Mobile Money Innovation… Waiting… Waiting…

We’ve been pointing out the deficit of fresh thinking on mobile money products (see my blog post after the GSM World Congress, and more recently Bill Mauer and Olga Morawczynski’s take on the subject and my colleague Sarah Rotman’s opinion as well). The topic came back to mind when Gartner released its annual hype cycle for emerging technologies, and tech investor guru Ron Conway made his list of tech megatrends – few if any of them seem useful to the majority of humanity that is low-income and living in a developing economy. Location-aware electronic paper might be cool in Palo Alto, but who is it going to help in the Amazon, Ahmedabad or Abidjan? That’s why we loved the strong nods to the potential of mobile phones at last week’s Clinton Global Initiative (including mobile money in Haiti) and Nokia World earlier this month.

To some extent, falling hardware prices and mobile data transfer costs make it inevitable that we will see suddenly cheap technology applied to old problems. But isn’t there more we could be doing? Since CGAP focuses on financial inclusion, I’ll restrict my musings to mobile money, but these might be applicable to mobile health, education and a variety of other fields.

I can see three avenues we ought to be looking down.

First, usability. Safaricom announced last week that they were finally integrating M-PESA with the phone book on customers’ handsets. Up to now, M-PESA users had to dial in the recipient’s phone number manually. Guess what one of their customers’ top three worries is: misdialing and accidentally sending money to the wrong person, perhaps losing a week’s worth of wages by getting one digit wrong. I’m positive Safaricom has needed a long time to negotiate access to the address book with handset manufacturers. But what other changes in the mobile money interface would make it easier to use and more trustworthy to customers? Maybe we ought to be talking directly to the handset makers.

Second, embeddedness. M-PESA succeeded in Kenya because it rode on the deep ties between family members separated between rural and urban areas, and the fact that money fueled those long-distance relationships. What other social bonds provide an entry point for mobile money? Back in March, I wondered about a Haj savings product paired with a Facebook-like function that would enable the user to let their friends and family know about their progress towards making the pilgrimage to Mecca.

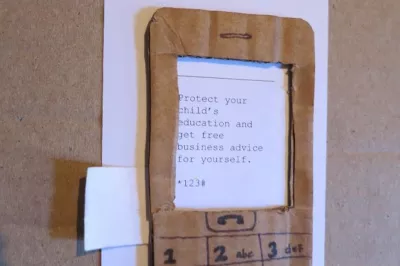

Third, customization. Mobile money is mostly one size fits all. Here is your mobile wallet and P2P function – you figure out what you can use it for. What if providers turned this on its head, asked customers why they were using mobile money, and then tailored its features? Saving through your mobile to pay for school fees? Let us send you weekly reminders to help you remember to make a deposit. Would that be terribly expensive for the provider? It would probably only include the cost of a software hack and a weekly SMS to the client. But if it made mobile money stickier, leading to more usage, more transaction fee revenue…

You get the picture. So when do we start seeing mobile money becoming more user friendly, embedded and customized? I’ll be at UC Irvine’s Money, Technology and Financial Inclusion conference later this week and can’t wait to hear what insights are coming from the field.

- Mark Pickens

Add new comment