Haiti: Strategies for a Multi-Competitor, Multi-Industry Market

This is a guest blog post by Dalberg Global Development Advisors Vicky Hausman, Matt Daggett, Lorenzo Bernasconi and Daniel Altman.

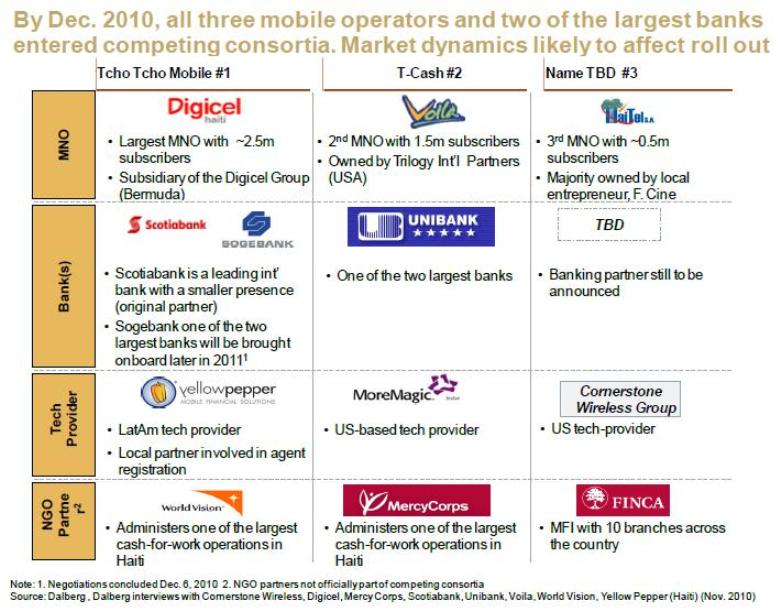

Last year, three partnerships involving all of Haiti’s mobile phone operators and some of the country’s biggest banks announced their intention to launch mobile money services. So began the competition for shares of a $10m incentive fund created by the Bill & Melinda Gates Foundation’s Haiti Mobile Money Initiative (HMMI). In December, Digicel-Scotiabank and Voila-Unibank both launched mobile money services in Haiti, and on January 10th Digicel-Scotiabank won the ‘First to Market’ prize – $2.5m for having completed 10,000 transactions spread across 100 agents. The incentive fund will continue to draw attention to this fast-growing industry, offering a unique opportunity to learn about the benefits and challenges for companies launching services in a multi-competitor, multi-industry market.

During the next two years, Dalberg Global Development Advisors, with funding from the Gates Foundation, will be analyzing the market’s growth and dynamics. Among the questions we will ask are these: What will be the most effective strategies for competing in this market? Will parallel marketing efforts by multiple mobile money services lead to faster uptake? What role will international remittances play in the industry, given the country’s dependence on these flows?

So far, Digicel-Scotiabank and Voila-Unibank have launched similar, consumer-focused mobile money services with identical pricing. Digicel’s market share – at least 55% of Haiti’s mobile subscribers – has predictably given the “Tcho-Tcho” service it offers with Scotiabank an initial advantage in the race to acquire customers. Digicel’s main competitor, Voila, has joined with Unibank, Haiti’s biggest bank, to offer “T-cash.” Unibank’s larger branch network will help its agents to manage liquidity, an important factor for agents as they consider how strongly to push this new service. Though Digicel’s newly signed partnership with Sogebank will even things up, it may also add complexity in clearing transactions depending on how the relationship is structured.

Click on the image below to see a clearer summary of mobile banking in Haiti.

In interviews, executives of the companies converged in their view of the prize as speeding the launch of mobile money but differed in their primary rationale for investing. As noted by an executive of one of the banks involved, “the prize certainly got us more focused on mobile money; without it our roll-out would have likely taken two more years.” All the companies approached mobile money as a business opportunity, but none noted direct revenues as the main economic objective – perhaps because all expected a competitive marketplace. Mobile operators instead mentioned financial objectives such as lowering subscriber churn or increasing revenue per use, while banks offered rationale such as reducing the cost to serve low-income customers or competing for market share.

As the mobile money industry grows, Dalberg will work with the partnerships to understand their strategies and identify lessons that can be applied worldwide. The presentation here contains our initial findings. In mid-2011 and early 2012, we will carry out two additional rounds of research on the business models being deployed in Haiti. We hope that the results will prove useful and illuminating.

Add new comment