What Is Keeping Kenya From Becoming More “Cash Lite”?

In our last blog, we introduced granular, intra-day transaction data collected in the summer of 2011 across a sample of 61 urban and rural retail merchants in Kenya. The results starkly showed that cash still dominates the payment transactions in these areas, with mobile money being used for not even 1% of transactions. In this blog, we ask the question “What would move more customers and merchants to more cash-lite payment behavior?”

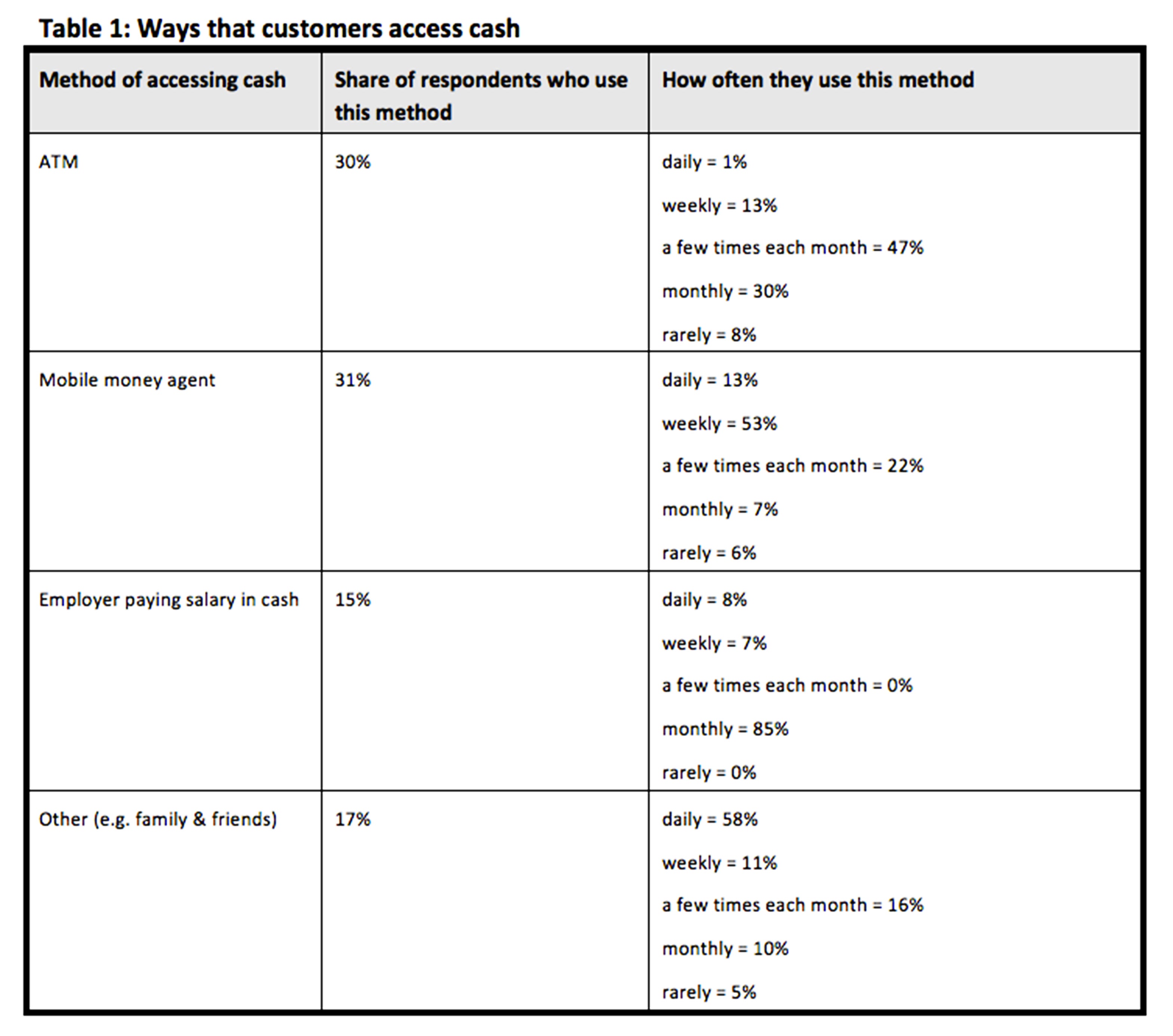

Our exit interviews with a total of 466 customers (1 for every 30 customers that we recorded a transaction for) show that most (95%) of these customers used M-PESA. Many used it weekly (40%) or a few times per month (30%), although few (10%) used it daily (see Table 1 below). One of the key blockages to high frequency use is economic cost. Customers expressed a willingness to pay, at the median, about US$ 0.13 for an electronic payment of US$ 6.25 or above, equal to a 2% transaction charge. This means the cost of transactions would have to be reduced by one third in order to begin to entice consumers to shift transactions as low as US$ 6.25 from cash to electronic. If it were possible to convert all transactions about equal to US$ 6.25 and above—assuming that transaction sizes remain constant—this would convert 14% of all transactions by number, but more than 50% of all transactions by value, to electronic payments. Transactions of this size are concentrated in a small number of retailers: hypermarkets, large shops, petrol stations, pharmacies, supermarkets and agro-vet stores.

Cash payment options are also inextricably linked with cash flow management. The move towards a cash-lite economy must consider not just retail transactions, but also the high frequency transactions consumers do amongst themselves. To some extent, these transactions, often in the form of borrowing and repayment are already electronic, as customers report that they use mobile money “to repay debts” with other individuals and to pay bills.

A chart showing how customers access cash

A chart showing how customers access cash

Behavioral implications for the shift to cash-lite

Consumers were nearly equally divided on whether digitizing their financial lives would help them stick to a budget. Some feel that they manage their money better by “seeing and touching what they have.” Further research should focus on understanding the differences between these two mindsets; whether the digital buckets do indeed improve money management; and what it would take to introduce a “digitized” mindset. Arguments also cut the other way, suggesting that electronic money is very liquid and therefore difficult to keep from spending. Recent research suggests that many M-PESA users deem money stored in M-PESA too liquid for effective saving. We also observe the sentiment that parting with electronic money is less real than departing with cash. This is not unique to M-PESA, and is perhaps implied as well in certain exuberant electronic money usage patterns in developed countries.

