Mitigating Digital Finance Risks for Consumers in Sub-Saharan Africa

Webinar

This interactive webinar highlighted the evolving nature and scale of digital financial services (DFS) consumer risks in the Sub-Saharan Africa context. Our panel of experts from BCEAO, FSCA, FSD Kenya and GSMA shared insights on how supervisors and regulators can use emerging consumer protection approaches to mitigate consumer risks and achieve positive outcomes for DFS users. This webinar was geared towards regulators, supervisions, DFS providers, and funders in Sub-Saharan Africa, this webinar will be translated to French. Participants will also have the opportunity to join breakout rooms for part of the session to discuss risks and solutions.

For our French-speaking audience, please select French closed-captions by clicking on Subtitles/close captions > Settings > Auto translate > French

Related Resources

The Evolution of the Nature and Scale of DFS Consumer Risks: A Review of Evidence >> [EN and FR]

Market Monitoring for Financial Consumer Protection >> [Toolkit]

Lessons on Digital Credit from East Africa >> [Collection of resources]

Is It Possible to Estimate Financial Stress Before It Harms Borrowers >> [blog]

Algorithm Bias in Credit Scoring: What’s Inside the Black Box? [blog]

It’s Time to Change the Equation on Consumer Protection >> [blog]

Agenda

| Opening remarks | Sophie Sirtaine, CGAP CEO |

| Presentation of DFS risks in Sub-Saharan Africa | Majorie Chalwe-Mulenga, CGAP |

| Panel discussion | Eric Duflos will moderate a panel consisting of Madame Akuwa Dogbe Azoma, Awelani Rahulani, Francis Gwer, and Kennedy Kipkemboi Sawe |

| Presentation of CGAP's Market Monitoring Toolkit | Juan Carlos Izaguirre, CGAP |

| Break out discussions | Moderated by Fola Agbejule, Emma Lala Bouali, Corinne Riquet, and Myra Valenzuela |

