Introducing MIMOSA: Microfinance Market Capacity Measurement Tool

When you hear the word "Mimosa," you might immediately think of the refreshing champagne cocktail. But now the MIMOSA - the Microfinance Index of Market Outreach and Saturation - also has relevance to financial inclusion. In brief, the MIMOSA is a simple way of measuring microfinance market capacity, an important complement to the approach described in a recent blog in this series by Annette Krauss and her colleagues from the University of Zurich. The key difference in the two approaches is that they work from entirely opposite starting points.

The Zurich team estimates the potential market for microcredit in a given country by referencing national poverty lines, household size and several other factors and then compares that to the number of borrowers reported to the MIX Market. This approach builds on a line of analysis going back at least several years. Indeed, one of us developed a simpler version of such a model to argue that the market in Andhra Pradesh was over-saturated a year before the crisis hit. Clearly this is an approach that works.

However, like all models, it has weaknesses, and perhaps the biggest is the significant number of assumptions that it requires: who are the microfinance clients in a given country and are they well represented by looking at the national or international poverty lines? What is the level of demand for loans in a potential population? Is the lending reported in MIX a good reflection of what's happening in the overall market? And finally, what is the level of cross-borrowing (or multiple borrowing) in the country and to what extent does it skew the results? As one can imagine, the answer to these questions differs greatly from country to country, and so does the validity of the model.

To keep the model as simple and easy to use as possible, MIMOSA takes a different route, bypassing these difficult questions altogether. In estimating credit market penetration, we treat all retail-level debt as interchangeable and make no assumptions of who constitutes the target market, taking in everyone – poor and rich alike. While unconventional, we find that this approach works well in most countries, since credit penetration rates in lower- and upper-income segments tend to move in parallel.

We are thus able to base the model entirely on the Global Findex dataset created from household surveys in 148 countries. The resulting model uses just three indicators to calculate credit demand:

credit_demand: | Predicted level of potential retail credit demanded |

HDI: | Human Development Index (source: UNDP, 2011) |

formal_savings: | Saved at a financial institution last year, % age 25+ (source: Global Findex 2011) |

semiformal_credit: | Average of (loan from a private lender in the past year (% age 25+), loan from an employer in the past year (% age 25+), loan through store credit in the past year (% age 25+)) (source: Global Findex 2011)

|

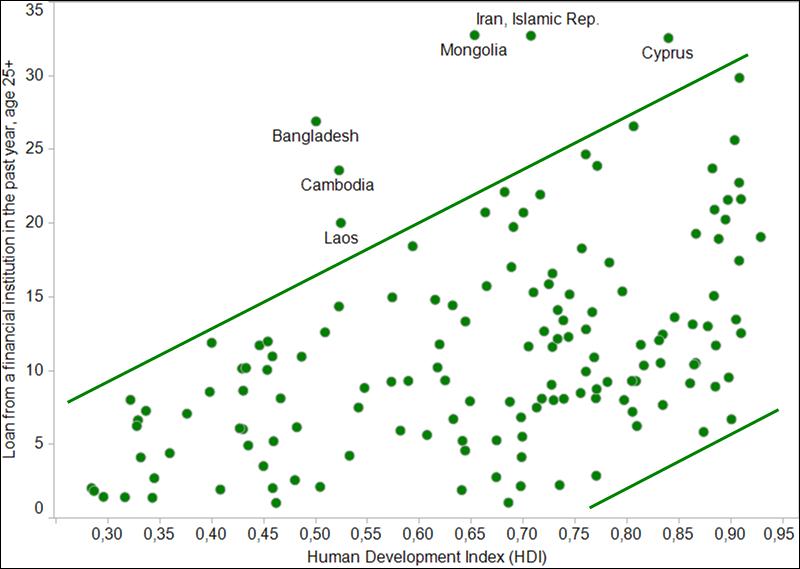

The heart of the model is the Human Development Index (HDI), which has an especially strong relationship with formal sector borrowing (Figure 1). A composite indicator based on economic strength (GNI per capita), life expectancy and education levels, HDI is able to account for both the overall level of economic development and how broadly it is distributed across the population; our premise is that this compound indicator ultimately provides support for higher retail credit use. In addition, the educational access component serves as a proxy for the quality of governance.

Figure 1: Formal Credit Use Strongly Correlates with HDI, Source Findex

Note: Green lines represent visual approximations of upper- and lower-boundaries of borrowing rates

The second leg of MIMOSA is the rate of formal savings. Countries where individuals are more likely to save at financial institutions tend to also have higher borrowing rates. Part of this is simply a reflection of a more developed financial system. But from our perspective, savers also make better borrowers, and a more balanced financial sector is a more stable sector. Thus, in MIMOSA we rate countries with higher rates of savings as having higher credit capacity as well.

