Reading Findex With A Consumer Protection Lens

The Global Findex Database 2021 tells us a promising story of how financial access and usage have expanded in the past few years. With 71% of adults accessing formal financial services in developing economies and the acceleration of digital financial services usage during the COVID-19 pandemic, one might think the achievement of financial inclusion is in sight. Unfortunately, this is not yet the case — Findex shows us that we still need to make progress in strengthening customers' trust in financial services, and their financial well-being.

A key but often underappreciated dimension of financial inclusion is how responsibly providers deliver financial services in ways that help customers gain trust and derive value throughout their financial journey. Having a responsible finance focus is necessary to empower poor people, especially women, to capture opportunities and build resilience. So, what does Findex tell us about the quality of customers’ journeys in accessing and using financial services? This year, the database provided new information on the topic, including some of the risks consumers face, and the outcomes they experience.

Let’s first discuss the 24% of adults who have not even started this journey

When the Findex survey asked unbanked adults why they did not use financial services, almost one in four responded that they did not trust the financial system. In some regions, like Latin America, Europe and Central Asia, one in three unbanked consumers expressed no trust in the system. Low trust can result from a legacy of banking crises and appropriations, as well as high and unexpected bank fees. In Latin America, nearly 60% of unbanked adults indicated high costs of financial services as a reason for not having an account. We can expect that low-trust and high-cost issues might increase with the rapid expansion of new digital financial services such as short-term digital consumer credit, which may help consumers meet certain needs while generating greater consumer risks.

Vulnerable adults are the most likely to be unbanked. Globally, almost one in two of the unbanked belong to the poorest 40% of households, almost two in three have only primary education or less, and 54% are women. Many unbanked consumers say they would need assistance to use formal financial services, which further reinforces their greater vulnerability to a range of risks such as financial fraud, lack of transparency of costs and terms, poor recourse and data misuse.

For example, in developing economies, 64% of unbanked adults said that they would need some assistance to use formal financial services, with that figure at more than four in five adults in Pakistan and above 70% in India. This phenomenon is even more true for unbanked women. In developing economies, they are 10% more likely than men to need help using financial services. In Nigeria, they are 50% more likely than men to need help.

What about those who have already started their journey in accessing or using formal financial services?

Some 9% of adults in developing economies have an account but don’t use it. India leads this group, with the highest share of account inactivity globally (35% of account owners). Lack of trust and need for help in using an account re-appear as major causes of inactivity. In India, about half of the people who have an account and don’t use it cite lack of trust as a reason, whereas three in 10 cited not being comfortable using an account by themselves. As for those who have and use financial services, the survey revealed that in Sub-Saharan Africa, 31% of mobile money account holders cannot use their account without help from a family member or an agent. This proportion is even higher in Liberia, Malawi and South Africa, where more than one out of every two persons needed help to use their account. Here, too, women are more likely than men to need help.

This data provides valuable information about customers’ potential exposure to digital financial services risk. Indeed, if an individual is receiving help, the person helping them may offer incomplete or misleading information on fees (as seen in Kenya and Zambia), or in the worst case may steal their data or their money. The fact that so many people cannot use their account without help may also indicate low digital finance capability, showing some significant challenges in Sub-Saharan Africa, where 33% of people use mobile money. This data on mobile money usage corroborates our perception of digital consumer risks in the region.

