How Juntos Finanzas Engages Customers to Use Digital Finance

Active customer usage is the “Holy Grail” for many digital financial service providers. One of the key challenges for choosing and using financial services is the engagement gap between customers and their providers. Not only do customers often lack necessary information, but also the trust and confidence to interact with their financial service providers. Building a true relationship being responsive and attentive to customers’ questions, however, can be costly and time-intensive. So how can we bridge this gap? How can we empower clients to make good choices and effectively use financial services without losing sight of the business needs of financial service providers?

Photo Credit: Juntos

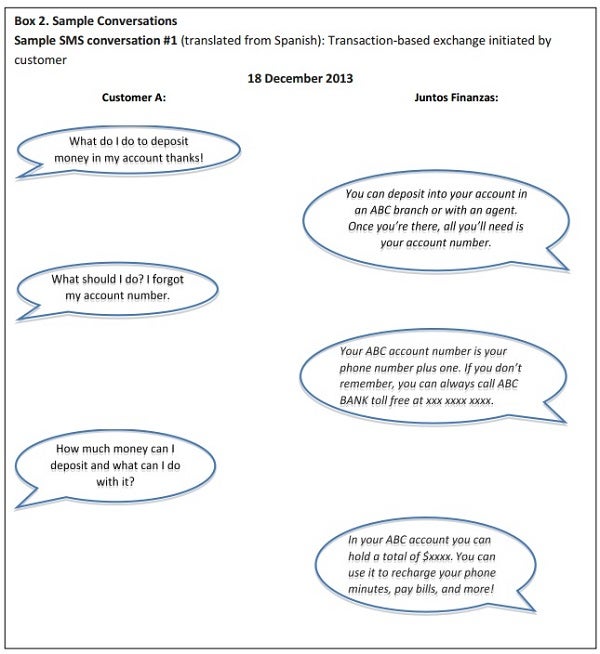

Technology can offer a scalable solution. Juntos, an early-stage Silicon Valley start-up, provides a real-time automated conversational platform that allows customers to engage with the Juntos Finanzas platform (typically positioned as a “friend of the bank”) via SMS. Juntos aims to answer customers’ questions in a timely manner, providing valuable just-in-time information, such as how to deposit money, what the forgotten account number is, where to get additional assistance, etc. It also reaches out proactively to customers, trying to influence their financial behavior, for example, by messaging, “Saving today is the way to achieve your future goals. How much will you put away this week?” In their first deployment, the Juntos Finanzas platform was initially able to handle 93% of their conversations with customers, increasing to 98% automated replies nine months later.

Juntos is currently deploying pilots in several countries across the globe. The results of an initial pilot in Colombia are promising and convinced Juntos’s partner, Bancolombia, to continue its engagement with Juntos for an additional year beyond the duration of the pilot. CGAP’s new working paper gives more insights into the workings of Juntos’s design process, its technology, and the early results. We highlight 4 key findings here:

1. Customers interact with Juntos Finanzas. In the case of Bancolombia, the response rate to Juntos’s messages increased from 4% after one month to 32% after three and a half months, an impressive rate compared to the typical 1% response rate associated with SMS campaigns. Random customers surveyed by the bank were also highly satisfied with the service.

2. Customers change transactional behavior. In the Colombia pilot, Juntos was tasked with increasing account activity for a particular mobile savings product and to increase account balances. Three months after the introduction of Juntos, account activity increased by 32.5% and average account balances by 50% compared to a control group. The underlying mechanisms of this behavior change still have to be tested in future research. One plausible explanation however could be that Juntos provides information just-in-time when the customer needs it. Another important aspect could be that the interaction with the customer makes her/him feel less isolated in her/his financial life.

3. Customers gain trust and confidence. Ethnographic research conducted by Juntos before implementing its pilots identified lack of self-confidence and trust in providers as important barriers for people’s use of financial services. As a result, Juntos works to boost self-confidence through its messaging both by providing relevant information and positive reinforcement for desired behaviors such as depositing money. Juntos also tries to foster customer trust directly by designing the communication with its customers based on insights from their research about what and who people trust. In Colombia, consistency, timeliness, and responsiveness emerged as some of the principles that were incorporated in Juntos’s messages accordingly.

4. Providers learn about customers. Through continuous engagement with customers and tracking changes in their transactional behavior, Juntos is well-positioned to supply financial service providers with insights into their customers’ needs, interests, and behaviors - a service Juntos’s partners in Mexico and Tanzania mentioned as valuable in phone interviews with CGAP. For example, one of the most popular SMS received by Juntos from customers in Tanzania were on shopping tips, e.g. “Which shops would offer me the greatest discount for these types of goods?” In response, Juntos’s partner Tigo Tanzania is exploring how such messages might offer key intelligence to better segment their customer base and perhaps optimize on specific categories of merchants offering these products or discounts.

Juntos is still in the early demonstration stage of proving its concept and replicating across multiple countries. More pilots and research are needed to understand both the initial success of Juntos, as well as questions regarding customer data privacy, cost-benefit concerns for partners based on Juntos’s fee-based business model, and the sustainability of customers’ behavior change. We are looking forward to learning from the ongoing pilots and from other platforms that might perform similar functions of real-time interaction.

Add new comment