M-Pawa 1 Year on: Mobile Banking Perceptions, Use in Tanzania

In June 2014, Vodacom Tanzania and the Commercial Bank of Africa (CBA) launched M-Pawa, a mobile savings and loan product in Tanzania. The new service held great promise for Tanzania’s rural population, 93% of whom have never used a formal bank product (FinScope Tanzania 2013). A year after its launch, how are Tanzanian farmers using M-Pawa? How has it impacted their lives? What improvements can lead to even more uptake?

To answer these questions and to measure M-Pawa’s impact, The Connected Farmers Alliance interviewed more than 400 rural Tanzanians. These research findings provide us with a better understanding of M-Pawa’s impact on and role in Tanzanian farmers’ lives. Though our interviews, we gathered many insights:

- Farmers have positive perceptions of M-Pawa and Vodacom mobile money services;

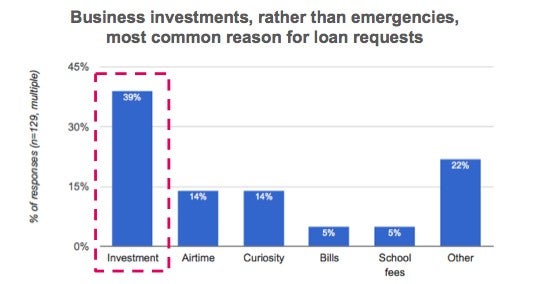

- Customers take loans mainly for business and investment purposes;

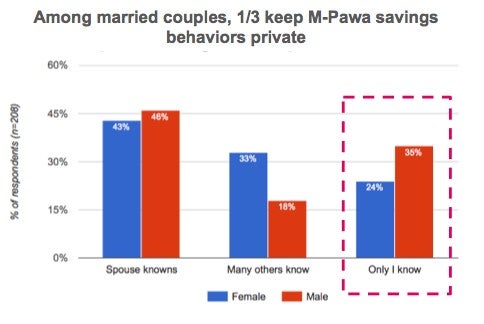

- Women feel empowered by M-Pawa to make financial decisions;

- Low financial literacy and confusing features limit wider M-Pawa uptake.

Positive perceptions of M-Pawa overall

At its core, M-Pawa builds on the M-Pesa mobile money foundation to offer additional mobile banking products. These include an interest-bearing savings account and instant loan service. (There is a similar solution in Kenya under the M-Shwari brand.)

Based on our research, we found that M-Pawa is delivering an effective mobile banking product. More than 90% of respondents agreed that M-Pawa is “easy to use”, “safe”, “private”, and has a good “integration with M-Pesa.” This sentiment was reflected in the strong word of mouth referrals: 78% of M-Pawa users reported recommending M-Pawa to at least one person, and 54% recommending it to 4 or more. Women were significantly more likely to refer through word of mouth channels then men.

Using small consumer loans for business purposes

M-Pawa features one simple option for a 30-day, 9% interest rate loan. Users request a loan and CBA instantly scores the request based on users’ historical mobile phone, data and money usage. While 61% of M-Pawa users signed up to the service for “safer money storage”, a large number were also motivated by the loan feature.

Given the difficulty low-income Tanzanians face in obtaining formal loans, the strong interest in an instant loan product is not surprising. What was surprising though is how, despite the very small (usually $1 - $15), short-term (30-day) nature of these loans, business investments were still one of the main reasons for loan requests by the farmers interviewed. Business needs included farm inputs (seed, livestock, equipment) and business investments (goods for resell, store space, etc.). Many rural farmers and small business owners mentioned actively saving and withdrawing from their account in order to increase their credit limit for future loans on M-Pawa.

Rural farmers have historically lacked access to formal loans; the introduction of M-Pawa gives them easy access to credit, and opens up new opportunities to finance their expenses and investments. However, due to the longer time period of crop harvest cycles, farmers often requested loan repayment periods longer than the current 30 days, which are still not available on M-Pawa. There is an opportunity to improve M-Pawa’s fit with farmers by providing loans of different sizes and lengths for various loan needs.

