Small Business Finance and Financial Inclusion in Latin America

Limited acceptance of digital payments and high fees associated with using such services are two obstacles to greater financial inclusion in Latin American countries. Can these issues be solved at the retailer level, rather than the individual level?

Several market trends suggest just that. Improving the way small businesses interact with formal financial services could have benefits for both entrepreneurs and their customers. Value chain finance – where businesses use digital finance to obtain goods from suppliers – could be one incentive for small businesses to begin using digital payments. Additionally, increased access to credit down the road as a result of a businesses’ digitally-established credit history could be an incentive to keep using digital means of payments. Finally, attracting more customers, who are looking for places to us their own mobile money accounts, could solidify the business proposition for going digital.

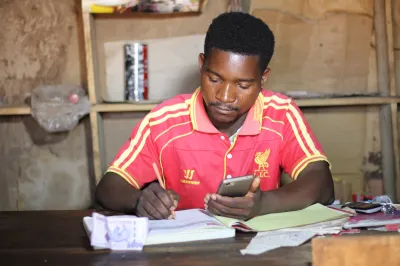

Photo Credit: Ariel Slaton

As these trends mature, we could imagine a scenario like this being normal:

A merchant in the outskirts of a large Latin American metropolis pays the truck driver of a soft drink distributor through a mobile payment which is in fact a microloan, authorized in real-time through an automated analytics tool. This loan will be paid back in seven days after these goods are sold and it is free for the merchant given that the distributor is willing to pay a commission for this service as it eliminates operational costs related to cash management. This merchant also accepts digital payments, as they are free and can also be used to pay other “consumo masivo” distributors for merchandise. In time, as the merchant utilizes the payments platform, data is generated that helps it obtain a working capital or investment loan to expand its business.

Looking deeper at this scenario, there are several interesting opportunities for digital finance and small businesses:

- Specialized network aggregators provide financial services to retailers

Since the digitization of airtime scratch cards, several highly specialized networks have delivered financial services to small and medium retailers throughout Latin America. These networks, such as Movilred in Colombia, operate technological platforms that enable retailers to perform real-time transactions such as bill payments, airtime top-ups, and domestic and international remittances. Rather than each individual retailer having to build connections with payments services, they need only link up with one aggregator, who subsequently makes connections with a myriad of other services.

These aggregators are continually adding services to the portfolio they offer retailers, ranging from government disbursements to metropolitan mass transit systems. Working capital loans and digital payment processing are the next frontier of services to be aggregated by these networks. Their position to offer these services is promising as they can leverage their deep knowledge of their customers, enhanced by their digital data trails and the fact that they are key suppliers in the retailers’ business. Some likely business models could for example enable these merchants to receive digital payments for goods for free. Cross-selling loans to these same merchants can create significant additional streams of revenue that can offset the cost of processing digital payments from customers to the extent that these could be free, boosting prospect of adoption.

- FMCG companies are seeing value in offering financial services to small retailers

Consumo masivo (or FMCG - Fast Moving Consumer Goods) companies are offering their merchants financial services in the form of transactional or credit products. For example, Bimbo in México – the largest bakery in the world with a huge distribution network - offers their points of sale a service that enables them to receive credit card payments from customers and pay Bimbo trucks electronically, as well as obtain short term credit.

FMCG companies understand the multiplying effect they can have for their own business. As many of these small retailers are still unbanked, financial inclusion means here increased availability of working capital and ultimately stronger sales.

It is likely that increasing competition in this segment of small enterprise finance will result in reduced fees and more efficient services. In addition, banks and microfinance institutions, together with public financial entities, may well play a role in structuring this novel market and mitigating risks.

- Data analytics for small enterprise finance

The increasing relevance of data analytics is an overarching trend. In the realm of SME finance it can efficiently provide risk management tools and reduce operational costs. The data trails that the above mentioned services produce can be especially relevant when it comes to offering services to unbanked segments.

Beyond scoring the recipients of these financial services, analytics can for example help reduce operational costs through inventory planning and even liquidity management for financial agent networks, as well as help implement marketing campaigns. Frogtek for example is a company that is focused on leveraging the data produced by their small-store management software through analytics.

These business models are within reach in most countries in Latin America, with several market players gathering the necessary tools and experience to gain scale in the long term. If successful they will certainly contribute to an inclusive financial ecosystem and offer more reasons for adoption of e-money and the use of accounts by the general public.

Comments

Very interesting subject! I

Very interesting subject! I am convinced that if a good value proposition is made for businesses acting as the acceptance network of all types of electronic payments, we will find the beginning of a cash-lite society. It will then make sense for example for CCTs recipients to use their mobile wallets to pay for their goods instead of cashing out at the first ATM all their subsidy. And in this sense Latin America, where small micro entrepreneurs acting already as cash in-cash out outlets of agent networks are increasingly being looked as possible agents for the acceptance networks will be a region to follow and learn from the hurdles they will face specially when confronting the limits of informality.

This model is great. We are

This model is great. We are doing something similar in several countries in Latam. The part we could not implement is where you propose that the distributor / FMCG will assume the entire cost, as well as the credit risk. We found they are not willing.

" This loan will be paid back in seven days after these goods are sold and it is free for the merchant given that the distributor is willing to pay a commission for this service"

The model has to be a win/win for everyone, for the store paying in cash is a great convenience today (since the store receives cash form all its customers) and uses the FMCGs as their cash collector agent at no cost. Credit is a great incentive to change behavior!

Regards

Dear Dan,

Dear Dan,

I am very interested in your model, can we get in touch?

It definitely is the model to

It definitely is the model to follow. Digital platforms will lead to more a cost-effective market place for micro businesses in LATAM. As digital transactions in the value chain increase (customer-micro merchant-retail suppliers), there are more valuable behavioural data available and thus moral hazard and adverse selection decrease. With this model, financial institutions will also be winners as they benefit from reducing their screening and transaction costs and, therefore, they should decrease their interest rates. The key issue here is finding the incentives for micro businesses to use this technology on a daily basis. We are working on a platform that connects micro businesses with their main commercial and financial suppliers. Our platform will enable an ecosystem with more cost-effective commercial and financial transactions amongst micro businesses, financial institutions and stock suppliers. We work with telecommunications, credit and commercial algorithms, electronic payments, mobile devices as well as a human-centered design approach to create a more efficient and profitable marketplace.

Agree with what's been said.

Agree with what's been said. When I ran a similar program in Peru back in 2012 with the country's largest drinks distributor and Scotiabank, shopkeepers showed an interest in participating but could not initially see the value in 'parking' funds for the initial float that did not immediately demonstrate a financial return. By providing loans for float, along with other business improvement services (inventory management, insurance, etc) the shopkeeper value proposition increased substantially. However, shopkeepers were hesitant as the task of refilling their wallet was a challenge. To resolve this, Peru is now taking an innovative approach, where a number of major CPGs have agreed to use an interoperable platform (meaning shopkeepers do not have to manage multiple wallets) and have agreed to (initially) use their drivers as mobile money agents. This removes the cost (time and effort) required to put balance in their account, allowing shopkeepers to have enough funds to pay a number of suppliers. Watch Peru for great things this year!

Thanks Jeffrey! Looking

Thanks Jeffrey! Looking forward to the upcoming developments in Peru and the region as well.

Add new comment