In Kenya, Bank Accounts Again More Popular than M-PESA – Why?

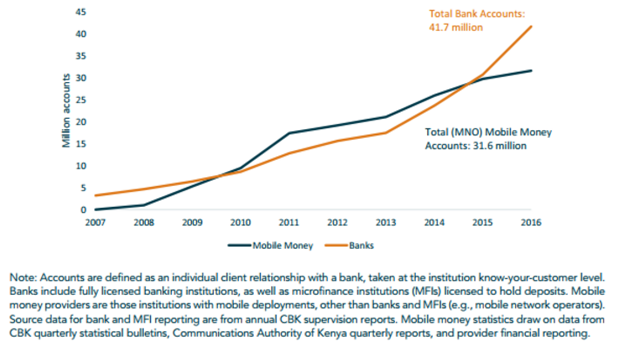

Many people are aware that within a couple years of M-PESA’s launch, the total number of mobile money accounts in Kenya eclipsed the total number of bank accounts. Mobile phones quickly became the preferred way to send, receive and store money for much of the country’s population. Yet fewer people realize that Kenya has already reached a second inflection in account ownership: Bank accounts today once again outnumber mobile money accounts — by over 30 percent.

Total Accounts of Kenyan Banks and Mobile Network Operators, 2006-2015

So how did Kenya’s banks achieve this growth?

Around the world, the digitization of financial services has helped to tear down long-standing barriers to financial inclusion. While mobile network operators (MNOs) are often credited with spearheading this change, banks have been as much a part of it, especially in recent years. They have discovered new ways to compete and collaborate in an increasingly digital and mobile financial services market. And their success helps to disprove the notion that mobile money is a zero-sum game for banks and MNOs.

As CGAP’s recent working paper Banking in the M-PESA Age: Lessons from Kenya explains, Kenya, as one of the largest and most mature mobile money markets, offers an excellent opportunity to explore how these strategies are playing out. Two of the key strategies employed by banks in Kenya will likely be familiar to those who are following the country’s financial services market: direct competition over a mobile channel, such as through Equity Bank’s mobile virtual network operator product Equitel, and collaboration with mobile money providers to offer banking services, such as through Commerical Bank of Africa's (CBA’s) M-Shwari. M-Shwari alone now holds over 19 million accounts, all accessed from M-PESA.

One of the more recent ways that banks have gained traction in the world of mobile financial services, however, is through the small-dollar interoperability scheme introduced by the Kenya Banker’s Association (KBA) and its 47 member institutions (of whom at least 30 currently participate in the scheme). Earlier this year, Kenya’s banks rolled out PesaLink, a real-time payments system that enables small-value transfers between institutions. While KBA initially spearheaded the initiative, a newly created, bank-owned entity called Integrated Payment Systems Limited now manages the uniformly branded scheme and operates the payments switch that supports the transactions.

The new scheme allows customers with accounts at participating banks to send money to each other easily and instantly. A sender simply designates a recipient by entering his or her phone number (or account number if the recipient doesn’t have a registered phone). This intuitive payments addressing system moves the business of interbank payments one step closer to the world of M-PESA and Kenya’s increasingly mobile-native, low-income population.

It is important to note that PesaLink is not solely, or even explicitly, about taking on M-PESA. The scheme was conceived as part of a broader effort to improve coordination between banks (e.g., better ATM connectivity and fraud services). Yet the prevalence of mobile money in Kenya makes the decision for Kenya’s banks to coordinate on small-dollar payments that much more logical. Together, participating banks have around 15,000 access points compared to the over 65,000 mobile money agents in Kenya today. Even working together, the footprint of Kenya’s banks remains a fraction of M-PESA’s.

PesaLink is still in its early days. Some banks have promoted PesaLink more aggressively than other banks, and the details of pricing and technical connectivity will continue to be a focus in the near term. However, when seen not only in the context of a shared-services banking project or a bank-led interoperability scheme, but one of a growing array of digital strategies, a clear picture begins to form as to how digital is tearing down barriers to financial inclusion for the world’s poor not just through mobile money, but increasingly through banks.

While nonbank mobile financial services can fundamentally reshape the financial sector in a developing market, as they have clearly done in Kenya, mobile services need not represent an existential threat to the traditional banking industry. In fact, the reach of models such as M-PESA can enable and even incentivize innovation in the banking sector, including a shift in focus to increasingly lower-income consumers. Kenya’s experience shows, above all, that retail banks can thrive in the face of mobile money, as long as they are prepared to adapt.

Add new comment