Six Takeaways from Rwanda’s Financial Inclusion Insights Survey

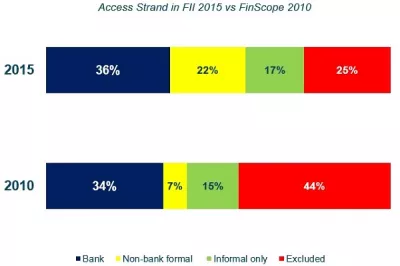

With a population of just over 11 million, Rwanda is a small landlocked nation that is in the midst of a promising economic transformation, driven by an ambitious government that sets aggressive targets and works hard to meet them. Things are no different when it comes to financial inclusion. The government’s goal is to have 100% of adults formally financially included, and to build a robust payments system that facilitates a cashless economy, by 2020. To better understand the Rwandan financial landscape, CGAP commissioned InterMedia to execute the Financial Inclusion Insights (FII) survey. This nationally representative survey of just over 2,000 Rwandans covers many aspects of mobile phone ownership and usage as well as financial behavior.

What surprised us?

1. Despite low rates of technical literacy and handset penetration, DFS is showing healthy growth in Rwanda.

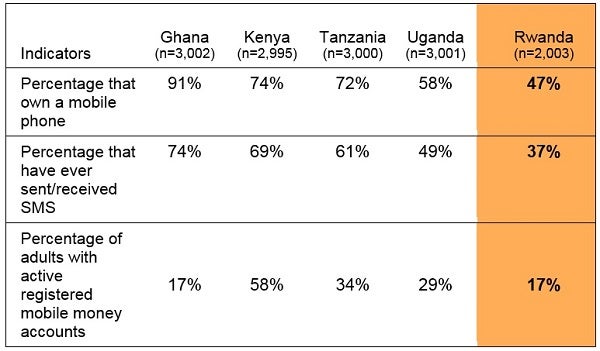

Seventeen percent of Rwandans are active mobile money account holders. This is the same as Ghana, and not far behind Uganda. This growth has occurred in spite of some of Rwanda’s relatively low rates of handset ownership (47%) and experience with sending/receiving text messages, i.e., technical literacy (37%).

2. Rwandans are actively using advanced features, especially bill pay.

Twenty-five percent of active mobile money account holders in Rwanda use their accounts to pay bills (mostly electricity) – the highest amongst FII countries in Africa. This habit provides opportunities for digitization that can push the needle on financial inclusion and rapidly drive the growth of digital financial services.

3. Rwanda has one of the highest rates of insurance penetration that we have seen globally.

Eighty-five percent of respondents claimed to have some basic form of insurance, with medical being the most common (83%). This is the highest penetration amongst FII countries, well ahead of runner-up Ghana with 65% penetration. Much of this growth has been driven by a government health insurance scheme known as Mutuelles de Sante. It is available for free to the poorest Rwandans (as classified by their communities), but 71% of respondents in our survey noted they paid an insurance premium.

Opportunities for growth:

1. Digitization of government payments and collections. The habit of paying bills using mobile money provides an opportunity for the government to drive uptake and usage of mobile money by digitizing collections (P2G). Insurance is one potentially powerful use case as the majority of the population (71%) pays premiums, usually through district level SACCOs. Digitizing insurance and other P2G payment streams could have an impact on the uptake and usage of digital financial services with strong government backing and effective execution. The government has already started making strides in this area with their Rwanda Online initiative, which facilitates payments for various government services (i.e., passport application) via mobile money and internet. But we expect to see more drive in this area, especially given the government’s ambitious targets regarding financial inclusion.

2. Increasing handset penetration. The low level of handset penetration is a significant barrier to the growth of digital financial services. Less than half of the population (47%) owns their own handset, and 51% has a SIM (an average SIM card owner has two SIM cards registered in their name). Until these numbers increase, the uptake and usage of digital financial services will be constrained. The government has already slashed taxes on handsets and introduced credit schemes to increase handset penetration in rural areas. Mobile operators could consider their own credit schemes to get more handsets on the market. Including smartphones in this credit scheme would build a powerful channel for the delivery of relevant financial services. Smartphones bring opportunities for more customizable and intuitive user interfaces that could drive usage of mobile money, especially amongst some of the less literate Rwandans.

3. Offering over-the-counter (OTC) services for those without phones. Many providers have found that OTC services are an easier on-ramp to digital financial services than mobile wallets, especially for segments of the population that are less literate and tech savvy. In Bangladesh, for example, 56% of all bKash account users made an OTC transaction before signing up for their own account.

Providers in Rwanda could consider offering an OTC option for those customers without phones or with low levels of technical literacy. This would enable customers to access services through agents without using their own phones. Once there is some traction and handset penetration rises, providers can encourage the transition to wallets. Although OTC can be used as an entry point to financial services, many benefits of financial inclusion will only be realized when customers start using their own wallets. Many providers globally have struggled to make this transition. Some customer segments (such as illiterate, infrequent users and the elderly) might never make the transition to wallets and OTC might prove to be a long-term use case for these particular segments.

Add new comment