Reaching the Next Generation of Financial Services Customers in Africa

Most financial services providers in Africa lack a clearly defined agenda for reaching the next generation of clients. A lack of data on the youth segment has led many to assume that young people don’t make good clients, whether because they lack money and collateral or because they just aren’t responsible borrowers. However, a growing body of evidence shows that youth have significant potential as clients.

Pent up demand for savings among African youth

To start with, young people in Africa have money to save. A national survey conducted in 2017 by Well Told Story found that 8.8 million youth in Kenya earn an average of $29 per month and can source an extra $24. That totals $4.7 million per month. Yet 84 percent never reaches a bank account, and 33 percent reaches neither a bank nor digital financial services (DFS).

More young people are opening financial accounts, but most youth continue to save informally. Findex shows that the number of accounts held by young people (ages 15 to 24) increased from 17 percent in 2011 to 37 percent in 2017. While an increase in DFS accounts for much of the increase, the number of youth-owned accounts at financial institutions also grew from 17 to 26 percent. Nationally representative surveys conducted by CGAP in several markets reveal that young smallholders save two to five times more than adults but that most prefer to save through investment clubs or other informal mechanisms.

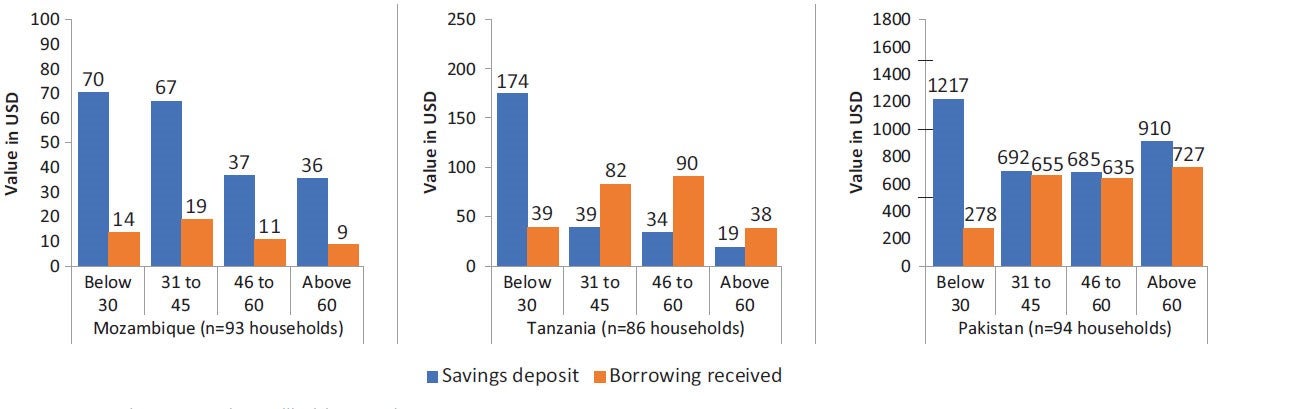

Borrowing and Saving by Age in Mozambique, Tanzania, and Pakistan

Similar demand for credit among African youth

There may be a similar opportunity for financial services providers to capture hidden demand on the borrowing side. According to a 2017 UNCDF report on African youth’s demand for financial services, young people borrow five times more from family and friends than they do from financial institutions. They consider this type of informal borrowing to be less risky, cheaper and more flexible in terms of repayment.

Responsible loan products better tailored to young people’s needs could tap into this demand. CGAP’s analysis of more than 20 million digital loans in Tanzania shows that youth (ages 18 to 24) received fewer and smaller loans than adults due to limitations placed on them by providers, whose one-size-fits-all products did not account for the fact that many youth lack credit histories and other factors.

Repayment Rates by Age Group in Tanzania

Youth who did borrow were less likely to repay on time or at all. Many described issues such as hidden costs that were not revealed when they applied for their loans or loans that were not tailored to meet their needs. CGAP's research on digital credit markets in Africa emphasizes the need for greater transparency and consumer protection measures in digital credit.

Data analytics enable providers to understand youth demand

Data analytics can play a pivotal role in helping providers to understand the youth segment and design more useful services. A 2018 CGAP paper, “A Digital Credit Revolution: Insights from Borrowers in Kenya and Tanzania,” illustrates how lenders like M-Shwari are using data-driven algorithms to determine credit limits. This year, we released a detailed, step-by-step guide on how providers can use data analytics to take customer segmentation to the next level and a separate guide on statistical credit scoring. Finally, a slide deck on digital consumer credit in Tanzania explores the importance of structuring the loan process to collect more data upfront and better assess clients’ needs to avoid one-size-fits-all digital loans.

Data on youth’s mobile money transactions could prove particularly useful for providers looking to offer savings or loan products. According to Findex, 75 percent of Kenyan youth in 2017 made or received a digital payment, and 74 percent owned a mobile money account. Approximately 29 percent of M-Shwari’s customers are between the ages of 18 and 24. The growing amount of data on digital credit can also be useful in identifying youth segments that are using credit for productive activities and designing products for them.

Data from social media platforms can also be useful in helping providers to understand the behaviors, aspirations, attitudes and motivations of the youth segment. Providers can also use social networks to build trust, enhance customer experience and create brand loyalty among youth.

Mobile technology provides a pathway to reach youth

DFS, including smartphone apps, have a vital role to play in reaching Africa’s youth segment. Pew Research Center surveys in several African countries show that over 70 percent of people ages 18 to 29 owned a mobile phone in 2017. While mobile phone ownership was high among all age groups, youth were far more likely to own smartphones and use the internet. Roughly 4 in 10 youth in the surveyed countries owned a smartphone.

The way forward

The data show there’s a large opportunity for providers to reach the next generation of clients in Africa. To do so, they will need to use data analytics to create DFS that are better tailored to young people’s needs.

This post is part of CGAP's "Financial Services in Youth Education and Employment" blog series. The series explores the challenge of youth financial inclusion from a variety of angles, including the ways young people are using digital financial services, strategies that financial services providers are using to reach more young customers, and the changing role of funders in this space.

Add new comment