Can Phones Drive Insurance Markets? Initial Results From Ghana

Burials in Ghana are socially very important and tend to be large and expensive affairs, often putting a strain on household budgets—particularly among the poor. The insurance market has however been slow to develop and very few products exist to help mitigate these costs. In this gap, Tigo saw an opportunity to deepen customer loyalty by offering an insurance product as a value added service. The main challenge was that many prospective clients, being unfamiliar with the insurance concept, were not willing to pay for something whose value they did not readily understand or see.

Tigo made a strategic bet: if it offered the product for free as a loyalty based product, clients would learn to appreciate the offering and subsequently be willing to pay a premium for higher coverage. Believing it would work, they promoted the free insurance for 12 months before enabling the premium function in November 2011.

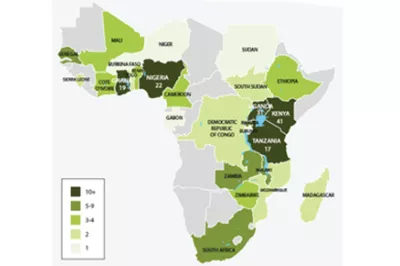

Four actors came together to enable the product: Tigo owns the product and has the front-end relationship with the client; BIMA owns the platform and the sales force; MicroEnsure, which helped spawn the concept, processes all claims, updates customer policy levels based on use and did the initial training of sales agents; and local insurer Vanguard Life Assurance bears the insurance risk. BIMA, it is worth noting, was set up in 2010 by Tigo owner Kinnevik specifically to deploy this type of mobile insurance product. Although Tigo Family Care in Ghana was its pilot deployment, BIMA is already active in five countries and expects to expand rapidly as mobile insurance takes off around the globe.

The product itself has been described elsewhere (both by CGAP and the GSMA MMU blog) but one of the key aspects is that it uses the type of ‘freemium’ model that CGAP argued for last year. In short, Tigo customers receive free life insurance for themselves and one family member, ranging from $104 to $520 depending on how much airtime they use in a month: $2.60 for the lowest level of coverage and $20.80 for the highest. The customer can stay on this free plan indefinitely provided the monthly airtime requirement is met, but can also choose to double it by paying a fee of $0.68 per month for what is called Xtra-Life, giving them up to $1,040 of insurance cover.

A mobile money account is not needed to register and fees are deducted from the customer’s airtime balance, but all claims are paid out through Tigo Cash, giving an exposure intended to help promote the electronic wallet.

Why would Tigo do this? The primary motivation was pure business: to gain an edge in Ghana’s highly competitive voice market by reducing churn and encouraging customers with multiple SIM cards to use Tigo more often, hypothesizing that people would be more loyal to a voice provider that is also giving them insurance.

So for the financial inclusion community, Tigo Family Care Insurance may be that rarest of things: a product that makes business sense but also gives access to vital services for people with little or no ability to pay. As the first year of Freemium is drawing to a close, we sat down with the companies involved to find out: did it work?

From a financial inclusion perspective, it appears safe to say that it did.

At the launch in 2010, only an estimated 5.4% of adult Ghanaians—around 720,000 people—had any kind of insurance, a quarter of which was informal. Tigo Family Care today provides insurance cover for nearly a million clients, an estimated 93% of whom have no other insurance cover. Thus Tigo Family Care has more than doubled the size of the insurance market and extended basic life coverage to 978,000 Ghanaians that are otherwise uninsured.

In terms of reaching the bottom of the pyramid, 22% of Tigo Family Care subscribers earn less than US$ 100 per month and 80% earn less than US$ 300. Largely ignored by traditional insurers, these customers appear happy with the Tigo service: in a GIZ study on the Ghanaian microinsurance sector, 61% of subscribers were satisfied with the product, 33% said "somewhat satisfied" and only 4% said were "not satisfied".

While the service is still in its early days, these initial results are nothing if not compelling. The Ghanaian National Insurance Commission (NIC) certainly seems to think so, awarding Tigo Family Care Insurance as the most successful microinsurance product in Ghana in November 2012.

So how does the business case stack up and what role has the freemium pricing strategy played in enabling this product? This will be the focus of next week’s post.

Add new comment