The ‘Ripple’ Effect: Why an Open Payments Infrastructure Matters

Payments are essential to the prosperity of the poor because they provide access to the global economy. Yet, moving money is one of the most underappreciated challenges facing financial inclusion today. Antiquated infrastructure lacks interoperability and involves multiple intermediaries to execute payments. This creates delays, costs and risks that prevent payment systems from adequately serving the world’s poorest.

As the payment sector contemplates new infrastructure, lessons from open infrastructure approaches, such as those adopted for the formation of the Internet, give an indication of how to remove barriers in financial services and foster innovation and growth in payments.

Building connectivity through open protocols

In the early days of email, users of one email domain were not able to send messages to users of other domains. Users either went without access to people on different domains or were forced to open numerous accounts for broader reach.

The lack of connectivity limited the value of email. To resolve this issue, email providers developed an open Internet protocol called Simple Mail Transfer Protocol or SMTP. With broad adoption, SMTP grew to become the standard language that email domains use to communicate with each other. SMTP enables the seamless connectivity we enjoy today.

SMTP is open, meaning it exists as a common standard and public good. It is not owned by any one party and is free to use. Through SMTP, we have seamless and instant global connectivity, enabling us to send emails across many different systems, providers, and domains for free.

Evolution of open protocols in financial services: the Internet of value

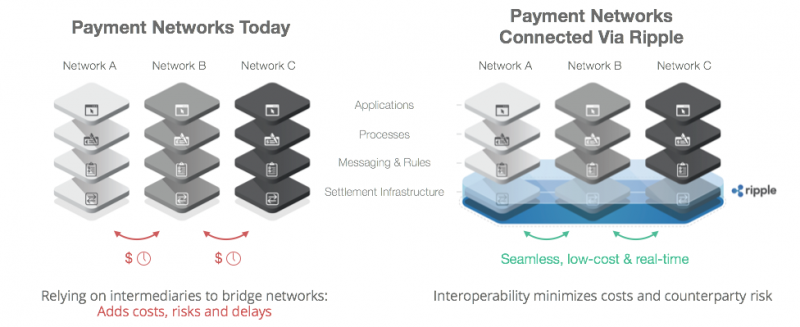

While the financial services sector has begun adopting open protocols to enable interconnectivity (e.g. between trading desks), the payments sector has yet to adopt a fully open settlement protocol to enable global connectivity, leaving networks siloed and lacking interoperability. This is often true for networks within countries (or within a single currency region), and almost always true for networks that exist across geographic (or currency) borders.

Currently, banks conduct payments through intermediaries: third parties that move funds across disconnected networks. The reliance on intermediaries adds costs, additional counterparty and settlement risk, and time delays to payments. As a result, cross-network payments only work well for certain geographies and only for high-value transactions.

For customers, this means the cost to send small amounts of money across networks (domestically or cross-border) is prohibitively expensive, mostly delayed, and in some markets not even possible (electronically). This forces customers to use cash for low-value transactions and, in some instances, results in money transfer recipients needing to travel long distances to cash out over-the-counter – even if they have a bank account or wallet – simply because they don’t use the same financial service provider as the sender. The safety, security and convenience of electronic payments are out of reach for those trying to make low-value transactions, precisely the type of payments poor communities need.

It is becoming clear that payment systems need to evolve to serve growing demands for low-value and cross-border payments. Recently, open protocols for payments have begun to emerge. One example is Ripple: an open protocol that financial institutions and payment networks can implement for settlement.

As an open protocol, Ripple enables a peer-to-peer server architecture to facilitate the movement of value among financial institutions. This allows financial services companies to make payments directly to each other, whether across different networks, geographic borders or currencies. In essence, Ripple does for payments what SMTP did for email, which is enable the systems of different financial institutions to communicate directly. With Ripple, transactions are handled efficiently, safely and instantly.

Global connectivity via Ripple eliminates the reliance on third parties, minimizing or eliminating many of the risks, delays and costs that have been a reality in payments for many decades. Importantly, Ripple provides connectivity at the settlement layer of a payment network – the foundational layer. This enables each network’s existing rules, processes, and messaging standards to remain in place.

The adoption of open protocols in payments would bridge today’s highly fragmented systems. For customers, this would introduce the ability to seamlessly send money from one account to another, across networks, institutions, and geographic borders. Critically, these transactions could take place in near real-time, and in theory, could be cost-effective even for low-value payments. This should significantly enhance the array of possible use cases for accounts, thereby exponentially growing the digital ecosystem and increasing the value of bank accounts and wallets for low-income people.

Enabling access to payments

Advancements in payment infrastructure have the potential to spur rapid and fundamental innovation throughout the entire financial ecosystem. With this technology, mobile money operators, banks, payments companies and governments are better equipped to create payment products that will have a profound impact on financial inclusion for the world’s poorest.

Affordable, low-value, cross-border payments and greater transparency in markets previously not economical to serve are early indicators of how new technologies can be applied. In addition to allowing poor customers to become a profitable market segment, open protocols and distributed architectures can enable entirely new and novel offerings. Just as the world witnessed with the evolution of mobile money, emerging markets can lead these developments.

Comments

There is a network called

There is a network called HomeSend which is attempting to just this. They are creating a global interoperable network that connects MTOs, MNOs, banks, and cash agents via one connection to the hub API. I don't think it has grown to scale globally but they have some pretty big MNOs and MTOs already connected in Africa, the Middle East, and Asia

This is the same company that

This is the same company that was fined by the US govt for money laundering law violations: http://bankinnovation.net/2015/05/ripple-labs-fined-by-fincen-for-money…

Add new comment