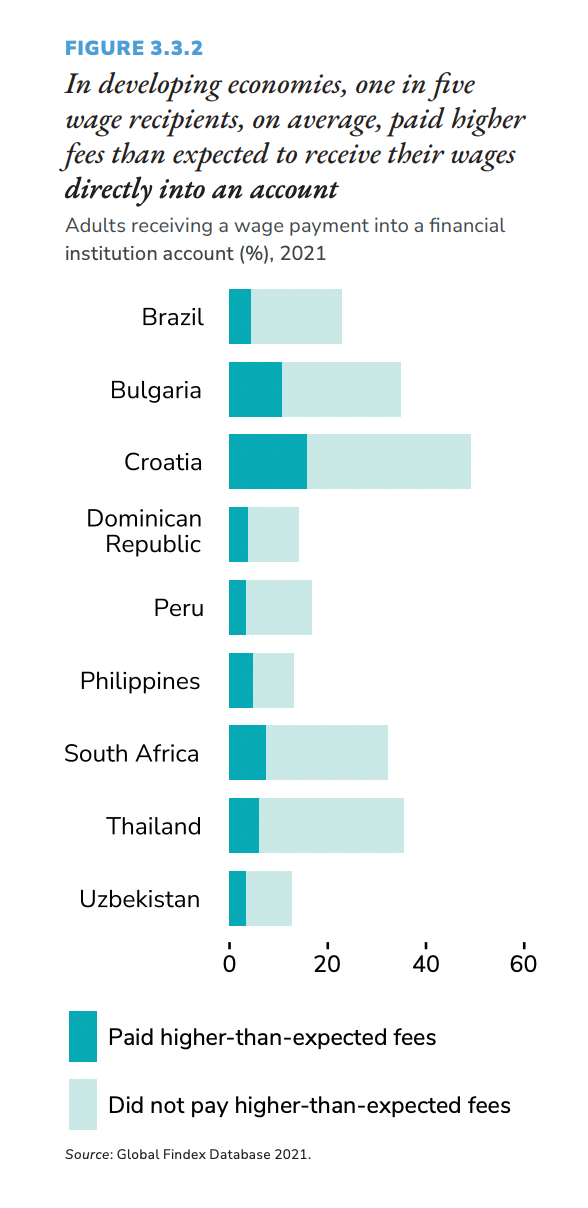

For the first time ever, Findex gathered data on unexpected fees collected from workers receiving wages through a formal account. In developing countries, one in five adults paid higher fees than expected when receiving their wages. In Uganda, two out of five adults receiving wage payments into a mobile money account reported unexpected fees, as did one in four in Kenya.

What can Findex 2021 tell us about possible outcomes for customers throughout their financial journey?

Findex provides interesting data on people’s perceptions of their financial life with its section on financial worrying, and on financial resilience, which is a key component of financial health measurement. For example, more than half of adults in developing economies (including over 70% in low-income economies) are very worried that they may not be able to cover emergency medical expenses. As for financial resilience, close to 44% of adults interviewed in developing economies would have significant difficulty pulling together the equivalent of 5% of their country’s GNI per capita (for example, about $320 USD in India) within a week, and 15% of adults couldn’t do so at all. Interestingly, the survey also tells us that people in developing economies considered “savings” the third most common but the most reliable source of emergency funds, highlighting the importance of good saving products and habits for financial health.

Looking at the Findex data through a consumer protection lens, we realize how critical it is to better prepare and protect consumers who don’t have trust in financial services or who have limited digital financial literacy. The fact that so many people don’t trust financial services or have had bad experiences using them, or are constantly worried about their financial lives, requires our urgent attention if we want to make meaningful progress in financial inclusion. Findex also provides us with new information on some of the risks that consumers face while using financial services, such as “lack of transparency” —an area where we had limited data in our global research on consumer risks. Through the latest Findex, we’ve also learned about customer outcomes, which is increasingly important for financial consumer protection authorities. Our expectation is that with better consumer protection, financial services will play a positive role in customer outcomes, such as financial health.

There are many solutions available or under construction to ensure that customers are better protected and get better value out of their financial services. It will take a holistic approach in every country to build a more responsible digital finance ecosystem, with more capacity across policymakers and providers to protect customers, more customer-centric business models and regulations, and increased collaboration among key actors in the ecosystem. As part of this approach, measuring progress in providing valuable services to customers is critical, as well as monitoring market conduct. In this way, Findex is an invaluable tool to us through its provision of significant global and country-level data to measure progress in the provision of responsible financial services.

Add new comment