Trust and Awareness Will Be Key for Open Finance Adoption in India

Amid a surge of open finance implementations worldwide, India and Brazil are pioneering open finance in developing economies, witnessing significant impact in just over two years. In India, as of March 2024, about 64 million accounts have been linked through the Account Aggregator (AA) ecosystem – India’s version of open finance – and in Brazil, over 43 million accounts have been linked through open finance. Key factors like interoperable fast payment systems (UPI in India and Pix in Brazil), and a flourishing fintech market have fueled this growth. In a previous blog and webinar, we highlighted early lessons from our customer research in Brazil. Here, we share insights from our research on India’s implementation of the AA framework. As India continues its journey towards implementing and scaling the AA ecosystem, these early insights could be instrumental in shaping the ecosystem’s future direction.

For financial services providers (FSPs), the implementation of the AA framework in India seems to be having positive results. A prominent private sector bank achieved a 25% reduction in credit application process costs, an investment advisor observed an approximately 60% increase in user engagement as individuals linked their financial accounts via AA, and lenders reported zero fraud rates on bank statements shared. Additionally, banks and fintechs have reported significant improvements in completion rates and processing times of loan applications as a result of integration with AAs.

CGAP recently conducted customer research on the implementation of the AA framework in India to analyze the current state of understanding and adoption of AAs among individuals. We conducted a customer survey between November 2023 and January 2024 with a nationally representative sample of around 2,000 smartphone users (roughly 74% of Indian households have access to a smartphone). We focused the survey on smartphone users because most people who have used the AA ecosystem so far have done so in the context of a digital loan application. While AAs can also be used for personal finance management and investment advisory, our survey focused on the loan application use case.

Key findings

Users of the Account Aggregator ecosystem are financially savvy and active users of digital payments services

The use of bank accounts (both savings and checking/current accounts) as well as UPI services is nearly universal among smartphone users. In our survey, all respondents reported having used their smartphone in the past year to make payments, purchases, and/or send and receive money. Additionally, the frequency of use of digital financial services (DFS) was high - 90% of respondents used digital financial services at least once a week, with the top apps reported being payment platforms/wallets including Google Pay, PhonePe, and PayTm. Additionally, a large share of respondents (80%) said they actively track their finances, with nearly half using their bank’s app to do so. These results indicate high levels of financial inclusion and digital savviness among smartphone users in India. CGAP’s recent paper makes the case that broad account ownership and fast payments are key elements in supporting the development of an inclusive open finance regime. India’s high bank account penetration and widespread use of UPI payments are pivotal factors in enabling the AA ecosystem.

Awareness of Account Aggregators is low

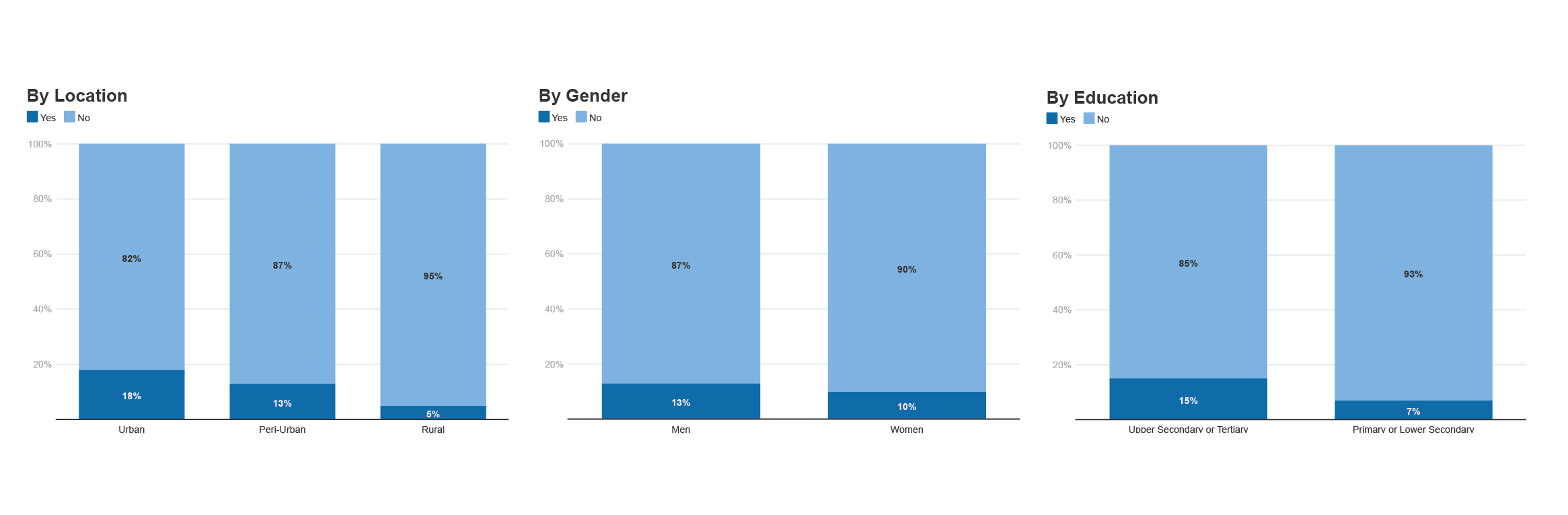

Only 12% of respondents were familiar with either the concept when described or the term Account Aggregators (compared to over 50% of respondents who are familiar with open finance in Brazil in our 2023 survey). Additionally, there were differences in the awareness of AAs based on location, gender, and level of education, with respondents in rural areas, women, and less educated respondents being less aware of AAs as indicated in Figure 1.

