Using SMS Messaging to Strengthen Your Agent Network

Agents are a key element of mobile financial services. In many cases, they are the only in-person points of contact that users have to the providers of their mobile services. Yet managing a large agent network can be challenging for financial service providers. Agents are usually not direct employees, and often they serve as agents for multiple companies, including direct competitors. These realities can make it challenging for providers to build a strong communication channel with agents and to align their incentives with company goals. A recent pilot in Paraguay suggests that interactive SMS technology can make this easier.

CGAP partnered with Tigo Money, a mobile money service offered by mobile network operator Tigo Paraguay, to test whether the interactive SMS platform Juntos could encourage agents to complete more know-your-customer (KYC) registrations. Tigo wanted to encourage agents to conduct more KYC registrations because customers without an in-person KYC are limited in the amounts they can transact. This was a challenge because agents are not compensated for the registrations and do not always see value in taking the time to do them. Over three months, however, SMS was able to increase the average number of KYC registrations per agent by as much as 12 percent compared to pre-treatment numbers.

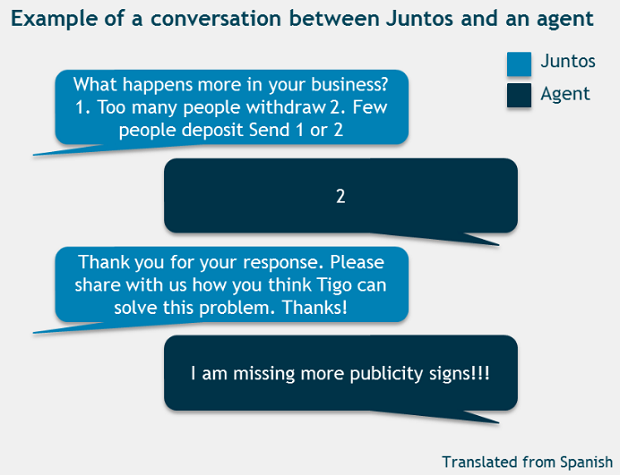

Juntos works by using two-way SMS conversations to build user relationships and later provide information about a given product and encourage certain behaviors. To build strong relationships, it iterates various communications strategies and identifies successful ones over time. As CGAP discovered in an earlier pilot with mobile money customers in Paraguay and the Philippines, different user groups prefer different strategies. In this pilot, agents were similar to customers insofar as they preferred building a relationship by discussing topics relevant to their lives. But the topics were different. Agents were most focused on:

- Conversations about their business. Agents wanted to know how Tigo Money could help to grow their businesses directly, and they desired a longer-term business partnership with Tigo Money.

- Opportunities to express themselves. Agents valued opportunities to share their feedback with Tigo Money.

Once Juntos had established a relationship with an agent, it provided information to encourage agents to conduct KYC registrations. For example, conversations showed that many agents did not have the phone application needed to perform the registrations and did not know how to get it. The SMS platform guided agents on how to obtain the application.

Conversations can be tailored to get agents to respond to simple questions about their interactions with customers, who often rely on agents for guidance and support in the use of their mobile wallets.

KYC registration is just one example of the many behaviors financial service providers might want to promote within their agent networks. Others include explaining procedures to customers, planning for liquidity needs, or promoting new products to customers. Using a tailored messaging platform can be a cost-effective solution for providers who are looking to strengthen their agent network management and drive such behaviors while gaining new customer insights.

Add new comment