Zoona Is Putting APIs at the Core of Its Business: Here’s Why

As a financial services provider (FSP), sharing your payments infrastructure, distribution network and regulatory capabilities with other companies — even competitors — might seem like a crazy idea fraught with risks. At Zoona, this is exactly what we’re doing as we transition from being a consumer product business to being a platform-first business and developing enterprise products only where there is demand, leveraging the platform. Despite the risks, we are seeing benefits and believe that providers in other markets will and should make a similar transition to grow their businesses and advance financial inclusion.

Why did we decide to become a platform-first business? Two years ago we started exploring the potential of open application programming interfaces (APIs) to grow our business. Because we were servicing such a small number of the potential use cases, we wanted to enable other businesses to leverage our payments infrastructure, distribution and regulatory capabilities to exponentially grow the number of services being offered to end customers and other businesses on our platform.

Initially, this was more of a side project for us, something we pursued as a potential opportunity after hours and in addition to the core responsibilities of the team. This involved prioritizing which functionality we wanted to open up to third parties, agreeing which segments of API consumers we wanted to target, enhancing our technical API management capabilities, designing and building our developer portal, API documentation and related processes, and thinking through our terms of use and commercial business model.

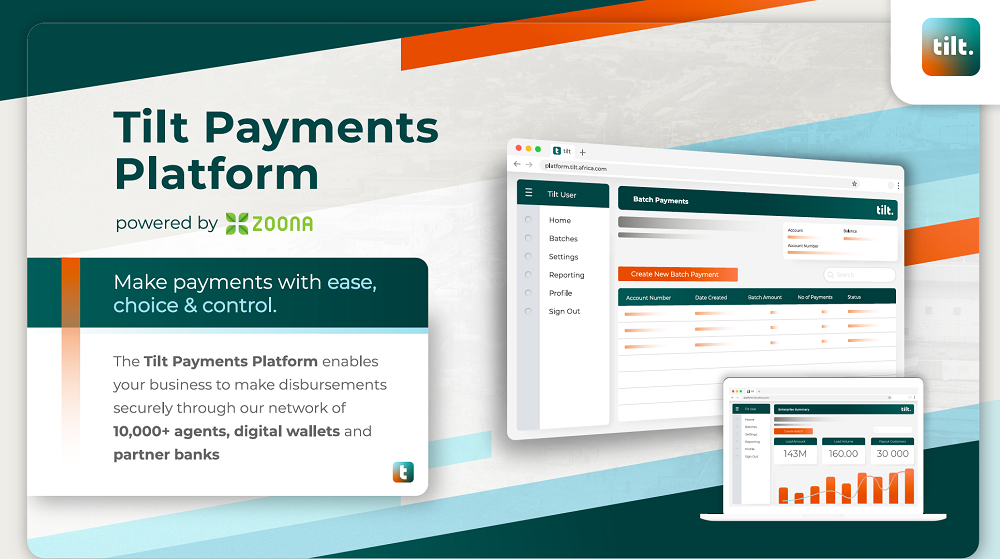

While developing and refining our open API strategy, our business was undergoing competitive pressure in the consumer space, which shifted our focus to how we could use APIs to enable interoperable payments with our partner banks rather than broad-scale integration into our own store-of-value accounts. This evolution to an interoperable strategy gave rise to the launch of Tilt, a Zoona fintech spinoff focused on enabling enterprise payments. While designing and building reusable APIs has remained core to our business, expanding access to these APIs via an open API platform has moved to a longer-term goal.

We still believe much of our growth is likely to come from new players that we have not yet met leveraging our platform to build new and exciting solutions — financial and beyond. However, our short-term growth is being driven by internal and partner innovation on the back of these same APIs.

Internally, we have used the APIs to create an interoperable bulk payments platform that enables businesses to make payments into the wallets and accounts of our partner FSPs or to be disbursed through any one of our over 10,000 Zoona and partner agents. We are in the process of adding collection functionality to this platform. As we are consuming our own APIs in the back end to create a simple, intuitive user interface and user experience, this portal is available to all our business customers. It does not require partners to have advanced internal technical capabilities.

The APIs are also enabling partner innovation. For example, customers of Atlas Mara and Tenga are able to access cash-in and cash-out services at any of our distribution partners, which include Zoona, Kazang and Afrivance. This is achieved through Atlas Mara integrating to our Z CODE Issuer API and Kazang and Afrivance integrating to our Z CODE Distributor API. We are in the process of bringing other banks and distribution partners on board, too. Similarly, another partner is in the process of leveraging our APIs to both originate and terminate international money transfers at any of our agents.

The reusability of APIs designed and built with the support of CGAP significantly reduced the time and cost to get these to market. However, our more than 10 years in this business has taught us that no one “killer” product will differentiate us or define our future. The ability to keep innovating and evolving as the needs of our customers change will be key to our future. We believe that designing and building with reusable APIs will help us to continuously and quickly adapt to the rapidly evolving markets in which we operate.

Ultimately, we hope to build a platform with rich capabilities that can be leveraged by partners and third parties we don’t yet know to offer a more diverse range of tailored products and services to more emerging markets.

Brett Magrath is co-founder of Zoona and CEO of Tilt Africa, a fintech spinoff of Zoona. Bridgid Thomson is COO of Tilt Africa. For more on why Zoona and other providers are opening APIs, see this short video and visit CGAP's collection of resources on open APIs.

Add new comment