Figure 1: Awareness of AAs (click to enlarge image)

About 20% of respondents said they were willing to share data in exchange for benefits

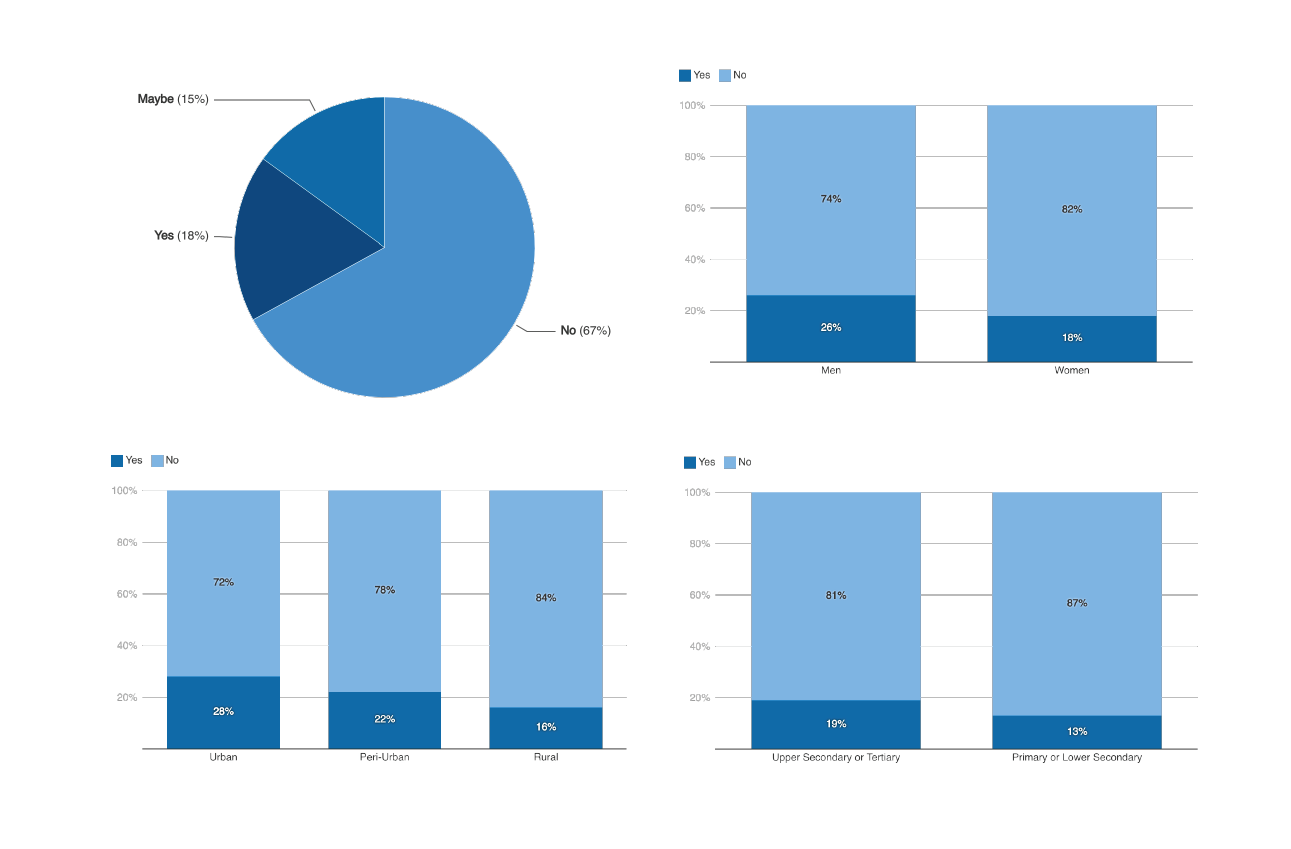

While about 20% of respondents were willing to share their financial data with another bank to receive benefits, this willingness differs by group as presented in Figure 2. Along the same lines we observed for awareness, women, those in rural areas, and less educated respondents were less willing to share their data as is evident in the figure. This finding is consistent with the findings in Brazil where roughly a quarter of respondents were willing to share data in exchange for benefits with women also showing a lower willingness to share.

