Who Is in Charge of MFIs?

“What was going on in those board rooms?” I doubt I am the only one asking myself that question as I watched microfinance developments over the past few years. It is difficult not to second-guess the decisions that MFI managers, boards and owners were making, especially since some of them seem to have missed the mark in striking the right balance between MFIs’ financial and mission bottom lines.

Recent crises and MFI failures exposed important governance weaknesses. They also underscored how strong boards help MFIs survive tough times. Efforts to improve MFI governance are central to making our industry’s responsible finance movement robust in its practices – not just high-minded principles — and ensuring that it offers meaningful benefits to clients.

With this post, we are launching a special blog series on corporate governance. We will hear from microfinance managers, investors, and advisors about the current state of practice, obstacles, and promising new work.

Role of governance in microfinance

Guiding retail MFIs is not easy in increasingly competitive and complex operating environments. Neither is making sure that an MFI’s practices fully align with its commitment to act responsibly. A new CGAP Focus Note takes stock of MFI governance and assesses in particular the performance of microfinance investors in doing their part to govern actively and effectively. The study, which draws on in-depth interviews with more than 100 industry insiders, concludes that the microfinance industry is lagging in applying accepted good governance practices and that equity investors need to step up and do more.

The main role of governance in any organization is to help owners (or other key stakeholders for MFIs without “owners” in a legal sense) ensure that their interests are still advanced and protected once they have delegated responsibility for day-to-day operations to the management. Shareholders rely on the MFI’s legal agreements, policies and particularly the actions of the board of directors to chart mission and strategy, oversee operations and management, and ensure the MFI’s long-term survival.

But MFI governance is a bit more complicated than governance for mainstream financial institutions. First, our governing boards must exercise a higher duty of care since many MFI clients are lower-income, less familiar with formal finance, and thus more vulnerable than conventional banking customers to things that can go wrong. Second, unlike conventional companies with just a single bottom line, MFIs rely on governance to identify and navigate trade-offs that arise between the mission and the financial bottom line.

Hot-button issues in MFI board rooms

Which decisions and trade-offs are reported to be most prevalent and challenging in MFI board rooms?The most commonly reported hot-button issue identified through the Focus Note research is the pace and quality of the MFI’s growth. In second place were decisions around the MFI’s product line that have significant financial and mission consequences, including how much to invest in serving rural segments and small savers. Next came responsible pricing and other client protection issues. The interviews also revealed a new generation of hot-button issues that are cropping up in MFI board rooms, including appropriate levels of profit and how profits should be allocated, executive remuneration, and how to handle the interest of more commercial players into MFI financing and ownership structures.

Challenges in implementing good governance

The current MFI governance picture is mixed with many weaknesses but also some bright spots. The ideal board is supposed to be well-informed, able to guide strategy, and willing to challenge management as needed (without crossing the line into micromanagement). Several common weak spots came up time and again: clarity on the respective roles of board and management; policies on conflict of interest; information disclosure to the board; and effective use of board committees.

Social governance – that is, building consideration of the social bottom line into strategy-setting, performance monitoring and decision-making — needs more work. Many of the people I interviewed expressed the sense that “the financial bottom line will always win.” There are quite a few promising new initiatives in the MFI governance space by individual providers, networks, investors, raters and social auditors, and others. This includes tools developed by the Social Performance Task Force through its recently-published universal standards.

Tackling management capture and “founder syndrome”

Effective MFI governance is also challenged by the reality that the sector is relatively young and many institutions are still led by charismatic founders. Managers are often reluctant to accept the need to give up some control in the interest of achieving more balanced governance. In principle, the owners could and should insist on this, but those interviewed for the study reported that too few investors have the intention or focus to take on cases of “management capture,” where the CEO or senior management dominates the board and as a result oversight of the MFI is weak.

Microfinance investors and governance – what’s their role and how well are they doing?

