Using Demand-side Surveys to Segment Client Groups in Brazil

Policymakers and donors, rather than private sector providers, are traditionally the main consumers of data from demand-side financial inclusion surveys. However, using demand-side surveys to identify client segments is compelling for service providers as well, as this information can be used to better tailor products and services to each target group.

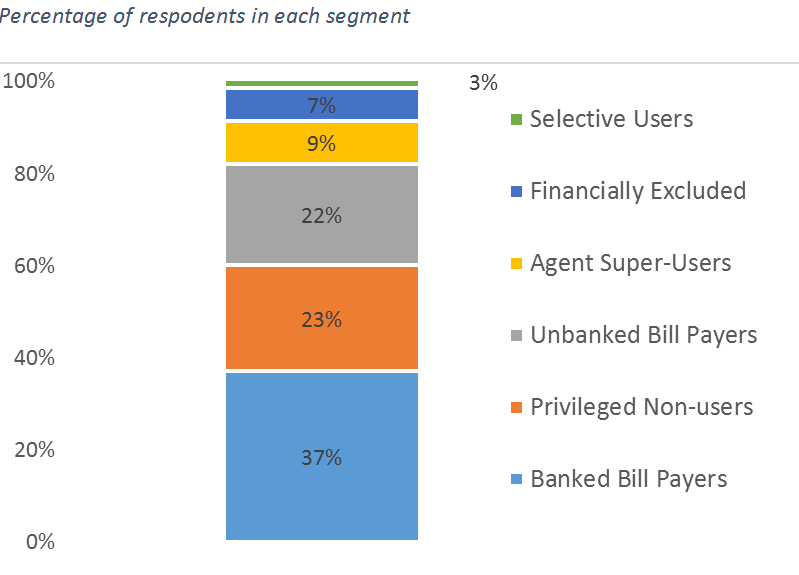

Using data from a national household survey in Brazil, we segmented Brazilian respondents into six categories based on how respondents use agents versus other channels. As shown in the Figure, these segments include the Financially Excluded; Unbanked Bill Payers; Selective Users; Privileged Agent Non-Users; Banked Bill Payers; and Agent Super-Users.

We define these segments based on whether clients have a bank account (the Financially Excluded and Unbanked Bill Payers are the groups that do not), and whether respondents use agents for bill pay, withdrawals or deposits (for banked segments).

We find that the Unbanked Bill Payers represent the biggest market opportunity for banks to expand agent services, as this group regularly interacts with agents for bill pay, but lack other formal financial services. This segment accounts for nearly a quarter of all respondents and is 57% female, 33% rural, and likely to work in the informal sector. Banked Bill Payers, Selective Users, and Banked Bill Payers also present important market opportunities for expanding services through the agent channel. We find that agents have had the biggest impact in meeting the financial needs of the Agent Super-Users, clients who use agents for all the transactions we considered. Respondents in this group tend to be poorer, live in urban and semi-urban areas, and to be concentrated in the Northeast.

In contrast, Privileged Agent Non-Users do not use agents at all and are much more likely than other groups to use online payment and transfer services. This is the wealthiest group, 60% of these clients are in the Southeast, and they are largely an urban population. Service providers looking to expand their agent channel should focus their efforts targeting other segments. For more in-depth analysis of these segments, please consult BFA's focus note on segmenting Brazilian clients.

In the financial services sector, understanding which clients tend to use which channels has important implications for fee structures, staffing and marketing. This segmentation exercise shows that banks and other financial service providers can take advantage of existing demand-side financial inclusion surveys carried out by governments and research organizations around the world as a low-cost option to gain insights about their clients.

Comments

Hello Caitlin... I'm

Hello Caitlin... I'm wondering if there's been any work on the development of "digital credit" (according to CGAP's definition) and the uptake, and regulation of that market. If you have any ideas or direction please share. Thank you... Max

Add new comment