Figure 2: Willingness to share data through AAs in exchange of benefits (click to enlarge)

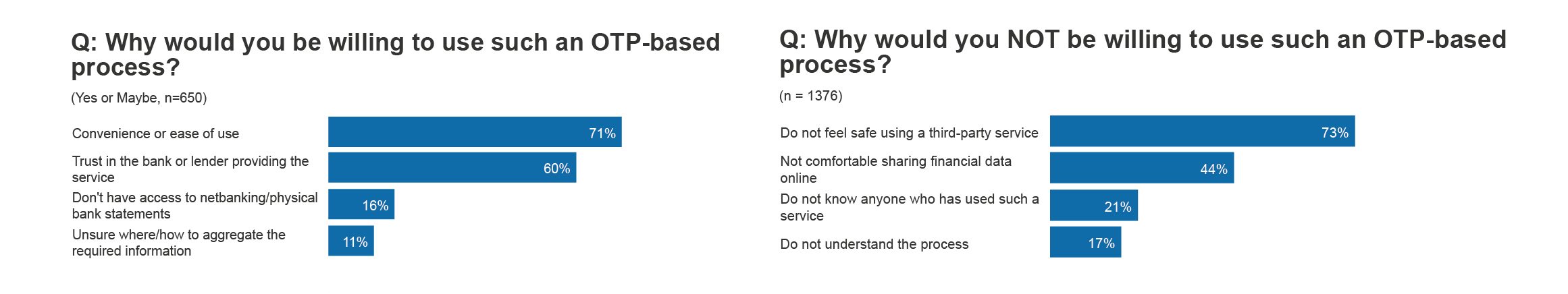

The majority of customers said they would not feel safe sharing data through a third-party

The main driver for those who said they would be willing to use the AA option for banking was convenience. For those unwilling to use it, the main reasons reported were related to safety concerns: lack of comfort using a third party (73%) and sharing financial data online (44%). It is interesting to note that while AAs were designed to support the customer consent process, which could be expected to help build customer trust, the research suggests that the introduction of a third party could be discouraging customers from participating. It is still very early in the implementation of the AA framework, so this could change as customers become more familiar with AAs and trust is built.

Figure 3: Reasons for willingness to use an AA (click to enlarge)

(Note: Financial data can be shared through Account Aggregators who take consent through a one-time password (OTP) from existing banks before fetching and sharing data.)

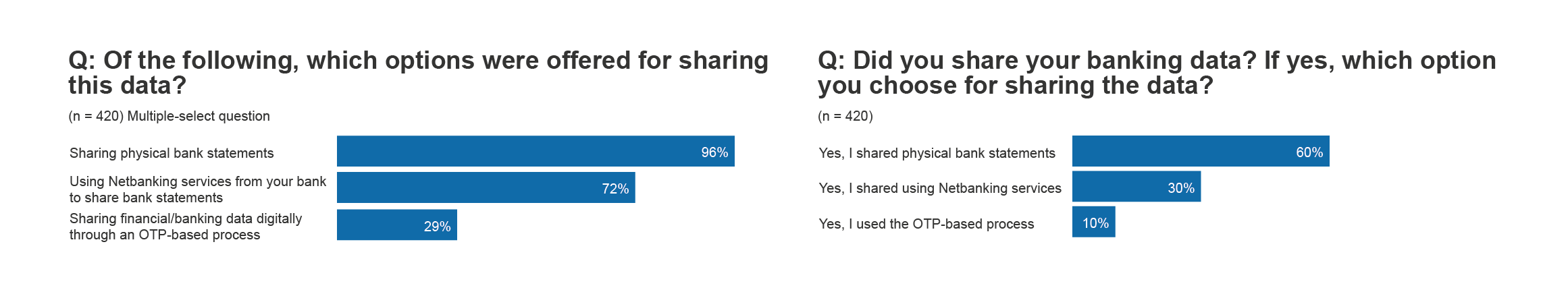

For respondents who applied for a loan in the last 18 months, 10% reported using the AA option to share their data

As mentioned above, most people who have used the AA ecosystem have done so in the context of a loan application. Some 21% of respondents said they had applied for a loan in the last 18 months. Of those, 29% recalled being offered the possibility to share data through AAs and 10% recalled using it, which translates to 2% of the total sample (Figure 4).

Figure 4: Options for sharing data and uptake of options (click to enlarge)

Although the initial implementation of the Account Aggregator ecosystem was slow, it has now made significant progress from an FSP implementation perspective, signifying a robust foundation for further growth. It is also important to note that AA use has grown exponentially in the last couple of months, so current usage is likely to be higher than that reflected in the survey, which covers an 18-month period. There is an opportunity for FSPs to capitalize on the streamlined experience that AAs can offer, not only to incorporate it into the current lending journeys but also to use the data shared to develop more use cases and products that are tailored to customer needs. As the ecosystem continues to develop, it will be important to build customer awareness and trust in the Account Aggregators, especially with traditionally excluded segments, to ensure that the potential benefits can reach historically underserved customers.

Add new comment