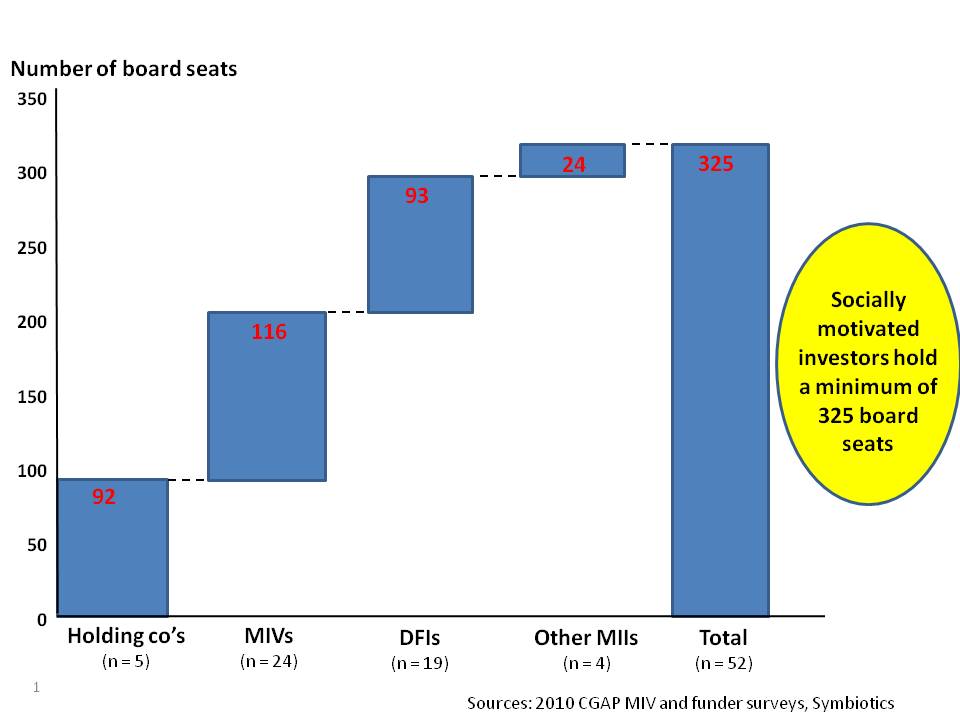

Social and development investors that provide equity to MFIs, funds, and other MIVs have ample opportunities to contribute to improved governance. For one thing, the research shows that they nominate and appoint well over 300 people to represent them on MFI boards. For another, they can shape MFI governance at every step of the investment process – by the way they do due diligence, the provisions they put in shareholder agreements, how they monitor their investments, and how they exit. Clearly investors that choose to govern actively throughout the investment process can promote stronger MFI practices.

So how well do investors perform their roles in the MFI governance process, as reported by their peers, their partners, and themselves? This research identified a number of smaller investors that “punch above their weight” and make outsized governance contributions when they take ownership stakes in MFIs. But it also found that many equity investors are not fully capitalizing on the opportunity for active governance. Some insist on board seats but do not fill them, or have difficulties in finding nominees with the right qualifications, time to serve, and willingness to ask tough questions. Another challenge is the fine line that the investor-nominated director must navigate between representing the equity investor and the best interests of the MFI. Many of those interviewed also pointed out that as microfinance attracts more commercial players, it will become even more difficult to align owners’ interests – in terms of their financial and (sometimes) mission goals, the returns they want, and how long they plan to keep their money in the MFI. At some point, if the owners’ goals are too divergent, might the MFI become ungovernable?

We can’t just assume that improving governance capacities and processes will pay off in better outcomes. We need well-designed research to tell us whether governance reforms actually pay off in better performance against the double bottom line. This demands deeper analysis of where financial and social goals have synergies and where there are difficult trade-offs that need to be anticipated, managed, and when possible, avoided. That’s why I’m a fan of the MIX research agenda on governance and MFI performance. Also the work that PROMIFIN is doing in Latin America to not just assess and fix governance weaknesses in MFI partners but actually measure whether they perform better as a result is extremely valuable to the industry as a whole.

Comments

Dear Kate Mckee

Dear Kate Mckee

I agree with you on the need for well designed research to tell us on better performance of governance against the double bottom line. For such research, a few points merit attention

1. The assessment on the knowledge of board members including chairman on the functioning of micro financial products and its limitation of micro credit as one of the components of micro finance in the poverty sector and their exposure in this field need to be included.

2. Trade off between social mission and financial gain for equity investors is difficult so long MFI’s business continues to involves only in micro credit services only. Other wise called money lending services as “modern money lender.” What ever best management of micro credit is carried out, it may benefit equity investors in the supply side but not necessarily with equitable distribution of benefits to the bottom and the worst part the bottom line gets likely excluded in the demand side .It is therefore necessary for the MFI to go for diversification of MF products such as savings, insurance ,remittances etc and integration with other supporting services prudently for productive functioning of micro credit services at client level as the impact of such chemitry of pro poor products may benefit both the investors and the bottom clients on equity principles. Hence board’s capability of decision making on such dynamics of diversification and operational efficiency merit attention as this would also enhance the performance of social and financial goals as well. Further . these goals need to have synergy with ethics also for sustaining the implications on the achieved goals

3. As a corollary to the above, there is a need to asses the ethical attitude and moral sentiments of the board members towards the concern for benign graduation of double bottom with more appropriate parameters unlike ‘Yes’ or ‘No’ pattern followed in MIX . .This extent of ethical investment assumes more importance for MFIs with social mission keeping the poor segment as their market niche. As reported in MIX analysis , only 26% of total sample of MFIs’ boards reported having ‘ethics’ committee. This is unfair and unjustifiable from the social mission point of view. In micro credit money lending business, without this ‘ethics’ committee, equity investors alone gain more advantage for getting their return equitably, while there is no justifiable equity in distribution of benefits for the poor clients who only contributed for profit of the institutions.

4. Related to point 3, it is highly unethical to baptize an institution confining to micro credit service only as MFI that too in isolation which is inadequate in no uncertain term for the ultimate purpose of poverty cure . At the most these institutions may be called as micro credit institutions(MCI). But for benign social mission, we need true MFI providing all MF services comprehensively besides micro credit and other supporting services like capacity building for the double bottom. This type of ethical investment is inevitable in their business activities for the present MFI system for serving the purpose for which it has emerged. For this it is essential that financial and social goals have synergies as youe rightly pointed out, but qualitatively not adequate for sustaining the impact unless ethics is also synergized well. This aspects also need to be considered while formulating hypothesis for deeper analysis on governance of MFIs. Further, in this regard, the ways and means of ethical investment in MF industry , discussion topic ‘Ten Commandments for the use of MF arsenals in the divine battle of poverty’ posted in CGAP Linked in group would be useful to the researchers for appreciating the subject as a premise for their research and suitably incorporating in their study analysis on MFI Governance.

Thank for sharing my views

Dr Rengarajan

Add new comment