| Report back and final reflections |

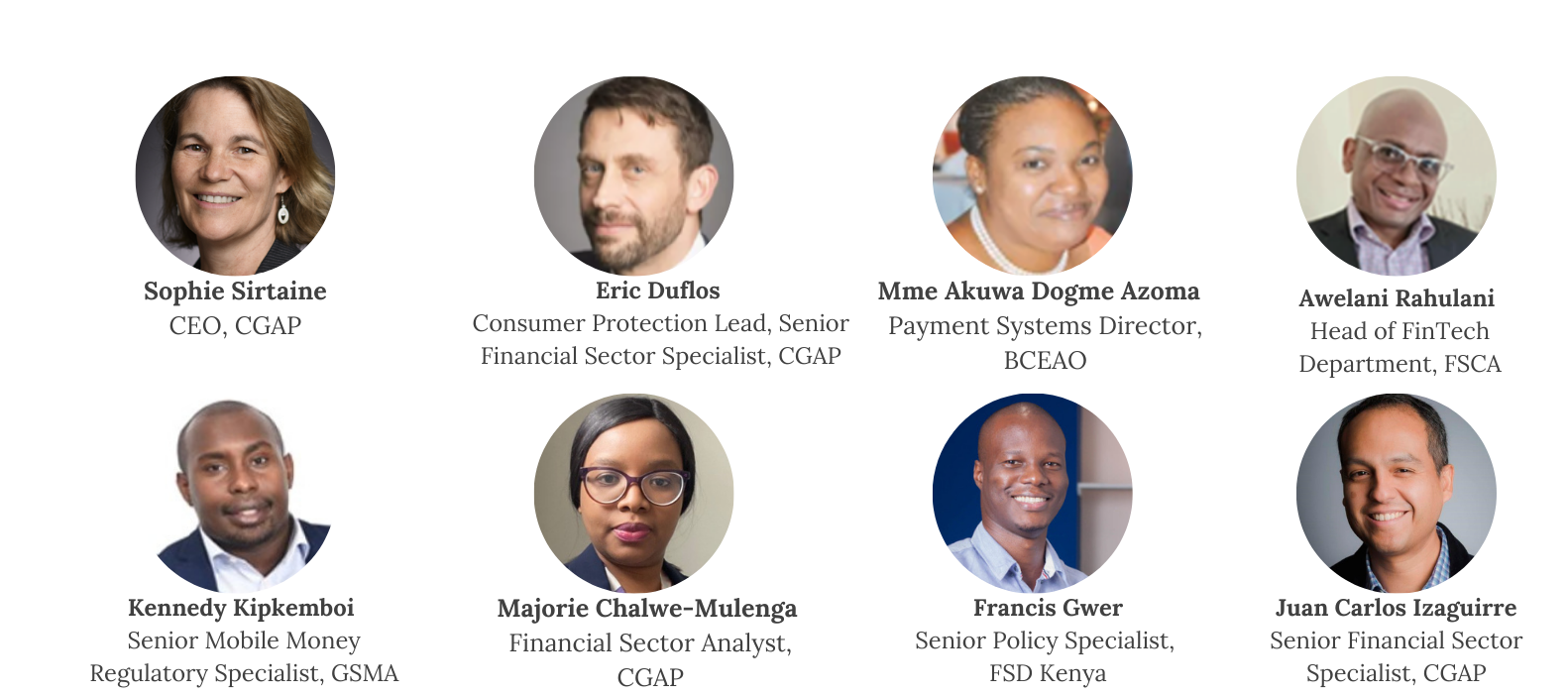

Speakers and Panelists

Sophie Sirtaine is CGAP’s CEO and leads CGAP’s operational team. With over twenty years of experience in the World Bank, Sophie has held various positions including as Director of Strategy and Operations in the Independent Evaluation Group of the World Bank Group from 2016-2021 and as country director for Latin America and the Caribbean from 2013-2016. She also worked in South Asia, and the Europe and Central Asia regions; the Corporate Secretariat; and the Operations, Policy and Country Services Vice Presidency of the World Bank Group. Among others, she led the World Bank’s banking sector crisis response in several EU countries during the 2008-2009 global financial crisis.

Eric Duflos leads CGAP’s work on consumer protection, from policy, industry and customer perspectives, ensuring that financial services have positive outcomes for customers. Eric has 25 years of experience in advancing financial inclusion and economic development. His most recent position was director of the office of the UNSGSA, H.M. Queen Máxima of the Netherlands, where he managed a team of staff and consultants working on fintech and digital finance for underserved segments. He also helped the UNSGSA design and launch the CEO Partnership for Economic Inclusion, which regroups 10 major global companies. Prior to this, Eric has held several positions within CGAP, including regional representative for East Asia and the Pacific based in Singapore. Mr. Duflos' research and advice have focused on policy and regulatory issues, digital finance, customer centricity, and aid effectiveness

Madame. Akuwa Dogbe Azoma is currently Director of Payment Systems at the Central Bank of West African States (BCEAO). She has more than twenty years of experience in the field of payments. She contributed to the implementation of the Interbank Automated Clearing System in the West African Economic and Monetary Union (SICA-UEMOA) and to the establishment of the oversight function of payment systems within the Central Bank.

Awelani Rahulani is currently Head of the Fintech Department at the Financial Sector Conduct Authority (FSCA) in South Africa. He is an experienced Financial Services professional with over 15 years of extensive track record leading projects, research, analysis, and crafting policy in the financial sector.

Kennedy Kipkemboi is a Senior Mobile Money Regulatory Specialist at the GSM Association (GSMA). In this capacity, he is responsible for shaping positions taken by some of the largest telecommunications and digital financial services companies and helping them find solutions to regulatory issues.

Majorie Chalwe-Mulenga is a Financial Sector Analyst at CGAP. She works with CGAP’s customer value pillar and co-authored CGAP’s global research on the evolution of the nature and scale of DFS consumer risks. She also supports CGAP’s engagement in sub-Saharan Africa. Prior to CGAP, she worked in the commercial banking sector and for the central bank of Zambia.

Francis Gwer works as a Senior Financial Sector Policy Specialist at Financial Sector Deepening Trust (FSD) Kenya. He works alongside Kenya’s financial sector policymakers and regulators on initiatives aimed at strengthening competition, stability, and market conduct in Kenya’s financial sector.

Juan Carlos Izaguirre is a senior financial sector specialist working on emerging regulatory and supervisory issues in digital finance and financial consumer protection frameworks focused on customer outcomes. He has over 15 years of regulatory and supervisory experience, primarily in banking, financial inclusion, consumer protection, and deposit insurance. He led the development of CGAP’s market monitoring toolkit.