International Remittances and Branchless Banking: Emerging Models

CGAP and Dalberg Global Development Advisors just finished the third update in their series of studies on international remittances through branchless banking. Download the report to read how the landscape continues to evolve one year later, what new players and models have entered the market and the implications that these models may have on financial inclusion.

When we last took a close look at international remittances in our 2012 study, the outlook was hopeful and continues to be so in 2013. Despite a number of challenges identified by operators and experts, the industry seems to be attracting more international remittance volumes, resulting in eventual financial inclusion benefits for the poor in developing countries.

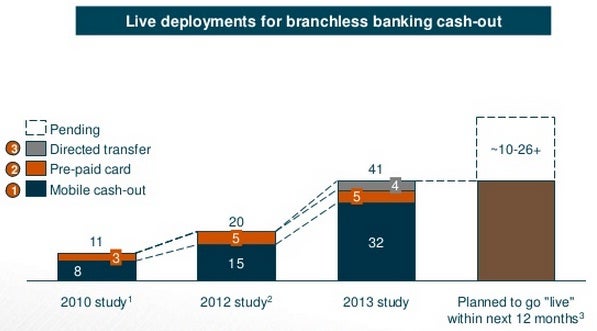

For example, deployments that transfer remittances into an mWallet further doubled in the last year, growing from an initial 8 identified as live in 2010, to 15 in 2012, and now to 32. The entry of new mobile-based deployments is accelerating through partnerships with key intermediaries such as Western Union or the BICS HomeSend hub.

Branchless banking deployments increased in the past 5 years.

Branchless banking deployments increased in the past 5 years.

Beyond that, innovations in foreign exchange models linked to mobile wallets are promising lower costs to consumers, provided these models can generate revenues and scale. By sending a remittance into a mobile wallet, a recipient can choose to store that added value for some period of time, pay bills directly, build some type of credit history, in ways that could mimic services provided by financial institutions. In comparison, any of the alternative pre-paid card models can at most hold some stored value, but otherwise are more limited in the functionality offered.

Yet while the number of mobile-based deployments has grown tremendously, our interviews with remittance actors indicate that transaction volumes and revenues generally remain low. This is due to a variety of push and pull factors. On the push side, senders either lack awareness of mobile channels on the receiving end, or are uncomfortable with using digital means and prefer a more conventional brick and mortar approach. Digicel in the South Pacific claims a 40% increase in transaction volume over 2012, but acknowledges ongoing challenges with customer acceptance; they have recently invested in retail stores on the sending side as a means of reaching more potential customers.

On the pull side, the low penetration of mobile money has limited the attraction of having remittances stored in receivers’ mWallets. Globe GCASH in the Philippines is an acknowledged leader in international remittances into a mWallet, yet appears to be de-prioritizing international remittances in favor of the greater volumes and revenues from domestic mWallet transfers. Similar de-prioritization is evident in pending deployments such as YellowPepper in Latin America, which also cited the need to focus first on domestic transfers despite describing great hopes for international remittances in our 2012 study.

But while the mobile story is one of latent promise, a number of brash newcomers have entered the landscape and are introducing new models (not necessarily mobile-based) for how remittances are transferred. Some models are moving beyond the cash-out model to restrict remittances to particular uses, through gift cards to a specific store, as with Regalii in the Dominican Republic, or to make needed bill payments for recipients, as with Willstream in Senegal. One of the newest models conducts online transfers using social media, through senders such as Azimo, which cash-out through agents or into an mWallet; or Fastacash, which offers an option for direct payments made online. Each of these new models (the restricted-use and social media models) promise benefits to the customer in increased affordability and convenience, particularly as internet access rapidly expands in developing countries.

Yet here, as with pre-paid cards, a closer look is needed to determine how – or if – price reductions and innovative transfer mechanisms may translate to broader access to financial services. There are still questions on how these models could serve as a bridge to greater financial inclusion beyond cheaper and more convenient payment transfers. Despite their potential to reduce poverty, remittances to retail gift cards or to pay bills directly do not expand access to other financial products for the unbanked (stored value, credit, insurance etc.), which is more likely to occur through a traditional electronic wallet. Therefore a year later, we are still wondering, “Are international remittances through branchless banking helping enable access to a range of financial services for the unbanked?” And the answer resulting from the 2013 study is“not yet”.

-------Wameek Noor is a Financial Sector Analyst at CGAP. Andria Thomas is a Project Manager with Dalberg Development Advisors.

Comments

Although channeling

Although channeling international remittances through mobile phones has the promise of expanding access and lowering costs, this service has yet to take off in a substantial way. It's therefore difficult to understand why the promise of mobile remittances is however yet to be fulfilled

Most home remittances are

Most home remittances are catering low income segment population in developing countries and consumed by beneficiaries for household maintenance rather than for saving purposes. There are few queries that might answer the main challenge:

1. What is the limit on amounts one can send on mwallets as compared to transfer in bank accounts or cash collection?

2. How the beneficiary will use that money through mobile devices? Is the money receiving country’s retail industry providing enough technology platform?

3. What is being done in the receiving country for awareness of beneficiary?

4. Who will provide the proof to the beneficiary that the received money is legal and has come via remittances?

5. Are banks profits (extra benefits) comparable with those of mwallets?

6. Applied taxes of remittances mwallets vs bank accounts?

7. Telco led model vs bank led model?

In my experience beneficiaries level of comfort is more important than the senders. For sender it is 12, 14, 16 or 18 digit code whether it is bank account #, pre paid card # or mwallet #. It is the beneficiary who decides how to receive money i.e. bank account, cash collection, via exchange company, pre paid card, mwallets etc.

Lack of Financial Literacy (Remember! mwallets is to cater unbanked population) coupled with tricky Technology (mobile phones) dilemma makes the use of mobile money more challengeable.

Are telcos ready for AML regime? I have not heard any Telcos being penalized for violation of AML regulatory framework. It is only the banks who face these charges in heavy amounts. Standard Chartered, HSBC is an example. Barclays Bank in UK is closing bank accounts of Money Service Operators probably for the same reason.

Add new comment