Global Financial Innovation Network: Not Global Yet

At the end of October, the Hong Kong Monetary Authority hosted a special meeting. In a conference room high above the Asian financial hub, more than a dozen people from various organizations met to discuss the future of the Global Financial Innovation Network (GFIN) — a collaboration of 11 financial regulators and CGAP formed earlier this year to respond to the challenges of the borderless and fast-evolving FinTech landscape. What started as an idea to bring the regulatory sandbox concept to a global level has evolved into a more structured initiative with the objective of creating a network of regulators who share experiences, collaborate on policy work and regulatory trials and support companies in conducting cross-border tests of innovations. GFIN has great potential, but to make a significant impact it will need to expand its membership and become truly global and representative. To make this happen, both current and aspiring members, including emerging markets and developing economies (EMDEs), should be more proactive.

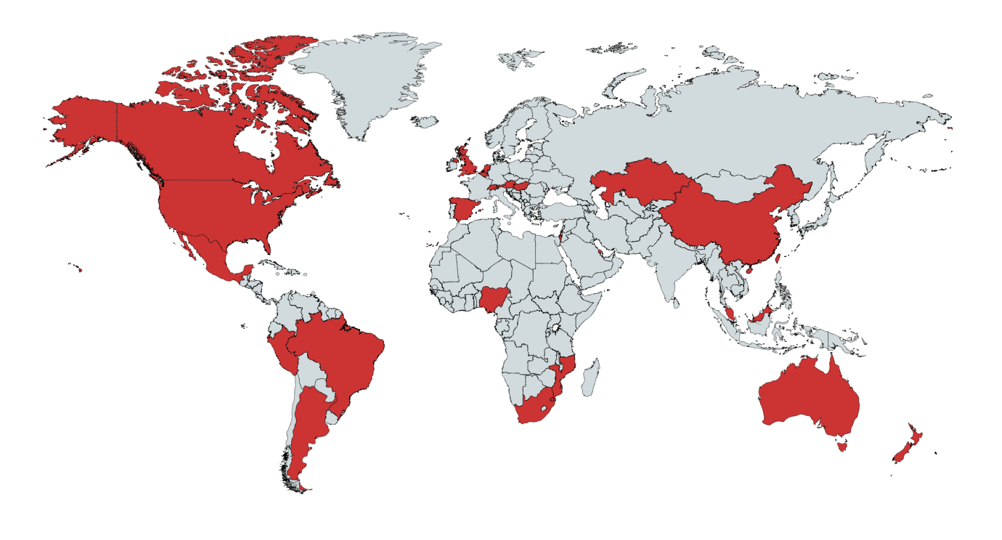

Earlier this year, GFIN’s founding members published a consultation document outlining the main thesis of how GFIN should operate and asking the global community for feedback. The consultation process attracted substantial interest, with nearly 100 responses from 26 jurisdictions and a diverse group of stakeholders, ranging from national policy makers to FinTech companies and international NGOs. Most responses were positive, emphasizing the need for an international initiative focused on emerging topics that can meaningfully complement the work of global standard-setting bodies (e.g., by offering practical regulatory guidance on how to implement international standards).

Location of Respondents to the GFIN Consultation Document

However, to deliver on this potential, GFIN needs to become more comfortable with a large and diversified membership. Currently, most of the participating agencies represent developed markets — the United Kingdom, United States and Hong Kong, to name a few. This composition does not quite reflect the fact that today financial innovation is dramatically changing lives of consumers in the markets that traditionally would be called developing (or emerging). India, Kenya, Mexico and others are not GFIN members yet.

Moreover, all the members attending the Hong Kong meeting were common law countries. Common law systems seem to be better equipped to cope with innovations (e.g., due to wider discretions granted to regulatory authorities), and only a handful of regulatory sandboxes currently live outside the common law system. However, any truly global network needs to appeal to a variety of legal systems and accommodate differences among them.

Finally, two types of stakeholders were missing in Hong Kong: the financial services industry and the global standard-setting bodies. One can understand the lack of industry presence. After all, GFIN is primarily a regulator’s club. However, GFIN directly relates to the work of global standard-setting bodies, and their voice in the discussion would certainly add value.

The imaginary empty chairs in the room reflect a challenge for GFIN: How can it create a truly global platform for regulatory cooperation with network effects while keeping it nimble, action-oriented and operational? Keeping the group small at this formative stage is practical, but the network can benefit only by opening up over time. The bigger and the more diverse the membership becomes, the more value and impact GFIN will create. For instance, EMDEs can contribute unique lessons and insights in cutting-edge areas, from regulation of mobile money to crypto assets. After all, Kenyans are among the highest per capita Bitcoin holders, and China has by far the largest person-to-person lending market.

GFIN is not the only one who needs to take action. EMDEs should seize the opportunity to voice their views and claim their spot at the GFIN table. At this stage, EMDEs can still actively shape the network. Many things about GFIN’s mandate, governance, operations and the like are still to be decided, and if EMDEs do not actively participate, their views and interests will not be reflected. Changing GFIN later will be more difficult than shaping it at its inception. Now is the time for EMDEs to engage with GFIN and for GFIN to be receptive and open to new members.

This post is part of CGAP's "Regulatory Sandboxes: What Have We Learned So Far?" blog series. The series takes a critical look at the concept of the regulatory sandbox and how it has evolved in different parts of the world.

Comments

Open to establishing a local…

Open to establishing a local, then regional FNI in west Africa starting out from Senegal with all the procedures and safeguards necessary to run it properly from communities known for their relative resilience compared to other sparse ones.

Any on-boarding process to look into?

Add new comment