Mobile Money Agents in Tanzania: How Busy, How Exclusive?

The Financial Sector Deepening Trust of Tanzania (FSDT) undertook a census of cash outlets in the country, and we previewed the results on the physical distribution of outlets in a previous post. Here we delve deeper into the situation of M-PESA agents, exploring how busy they are and how exclusively they are tied to an operator. As you read this, please keep in mind that transactions at agents are self-reported on a recall basis by the agents themselves, and are unverified by the mobile operators.

Almost two-thirds of M-PESA agents are exclusive

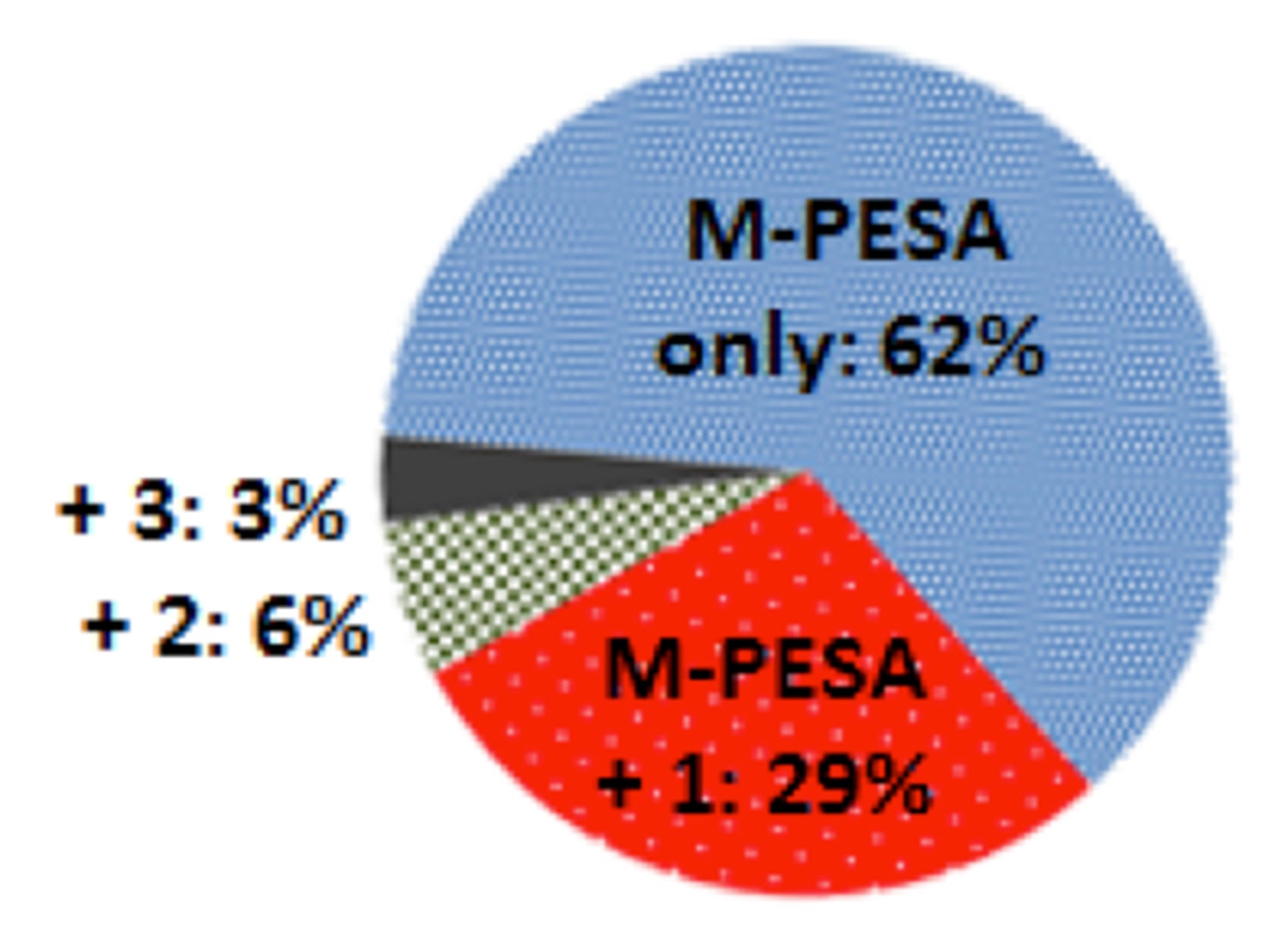

Figure 1 (right) shows the split of agents by the number of mobile money systems they serve. All of them serve M-PESA by definition, since the census only included M-PESA agents. The figure shows that 62% of M-PESA agents are exclusively dedicated to M-PESA, 29% serve one other mobile money system (Tigo Cash, Airtel Money or Ezy Pesa) in addition to M-PESA, and 9% serve three or four mobile money systems.

Agents near a bank branch or ATM (and hence presumably in busier, more densely populated areas) are only marginally more likely to be non-exclusive. (67% of agents within one kilometer of a bank branch – as the crow flies— are exclusive, against 70% for all agents.)

Half the agents do more than 30 transactions per day

All mobile money agents included in the census perform at least 3 transactions per month, as that was taken as a basic threshold of agent activity. However, transaction volumes vary widely. Some may not be considered as reliable cash points by the public, whether because they don’t wish to trade in cash often or because they run out of liquidity on a regular basis.

This means that well over half the agents are probably operating profitably as mobile money agents. Using a notional average agent commission of 10¢ per transaction, 30 transactions per day (which, as we have seen, at least half the agents do) translates to $3 daily margin contribution to the store, enough to pay a qualified clerk’s daily wage in many instances.

