articles and data, thank you Mark. Moving money over time in terms of borrowing now and repaying later jumped out at me. Although we do not have much data on this when it comes to using mobiles currently, operators in East Africa have launched services when they loan prepaid users small amounts of airtime/credit at low surcharges. They collect both the next time a subscriber buys and loads airtime/credit. Such data collected over time from a large group of subscribers might provide insight into the viability of operating small loan schemes directly over the mobile without need for/minimal interaction.

Add new comment