Navigating Compound Crises: Microfinance Learnings From Lebanon

At first, the signs of Lebanon’s financial crisis didn’t alarm Al Majmoua. As the largest microfinance institution in the country, and having successfully navigated several past crises, it had contingency plans in place. Yet, the “triple” crisis that started in 2019 was unlike any that had come before. Massive losses were generated across the banking sector, and the microfinance sector nearly collapsed. These crises provided the ultimate stress test, illustrating the diversity of measures that can be taken in the face of crisis.

Surviving the freefall

In 2019, Lebanon was an upper-middle-income country with a vibrant financial sector. Half of the population held a bank account, and the country featured a diverse and competitive sector for small business finance. However, cracks in the system began to show, and financial engineering by the central bank could no longer mask an emerging banking crisis. By March 2020, Lebanon’s government had defaulted on its debt obligations.

Compounded by the effects of COVID-19 and an explosion at the Beirut port that caused an estimated four to five billion USD in damage, the crisis has exacted a heavy toll. The Lebanese currency has lost more than 90% of its value, with funds from before the crisis severely restricted in access. Some customers have resorted to extreme tactics, such as armed robbery, to retrieve their own money from insolvent banks. Not surprisingly, financial inclusion has fallen by nearly 60%.

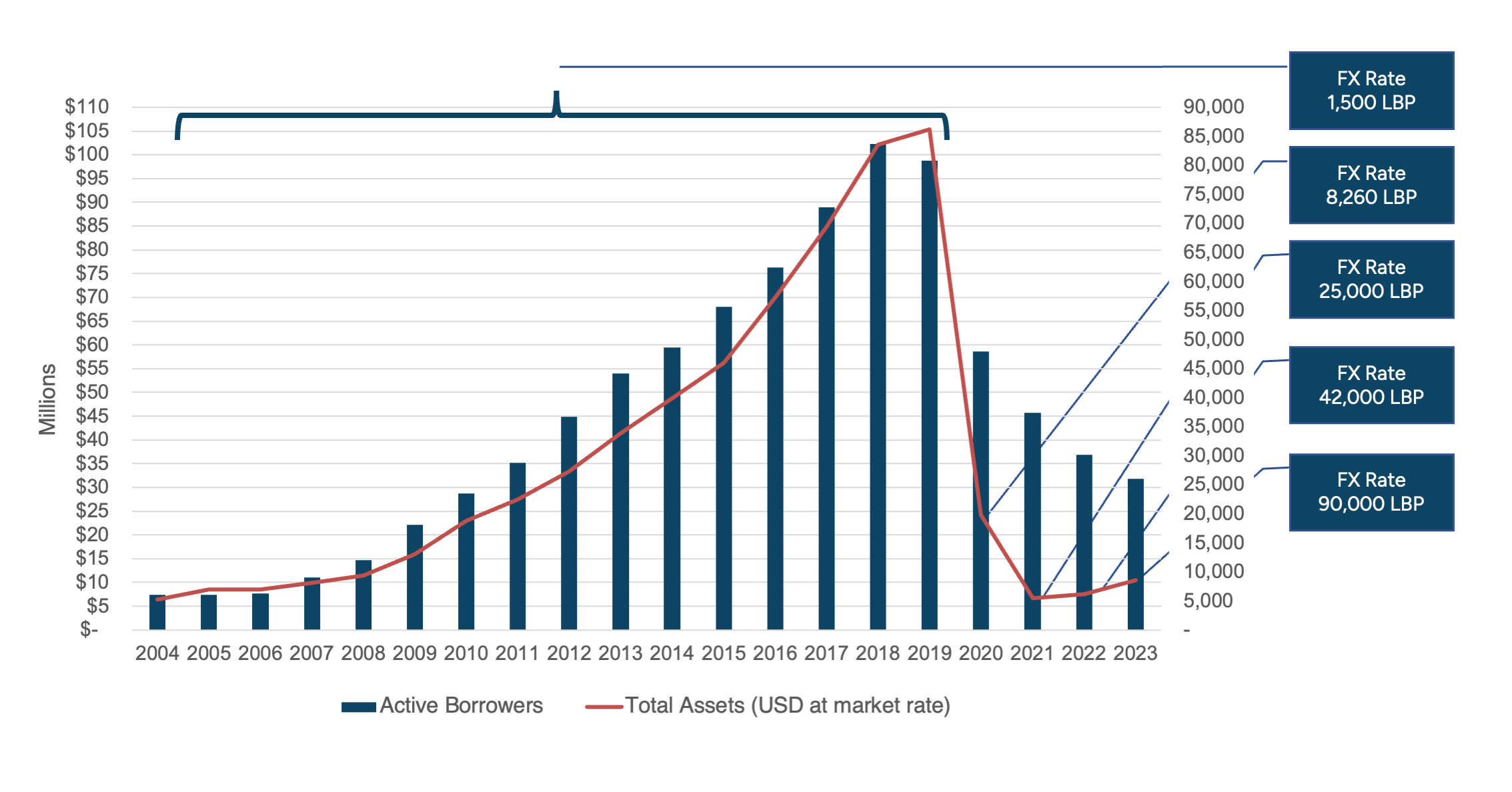

For Al Majmoua, the risks were similarly diverse and compounding. Protests in the streets and energy shortages presented challenges to business continuity. Currency devaluation and bank insolvency threatened liquidity and posed an existential risk – it had taken Al Majmoua 20 years to accumulate equity worth over 100 million USD, but it evaporated over a matter of months.

Preserving capacity through crisis

For Al Majmoua, these crises were unprecedented and often confounded even seasoned crisis experts. It responded to emerging risks with a series of specific responses.