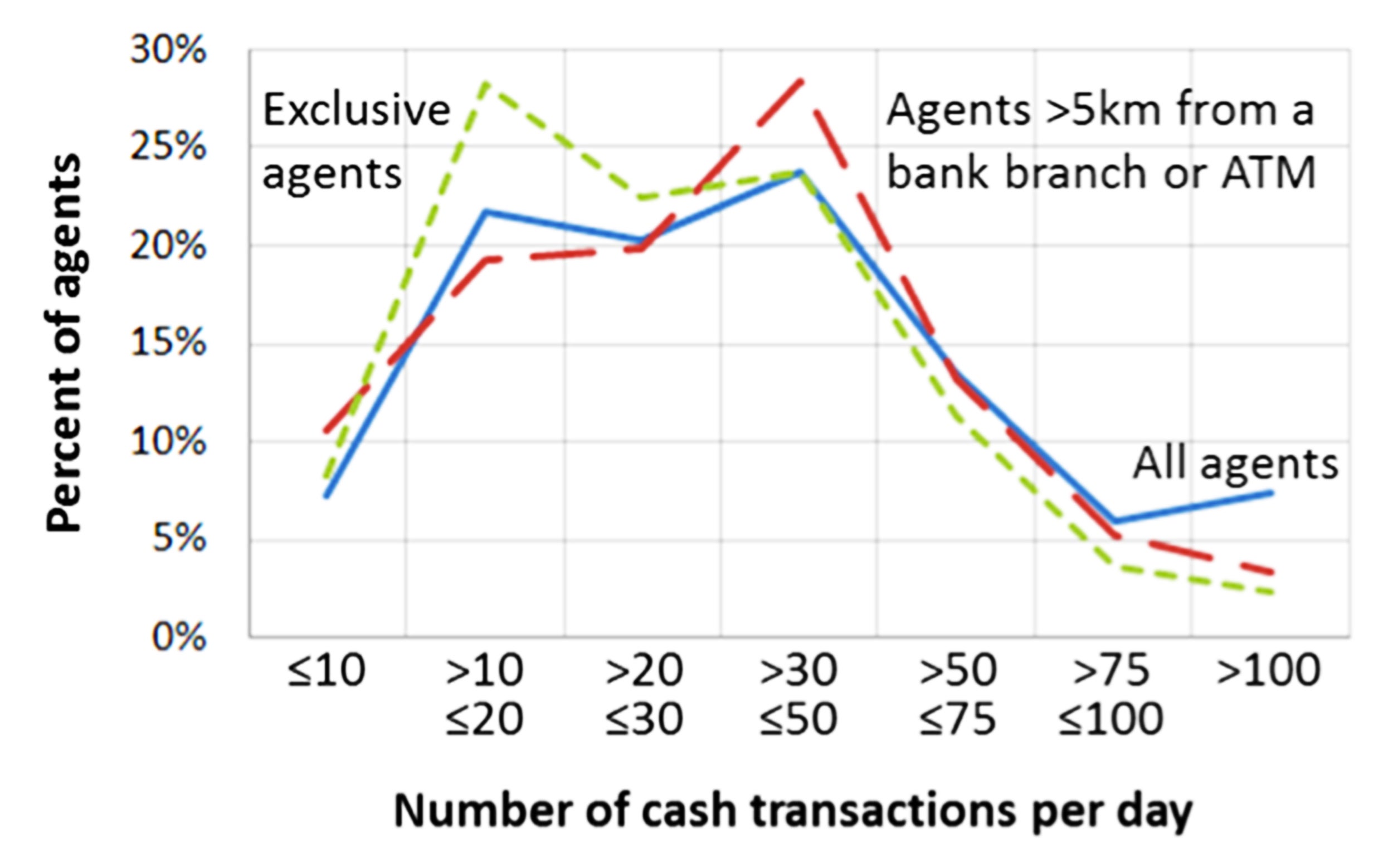

Non-exclusive agents and agents further from banking outlets tend to do more transactions

Next we explored the relationship between agent activity levels and factors such as agent location and exclusivity.

Figure 3 (below) shows the distribution of agents by transaction bracket. The solid blue line is equivalent to the line in Figure 2, but without accumulation of values across transaction brackets.

Conclusions

One of the main challenges in building mobile money systems is to balance two competing business imperatives: on the one hand, to sign up as many agents as possible to deliver ubiquity and convenience to the customer, and on the other to control agent growth to maintain a healthy, profitable channel.

In the past, Vodacom Tanzania has opted for faster agent growth, probably in order to cement a first-mover channel advantage over its mobile money competitors. The growth of the agent channel to almost 17,000 (according to the survey conducted in mid-2012) has put pressure on agent economics. But we can see from this analysis that at half the agents are conducting at least 30 transactions per day, which should translate into a daily revenue contribution of somewhere in the order of $3 per day, which might be considered a minimum profitability hurdle. These numbers should be taken as a very rough indication: it must be remembered, though, that this data is self-reported by agents on a free recall basis, and are not externally validated.

At the same time, Vodacom’s first-mover development of an agent network exposed it to cherry-picking by its competitors. In a country where no operator is big enough to force exclusive agency contracts, later entrants into the market were able to run faster by signing up M-PESA agents as their own, thus reducing their own cost of agent selection and training. But the data in this census suggests that almost two-thirds of M-PESA agents remain exclusive to Vodacom in practice.

Comments

Got some meaningful insight.

Got some meaningful insight. Can u please share some thoughts how the service providers ensure profitability of agents, how can they ensure sufficient float at agents. Thanks.

Add new comment