Recent Blogs

Blog

Why M-Shwari Works

With the rapid uptake of M-Shwari, Commercial Bank of Africa (CBA) is the envy of the digital financial services industry. Many factors led to M-Shwari's success, including that it solves a real problem faced by Kenyans: on demand liquidity.Blog

Top 10 Things to Know About M-Shwari

CGAP’s latest Forum publication explores M-Shwari and examines what a critical gap it fills for Kenyan households. We highlight 10 facts about M-Shwari that mobile money watchers should know.Blog

6 Insights Driving Digital Design for Smallholders in Zimbabwe

IDEO.org designers have traveled across Zimbabwe to gain an important understanding of the lives and aspirations of Zimbabwe’s smallholder households.Blog

Beyond Numbers: How One Gaza MFI Emerged from the Rubble

With unemployment rates in Gaza reaching the double digits and the UN estimating that more than three-quarters of the population depends on aid to survive, it’s little wonder that the services of microfinance institution, FATEN, are in such high demand.Blog

PMJDY: Improved Financial Inclusion, But Roadblocks Remain

MicroSave has conducted a study on the progress of the Pradhan Mantri Jan Dhan Yojana (PMJDY), arguably the largest financial inclusion drive in the world.Blog

The ‘Uberification’ of Financial Inclusion: What’s Possible?

At CGAP, we want to understand what Uber and other socially interactive business models could mean for financial inclusion.Blog

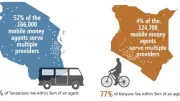

Tanzania: Africa’s Other Mobile Money Juggernaut

Tanzania has seen a rapid spread of mobile money and is hot on the heels of Kenya in terms of uptake and use of digital financial services.Blog

Agent Network Expansion: What Can We Learn from Cote d’Ivoire?

The mobile money market in Cote d’Ivoire has boasted impressive acceleration in terms of registered customers, but the number of transaction points in the distribution networks has also seen tremendous growth.Blog

Telenor’s Shared Agents: Digital Finance Catalyst for Bangladesh?

New business models for agent networks, such as shared agent networks, are emerging and may offer more sustainable, competitive and efficient mobile financial services.Blog

What is Digital Financial Inclusion and Why Does it Matter?

A new Brief from CGAP aims to provide national and global policy makers with a clear picture of the rapid development of digital financial services for the poor and the need for their attention and informed understanding.Blog

Mobile Money Moves Forward in Uganda Despite Legal Hurdles

Despite unfavorable financial sector laws, Uganda is among the most successful countries in Africa with regards to mobile financial services (MFS).Blog

How Tanzania Established Mobile Money Interoperability

Tanzania’s mobile money industry is flourishing. With a new set of standards governing person-to-person payments across multiple networks, it’s now evident that interoperability is here to stay.Blog

What Could Digital Finance Look Like in 10 Years?

CGAP imagines what a digitally-powered, financially-inclusive world could look like in the future.Blog

Sharia-Compliant Microfinance: 5 Takeaways from CGAP's Research

We take a look at five takeaways from CGAP's most recent research on the subject of sharia-compliant products.Blog

Cashless & Cashy: The Yin-Yang of Digital Delivery in Peru

When it comes to delivering financial services to lower income segments in Peru, innovators have struck an interesting balance between cashless and cashy transactions.Blog

Can Digital Cash Transfers Enable Financial Inclusion in India?

Although digitizing cash transfers in India is gaining momentum with a renewed effort by the national government, the direct positive impact on financial inclusion remains unclear.Blog

USSD Access: A Gateway and Barrier to Effective Competition

To serve the unbanked, mobile financial service providers continue to rely on USSD technology to bring innovations like mobile money to the unbanked. CGAP research in Kenya and Tanzania identified several competition-relevant issues in USSD access.Blog

What is USSD & Why Does it Matter for Mobile Financial Services?

USSD - unstructured supplementary service data - is currently the best available communications technology to deliver mobile financial services to low-income customers.Blog

Wing Pushes Digital Finance Frontiers Further in Cambodia

Wing has become a leading player in financial inclusion in Cambodia, with over one million over-the-counter (OTC) customers and about 500,000 registered customers who can make transactions with cards or mobile phones.Blog