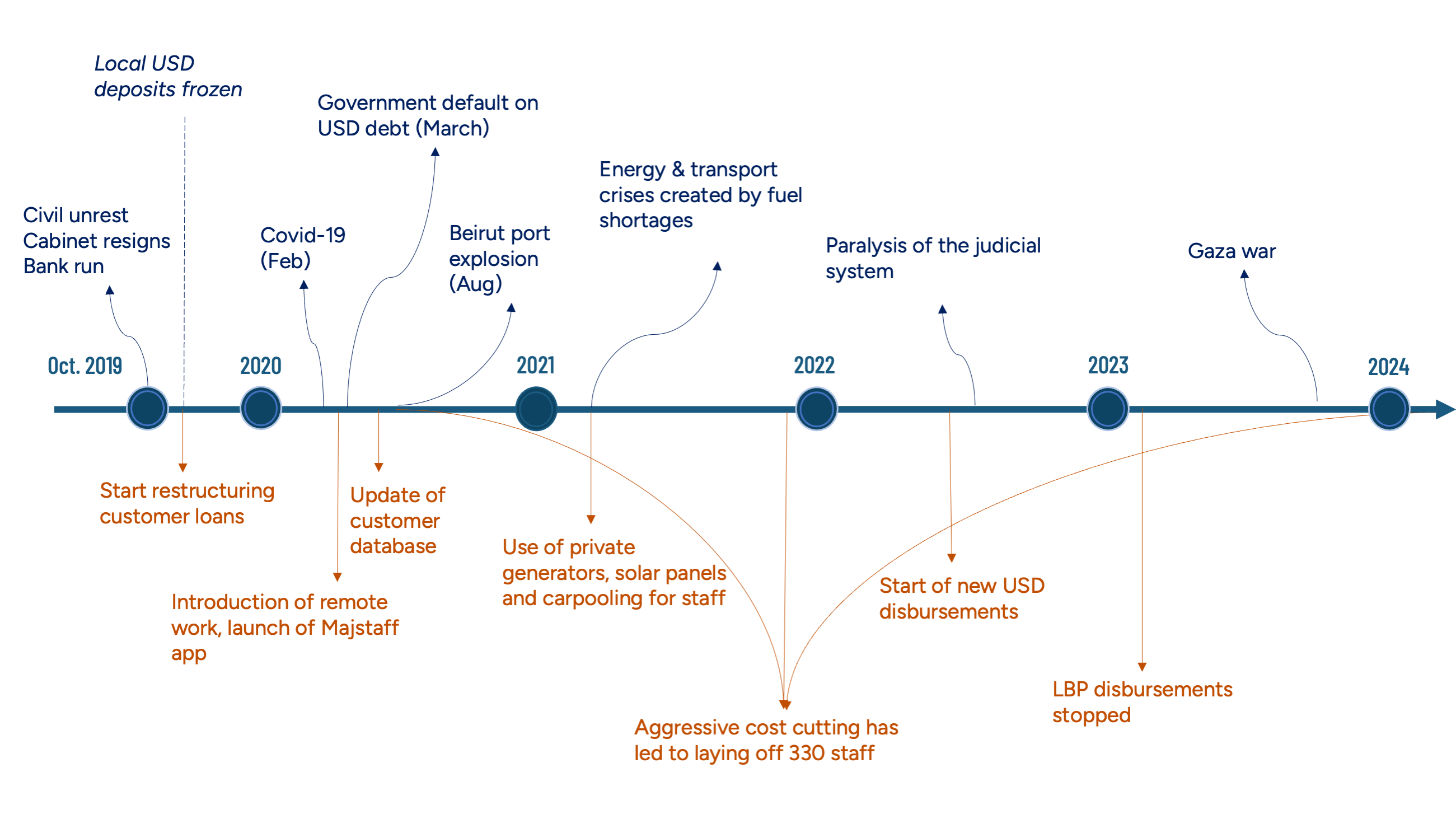

- Business disruption meant a shift to hybrid operations. There were several occasions during the past five years when staff were unable to reach the office. From uprisings to the storming of banks by disgruntled citizens, management was constantly on their guard. They implemented new procedures for contacting staff and customers, provided regular safety and security training, and accelerated a planned digitization agenda to better facilitate remote work.

- Credit risk meant a diverse set of tools for portfolio management. Customer loan repayment was deferred in light of COVID-19, then adjusted as the value of the Lebanese currency declined. Loan rescheduling and refinancing were also used to give customers fresh starts where needed. However, Al Majmoua simultaneously created a new collection unit to help ensure no loans were written off absent exhaustive follow-up. This ensured the organization could continue to service those clients with a realistic chance of repayment while saving time chasing collection for those facing truly dire financial issues.

Customer loan repayment was deferred in light of COVID-19, then adjusted as the value of the Lebanese currency declined. Loan rescheduling and refinancing were also used to give customers fresh starts where needed.

- Liquidity and sustainability risks meant cost-cutting measures and a reliance on alternative revenue streams. As the Lebanese banking sector crashed, Al Majmoua struggled to access its own capital and lost purchasing power as the local currency depreciated. The organization closed 20 of its 30 branches, let go of 330 employees out of 500, and used non-financial project revenue to help cover the cost of the remaining staff.

- Solvency risks meant proactive communication with funders. Al Majmoua gathered its lenders in one room at the onset of the crisis and provided updates on the economic, financial, and political situation on a weekly and monthly basis. Renewable waivers were negotiated, up to the selected agreement not to settle. Following the Port of Beirut blast in particular, Al Majmoua was selected as an implementing partner for reconstruction support projects like the B5. Other relief came from donors to cover operating expenses, such as subscriptions and licenses for IT infrastructure thanks to FMO, as well as new loan capital thanks to FMO and ILO.

Figure 1: Evolution of Al Majmoua’s Total Assets and Active Borrowers (all currencies)