Finally, in semi-formal borrowing (from moneylenders, employers, and stores), we find an indicator that serves as a good proxy for the intrinsic level of credit demand. Different societies show different predisposition towards credit, especially outside of family relationships, and because semi-formal credit markets evolve largely independently of government policy and are entirely locally-funded, they are in many ways the best reflection of that intrinsic demand. Moreover, contrary to what one might assume, this type of borrowing does not appear to be replaced by the advent of formal lending – an increase in one usually accompanies an increase in the other.

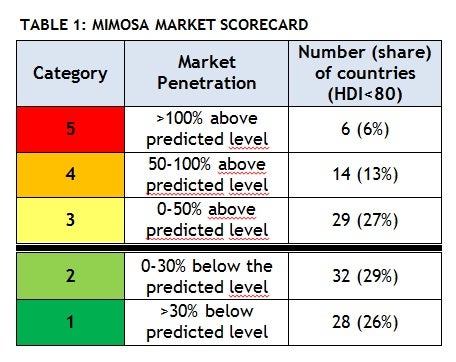

Once we calculate credit demand using these three indicators, we then compare the actual credit penetration reported by Findex to the level predicted by the model and apply a penetration rating, based on the difference between the two (Table 1). Though the model is simple and avoids any focus on microfinance (or generalization from the microcredit sector to the broader retail credit sector), many of the results appear to be quite robust and fairly well-aligned with microfinance penetration rates and expert views of countries of concern, including Cambodia, Kyrgyzstan, Mongolia, and Bangladesh (Figure 2).

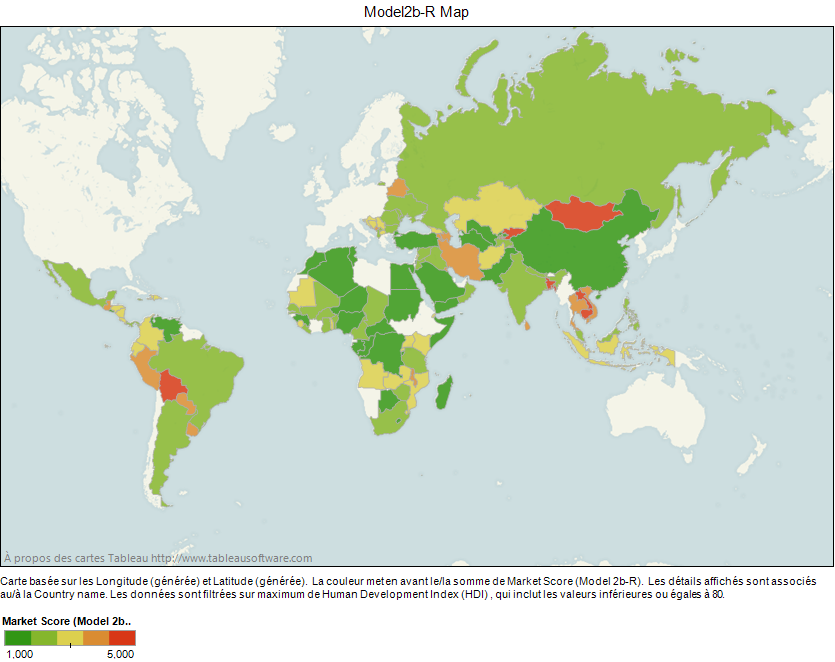

Figure 2: Global View of MIMOSA Scores

But since MIMOSA isn't limited to microfinance, it also highlights high credit-use countries normally outside our purview such as Thailand and Vietnam. Another plus of MIMOSA is identification of high-potential countries, where demand for credit is not being met. Most of Africa and the Middle East fall under that category, as does China and several countries in between.

As any model, MIMOSA has its limitations. The biggest of these is MIMOSA's inability to recognize differences within a country's borders, where some cities or regions may be breaching their limits for credit, even as the rest of the country remains largely underserved by financial institutions – a limitation that we will seek to address in subsequent iterations of MIMOSA. Some aspects of the model, especially the emphasis on semi-formal credit, might also not apply to all countries, where informal borrowing may be less commonly accepted.

However, even in its current configuration, MIMOSA provides an important tool to help slow the flow of credit to countries that may have too much, and focus instead on those that have too little.

Emmanuelle Javoy is the Managing Director of Planet Rating.

Daniel Rozas, is an independent microfinance consultant.

MIMOSA was sponsored by the PlaNet Finance Foundation. The report is freely available here. To request the model output and underlying data, please email rating@planetrating.com.

Add new comment