Recent Blogs

Blog

Smartphone-Led Digital Finance: Three Areas to Watch

The rapid uptake of smartphones stands to enable a transformational opportunity for digital finance, also raises important questions concerning security and privacy.Blog

New Tools to Accommodate Old Financial Habits: Key for DFS Usage

Digital services that are able to replicate what poor people already do informally, in everyday life, may be critical to starting new customers on a path to using money in new ways.Blog

Ghana: DFS Taking Off Amid New Regulations and Market Momentum

Ghana looks increasingly poised to assert its regional leadership in digital financial services in West Africa.Blog

Deposit Insurance for Digital Financial Products: 3 Approaches

Countries have adopted three approaches to addressing digital "deposit-like" products when it comes to including them in the deposit insurance system.Blog

Consumer Risks and Rewards Amid Increased Competition in Kenya

In Kenya, product development and the growth of agent networks are moving in the right direction to provide customers with more options, but we must also remain mindful of the risks these developments pose to customers.Blog

Should Your Friend Be Your Banker? Digital Models Test the Waters

A recent study by CGAP identified three Person to Person (P2P) business models that could be applicable to underbanked populations in developing countries and help them move up the financial ladder.Blog

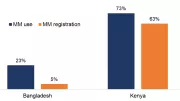

Mobile Money in Bangladesh: Still a Long Way to Go

Bangladesh is one of the fastest growing mobile money markets in the world. Yet, mobile financial services in Bangladesh have a lot of room to grow before they can claim any wide national impact.Blog

Cutting the Cost of Remittances

For migrant workers, the costs of remitting money remains high. However, three trends that could disrupt the remittances status quo are emerging.Blog

Lessons Learned from Digital Microinsurance ‘Sprinters’

A number of mobile insurance initiatives have achieved exceptional scale in a short period of time. There are at least 7 keys to success.Blog

DaviPlata: Taking Mobile G2P Payments to Scale in Colombia

DaviPlata, a mobile wallet offered by Banco Davivienda in Colombia, is an application helping to shift social safety net payments – often paid in cash – to digital delivery.Blog

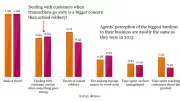

Sprint or Limp? Investing In Customer Service to Achieve Success

Investing in first class platforms and agent training can be the difference between providers of digital financial services who "sprint" or "limp" across the finish line.Blog

Five Ways Providers Can Do Digital Finance Better

A new Focus Note from CGAP recommends five core priorities for digital financial service providers to address to improve the safety, reliability, and performance of their products, channels, and systems.Blog

Seven Customer Risks that Need Attention Now

CGAP’s latest Focus Note identifies seven key risk areas for customers of digital financial services.Blog

myAgro, HCD, and Supporting Smallholder Savings in Senegal

myAgro, CGAP, and IDEO.org are partnering to use human-centered design to further align product offerings in Senegal with smallholders’ behaviors, needs, and aspirations.Blog

India Digitizes its Merchants in Partnership with the U.S.

A partnership between the U.S. and India will focus on commercial and policy solutions to spur India’s nearly 10 million merchants to accept electronic payments.Blog

Designing Digital Financial Services for Cambodian Smallholders

As Cambodian providers continue to develop innovative new digital financial products and services, tailoring them to the unique needs of smallholder households remains a significant challenge.Blog

Why Open APIs Matter: Tech Partnerships Power Development

The potential for open APIs to drive innovation in the mobile money space is tremendous. There are several key elements crucial to the success of any open API ecosystem.Blog

What’s Undermining India’s Financial Inclusion Progress?

The success of India's financial inclusion efforts hinges on one factor above all: the quality of the last-mile banking agent networks that will disburse payments and enable customers to access their bank accounts.Blog

Three Questions for Determining if a New Product is a Deposit

This first post in a new series on deposit insurance and digital financial inclusion focuses on the basic, but not easy question, of how to define a “deposit.”Blog