No traction until the system is more reliable

Retail merchants lose out in two ways of cash transactions as they recognize safety issues of having too much cash, yet bemoan the effort and time it takes them to bank cash. However, they also are not yet ready to encourage cash-lite payments, they are concerned about payment system reliability, both in their transactions with customers and with suppliers. Several retail merchants said they do not encourage their customers to use mobile money out of fears that customers will reverse the payment after the transaction.

Inventory is restocked frequently—for nearly one-third of merchants, restocking happens every day. About a quarter restock once a month. Payment to suppliers for inventory would then be a significant place to start thinking about promoting cash lite transactions, but retail merchants report that their suppliers most often want to be paid in cash (and usually do not offer non-cash payment options). Their suppliers are concerned about the reliability of the M-PESA system due to periodic system outages. Customers and retail merchants report that M-PESA’s system is regularly (at least once a week) down for hours at a time, and sometimes remains down for a few consecutive days.

Kenya, despite being the mobile money capital of the developing world, is still far from cash-lite. In order to bring Kenya into a more digitized environment, the cost of transactions need to decline, services need to be more reliable and the right messaging needs to herald the possibilities. The entry points, motivations and pathways to clear these blockages are there, waiting for the right entrepreneurial mind to take them into the next frontier.

Comments

Could this be the "right

Could this be the "right entrepreneurial mind" being talked about? http://www.safaricom.co.ke/personal/m-pesa/m-shwari . This is the the new banking service (savings and loan) product offered through M-PESA.

Mpesa is like a new born baby

Mpesa is like a new born baby that everyone wants to touch, hold, toss up, cuddle, swing and even wish it can walk. But like any other product, there is a growth path and cycle. It is very ambitious to want Mpesa to replace cash. Plastic money hasn't accomplished that feat either. How is plastic money penetration in the world? And how long have we had that mode? I would be curious to know how much cash it has displaced so far and after how long.

Now, with the too many visitors, the baby may not have time to sleep and grow. The parents are fine with the so many comments that keep coming " What a cute baby!, resembles its dad! bright eyes!, so healthy! But for heaven sake do not try to feed it with hard food or make it walk.

Joyce, too early to talk about the entrepreneural genius of M-Shwari. It's a great saving tool but as a credit ATM, not sure! But it's a good start in the right direction, inclusive vehicle a few hours to dawn..

Add new comment