PMJDY: Commendable Growth, Yet Low-Hanging Barriers Persist

Two years ago the prime minister of India launched a national financial inclusion program that has now been hailed as the world’s most successful. As of 11 August 2016, the scheme had mobilized approximately INR 408 billion (US$6.1 billion) through 228.1 million new bank accounts.

In one village, a bank agent told us: “The number of bank accounts has increased from 15 to 500. Villagers have understood banking now.”

The program – known as Pradhan Mantri Jan Dhan Yojana (PMJDY) – aims for universal access to banking facilities with at least one bank account for every household. Bank accounts opened under the program are meant to provide access to a range of financial services such as credit, insurance, and pension.

Is there any real impact of PMJDY on financial inclusion in India after it was announced on the eve of Indian independence two years ago? MicroSave set out to answer that question through a cross-sectional measure of PMJDY performance at regular time intervals, with support from the Bill & Melinda Gates Foundation.

Three rounds of PMJDY assessments were conducted from October 2014 to December 2015. While wave I and wave II were undertaken among randomly sampled districts from nine states, the wave III assessment was an independent nationally representative survey across the country. The findings pertaining to Bank Mitrs (BM or agents) and to customers are particularly notable, as they are the building blocks of the rural financial inclusion landscape in India.

Agent outreach and infrastructure readiness

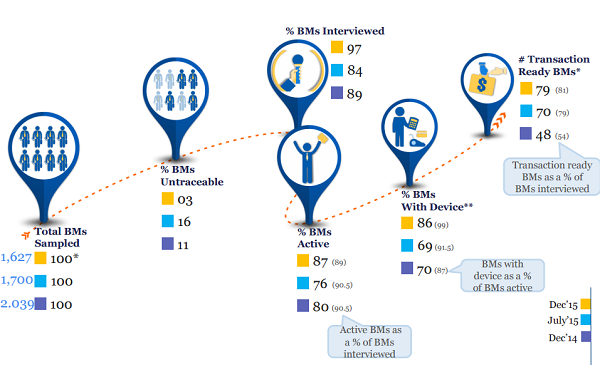

- Agents were highly available for interviews for our research, with 97% present at the stated meeting location. This reflects how the channel has now moved from initial fledgling phases of establishing an agent network, through identification and enrollment, to a more mature, operational and stable agent base.

- Transaction readiness stood at 81% of the agents interviewed (an agent is “transaction ready” when a customer walking into a BM outlet can conduct transactions). The increased availability of transaction devices for agents was an impetus behind this.

- Agent dormancy increased to 11% of the agents interviewed. This is a worrying trend, especially given the poor track record of agent dormancy in India. A total of 73% of the dormant agents felt that inadequate compensation from banking business was to blame.

- Device enablement – A total of 73% of agent devices were enabled for Aadhaar (a unique identification number issued by the government), while the number of devices enabled for RuPay cards almost doubled to 50%. (RuPay is an Indian version of a debit/credit card initiated by National Payment Corporation of India.)

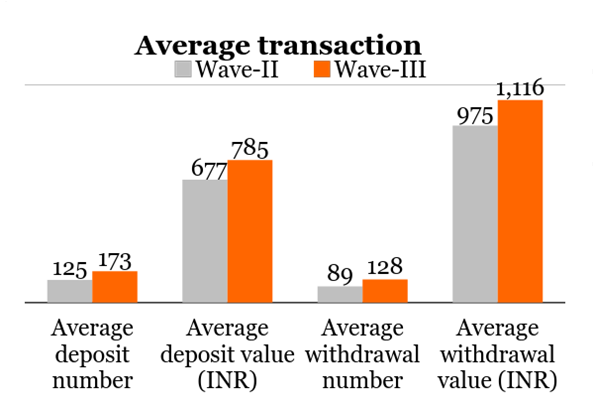

- Monthly transaction and commission – The average number of transactions per agent per month stands at 301. A shift in focus from customer retention to transactions is the cause (commission is now driven by total number of transactions). Enhanced transactions also resulted in growth in monthly agent remuneration, recorded at INR 4,692.

- Daily customer footfall – Almost half of the agents receive fewer than or equal to 19 customers in a given day, which is insufficient to sustain business. Dedicated agents should have between 50 and 150 customers per day to ensure sustainability.

Customer outreach and awareness

- Transaction point preference – 80% of the customers interviewed rated agents as their first preference for conducting transactions, rather than an automated teller machine or bank branch.

- Aadhaar perception – 62% of customers interviewed felt that having an Aadhaar number has helped make their financial transactions easier, for reasons such as “easy and quick transactions,” “potential to receive government benefits,” and “its usage as an identity proof.”

- Duplication of customer accounts – 33% of customers indicated that PMJDY was not their first account. Customers have opened another PMJDY account under the misconception that they will receive additional government benefits and overdraft facility.

- RuPay card – 47% of the customers have received a RuPay card, implying that the remaining customers cannot avail insurance, pension and overdraft benefits.

- Savings behavior – There is a decrease in the number of customers who don’t save, or save at home. A total of 86% customers have started to use their own savings account.

Moving forward

While PMJDY has increased bank account penetration in India, our findings reveal that dormancy in these accounts stands at 28%, mostly due to factors such as lack of information on operational procedures, product features and account duplication. A customer, for example, told us: “It was communicated that opening a PMJDY account is a must. I got three accounts opened with different banks to receive INR 15,000 as overdraft.”

As the agent is the single point of contact for most customers, protection against fraud is vital. In fact, during our assessment, a few instances of unfair and hidden customer charges were observed for services such as withdrawal and deposit, SMS update and personal identification number generation.

One customer’s experience underscores the challenge: “I have enrolled for INR 330 insurance, but no amount has been deducted from my account. Where will we go if an accident happens now?”

Getting customers on board has been the easier part; getting them to trust the channel and use these accounts regularly will be more difficult. Ensuring that BMs continue to find the business attractive is yet another struggle – a struggle that only adequate compensation and business volumes leveraging product-level innovation can overcome. Dedicated guidelines for stakeholders and minimal capital requirements are a couple of essential elements to better chisel financial inclusion from the mold that PMJDY has very efficiently created.

For more details about the assessment, see Leveraging Pradhan Mantri Jan Dhan Yojana.

Add new comment