Helping or Hurting? 10 Facts About Digital Credit in Tanzania

Digital credit is a growing phenomenon, surrounded by much excitement and expectation that quick access to credit could help poor households, especially when faced with emergencies or other financial needs. A new nationally representative phone survey conducted by CGAP in Tanzania examines whether it is living up to this hype. We interviewed more than 4,500 Tanzanians, including 1,132 digital credit users, to understand who is using digital credit, how it fits into borrowers’ portfolios, and what risks are emerging. Our findings suggest that while borrowers are using digital credit to meet everyday needs, few turn to it for emergencies. We also find that nearly a third of digital borrowers have defaulted on a digital loan, and more than half have repaid a loan late.

Digital credit has been available in Tanzania since 2014, with the launch of M-Pawa which now boasts nearly 5 million subscribers. As our findings show, while digital credit has the potential to bring benefits to low-income individuals with limited access to formal credit, it also carries potential risks that need to be balanced and understood. Better understanding digital borrowers and their experiences with loans is critical for determining steps regulators and providers should take to maximize benefits and mitigate risks.

Who is using digital credit?

A fifth of Tanzanian phone owners have taken out a digital loan. The digital credit market is dominated by three lenders: M-Pawa (which 48 percent of digital borrowers have used), Airtel Timiza (39 percent), and Tigo Nivushe (29 percent); numbers add to more than 100 percent as many borrowers have used more than one digital lender.

Digital borrowers tend to be men between the ages of 26 and 45. They tend to be better educated than people who have not used digital credit, but still the majority have only primary education. They are more likely than the average person to live in urban areas.

Digital borrowers are much more likely to have used banks and other financial services. They are three times more likely to have a bank account than the typical Tanzanian adult (44 percent vs. 13 percent, respectively), and 11 times more likely to have taken a bank loan (11 percent vs. 1 percent).

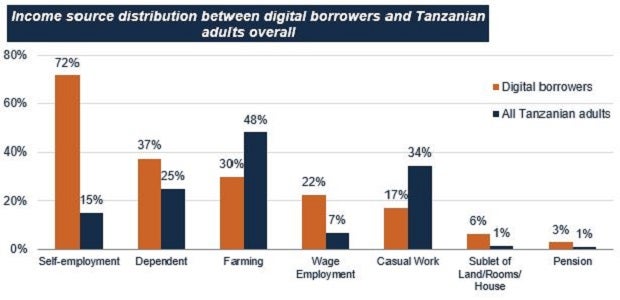

While most digital borrowers are self-employed, other income sources are mixed. Seventy-two percent are self-employed, compared with just 15 percent of Tanzanian adults overall. A large portion of digital borrowers rely to some degree on income from family, friends or government aid transfers (“dependents” in the graph). Yet digital borrowers are also more likely than average to be wage earners, which is correlated with higher-than-average education levels. This suggests that digital credit is reaching a few distinct segments: a segment of educated wage earners, a potentially less-well-off segment that depends on others for income, and segments that fall somewhere in between.

How is digital credit being used?

Although most digital borrowers are self-employed, only a third report using a digital loan for business purposes. Even within the self-employed segment, fewer than 40 percent of borrowers report using a digital loan for business. Digital loans are most commonly used to meet ordinary household needs and to purchase airtime. Only 9 percent of borrowers report having used the loans for medical expenses, including emergencies, and fewer than 1 percent have used them for any other type of emergency. The only use case for which digital credit is more commonly used than other sources of credit (informal or formal) is for purchasing airtime.

Digital credit primarily complements existing loan sources. Two-thirds of digital borrowers have not reduced their use of other loan sources since gaining access to digital credit, while one-third has.

Digital credit is a frequently used part of borrowers’ portfolios. Sixty percent of digital borrowers had at least one outstanding digital loan at the time of the survey, and 67 percent had taken a loan out in the last 90 days. This active rate is much higher than the 31 percent typical of mobile money accounts.

What risks are emerging from digital credit use?

Late repayment and default are widespread. Nearly a third of digital borrowers have defaulted on a digital loan, and more than half have repaid late. Late repayments and defaults are surprisingly consistent across segments. While casual workers and those reliant on income from others are the most likely to have defaulted, even among employed borrowers and those with tertiary education a quarter have defaulted. And this is just the percentage that admitted to defaulting, so the true figure could be even higher.

Poor transparency means borrowers may not understand fees or repayment requirements. Just over a quarter of digital borrowers report that they were charged fees they didn’t expect, that they did not fully understand the costs associated with a loan, or that a lender unexpectedly withdrew money from their account. Poor transparency has follow-on repercussions, as those who reported poor transparency were more likely to have repaid a loan late or defaulted.

Nearly 10 percent of digital borrowers report that they have reduced food purchases to repay a loan. This group is more likely to have defaulted on a loan (37 percent) and more likely to have repaid late (82 percent). They are also more likely to have been balancing multiple loans at the same time, suggesting that they may be carrying too heavy of a debt load (though further research would be needed to rigorously assess the impact of digital credit on borrower financial portfolios).

While digital credit may be providing benefits for many borrowers, perhaps smoothing consumption when it is used for household needs, it doesn’t seem to be living up to the hype of helping households cope with medical expenses, emergencies or paying school fees when income is tight. And there seems to be at least one segment for whom it may be having detrimental effects, as families struggle to purchase food while repaying. Smart regulations, such as requiring better transparency as well as suitability and needs assessment rules, and proactive steps by providers, such as better identifying borrower repayment abilities to limit over-indebtedness, could go a long way towards maximizing benefits and minimizing risks as the digital credit market evolves.

Add new comment