- Currency, exchange, and inflation risks meant ongoing experimentation with loan products. The one risk that had the biggest impact while still having no appropriate response was the currency risk. Al Majmoua restructured its portfolio from USD to Lebanese pounds (LBP) when USD was no longer available. As inflation soared, the organization resorted to offering smaller and shorter loans. Nothing, however, could compensate for the LBP’s free fall, and Al Majmoua progressively lost 95% of its portfolio value over time. As the economy dollarized, it stopped its LBP disbursements, returning to USD.

These are just a snapshot of the risks Al Majmoua faced and its actions in response to them.

Figure 2: Chronology of shocks and Al Majmoua’s response

Lessons learned for MFIs

Significant challenges remain for Al Majmoua – in particular, securing access to several millions of dollars of loan capital to sustain its operations amidst an escalating conflict. However, important lessons can be gleaned from the steps taken to manage the crisis.

- Expect the unexpected. Businesses should be run with a close eye on the full spectrum of possibilities. Business continuity plans should be built, tested, reviewed, and endorsed. They should be flexible enough to adapt to any situation that arises – resistance to change can be lethal to a firm’s survival.

- No matter how successful your business model is, diversify. When a recipe for success works, start creating the next one. Never rely on one line of business, no matter how successful it might be. For example, had Al Majmoua ventured into another avenue such as money exchange or banking, it may have alleviated the freefall. Such diversification has proven to be successful for MFIs operating in other countries experiencing similarly high instability.

- Communicate objectively, transparently, far, and wide. In times of uncertainty, communication is key. Consistent, transparent communication across stakeholders – including clients, staff, funders, and policymakers – improves the chances that partners will be supportive if eventually asked to share the financial burden of the crisis.

- Cash is king, take heed of liquidity. Never take liquidity for granted. It can either make or break an institution. Nurturing business relations during normal times with different banks locally and internationally and holding hard currency in a different jurisdiction improves survivability.