Women feel empowered by ownership of a savings and loan account

Women frequently mentioned how M-Pawa has allowed them to be more financially independent. One woman noted, “It’s helpful because I can now access my own money for family issues without asking my husband for money. There are fewer fights.” Before using M-Pawa, women either hid their money or brought all of it with them into the field each day. Even if a woman had a bank account, she had to hide the bank account card from others. M-Pawa is a solution that enables women to securely and privately store money on their mobile phones. Among married women, 24% are saving on M-Pawa without their spouses’ knowledge, enabling them to make financial decisions without constantly asking their husbands for permission.

Low Financial literacy limits product uptake

Unsurprisingly, there is a low level of financial literacy in the rural population. For example, one female farmer admitted that, “At first, I though M-Pawa was the devil! How can one actually get more money by putting money there? In the past, banks always took money away.”

For those with limited experience with financial services, M-Pawa can be hard to understand. While farmers are aware of M-Pawa through radio, billboards, Vodacom SMS messages and Vodacom/TechnoServe training sessions, they often don’t understand how it works. They are confused about the savings interest rate and why it takes three months before they see any benefits. They are even more confused about the loan limits and how to increase them.

This research highlighted how additional education, in the form of SMS tutorials, in person training (currently being rolled out by Vodacom and TechnoServe) and additional marketing will be instrumental in helping M-Pawa gain wider acceptance. Viral campaigns which leverage the propensity for farmers to recommend the service to others is also an opportunity.

Comments

Fascinating data, but the fee

Fascinating data, but the fee (9% for a 30-day loan = annual rate of 108%) is shocking. Let's hope we see competition drive down prices soon, before digital financial services become Tanzania's version of payday loans. Especially since demand for instantaneous, small value credit is so great.

Here we have in Tanzania a

Here we have in Tanzania a clon of M-Shawari from the same bank the CBA. The results seem to be similar in proportion as the original results when first launched in Kenya (Visit in this same blog “Interactive SMS Drives Digital Savings and Borrowing in Tanzania”). It worries me because the more it grows, the more volume of people that will be affected by both: the high interest rates and being added to the Credit Bureaus.

There as tendency to analyze the obvious, but ignore the important. In the first graphic the business use of the loan was the most frequent application, no reference is made to the use of savings, actually loans are liabilities that if unpaid bring trouble to the debtor, savings are assets that can be use safely to produce income without any risk and the product offers both. On the other hand, using very short term loans (In Kenya 30 days with a maximum of 45 days) to finance business inventories should be related to the inventory turnover and usually, this takes over 90 days. Unless we are talking of a very short term inventory, that has a less than 30 days turnover (Selling water bottles in the traffic jams, for example), usually applied to survival income producing activities. Therefore, I am not too sure if that this loan is useful to a typical Microenterpriser, except in exceptional circumstances.

But I must say that this is the first time I see something that I been preaching since the Financial Inclusion based on mobile money fashion have been started. I always ask myself why the information and communication resources are not massively used for financial education, at least I used it in the international consulting projects were I have bee involved in the last 30 years. You may ask yourself why I do this?.

Back in the 70s I was well involved in the so-called “bankarization” at that time in Brazil (Now Financial Inclusion) by the Housing Savings and Loan Associations. At that time, we did not have Internet nor did we had easy access to communications as today. However, 700 private Savings and Loan Associations partnered with the public Housing Central Bank to create the “Centre for Savings Promotion”, this institution started nation wide advertising campaigns to promote the opening of a Savings Passbook (Caderneta de Poupanza) and devise distance training courses on financial education. We used synchronized sound with slides projectors in all the institutions to teach finances, giving distance training booklets to be filled and sent back to be punctuated and give a passbook, with a small initial deposit, as a prize to those who successfully ended the course. Well, Brazil today has an 85% of financial included, compared to the rest of Latin America with 52%, nearly half of that of Brazil. It is very motivating for me to think I put at that time, my sand grain. Today with Internet and the multimedia, we have a very powerful tools to do effective and healthy Financial Inclusion, because to me loans are trouble and savings are strength in Microenterpriser and families in general balance sheet. I think that short term loans should not be used as a way to push savings. Worse with such a high rate of interest, it is looking for trouble in the loan run. Moreover when there is clear evidence that in the long term financial education and asset creation do a better job, because the majority of debtors do not have the capacity and the ability to make a liability produce income.

Add new comment