Lessons learned for funders

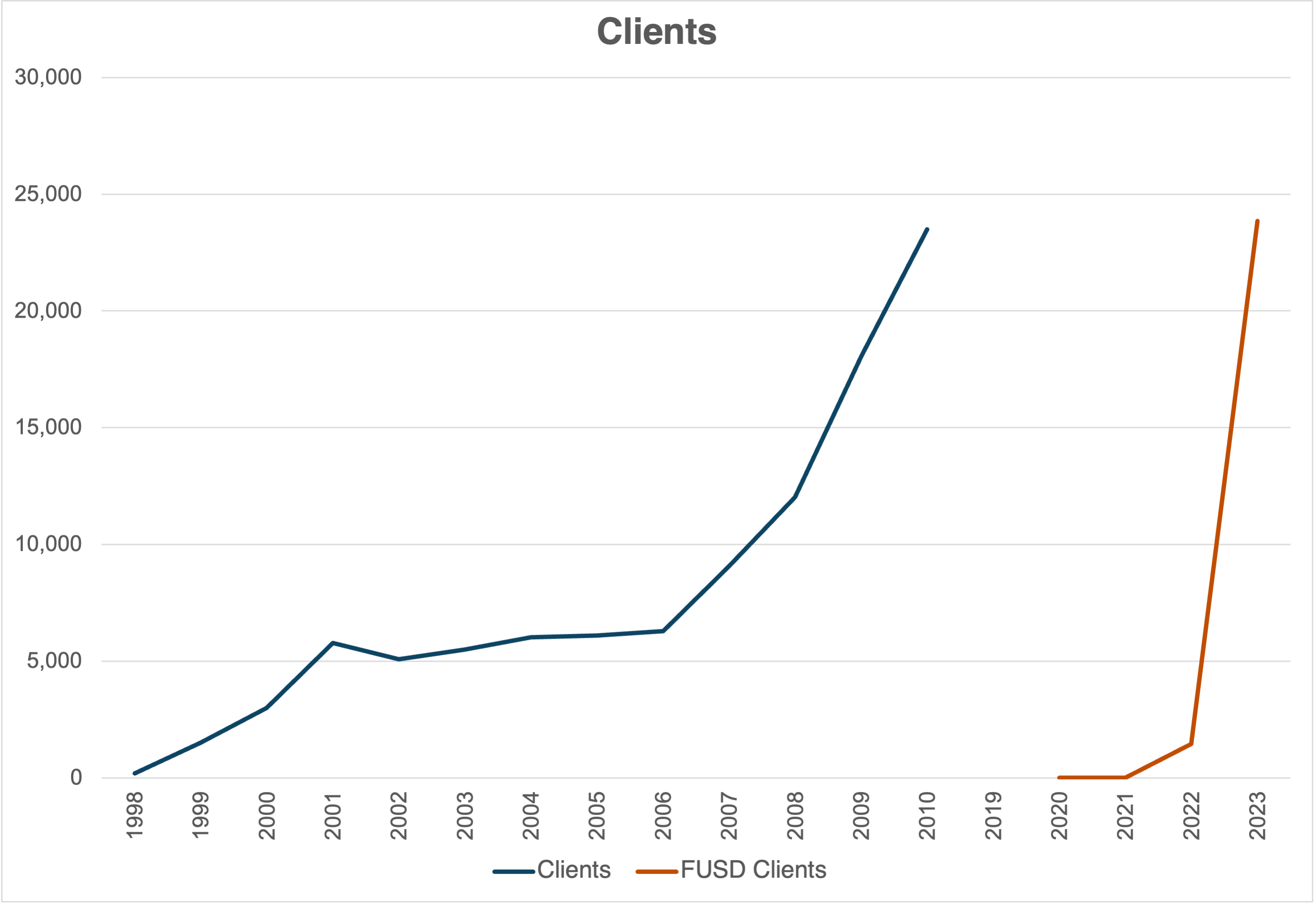

- Invest during the crisis, not after. Al Majmoua had 90,000 borrowers at the onset of the crises. By helping preserve capacity throughout the crises, donors have allowed Al Majmoua to scale its new USD portfolio from zero to 26,000 clients in just one year, at an estimated 230 USD customer acquisition cost, as compared to 1,200 USD on the original portfolio. Compared to Al Majmoua’s inception, funder dollars have proven five times more cost-effective and scaled 10 times faster.

- Search for innovative hedging mechanisms going forward. While the Lebanese triple crisis is unprecedented because of the absence of an official public response, the fundamental underlying trade and fiscal imbalances that characterized the economy prior to the crises are widespread among developing countries. Finding new and affordable mechanisms to mitigate related risks will be key to allowing a prompt response in a similar future context.

Figure 3: Al Majmoua’s Reach to 22,000 New Clients (in USD): 1998-2010 vs. 2022-2023

Add new comment