What Options do MFIs Have to Leverage M-banking?

Today we are releasing our latest Focus Note, Microfinance and Mobile Banking: Blurring the Lines?. When we first wrote on this topic three years ago, there was limited experience of MFIs leveraging m-banking. This time around, there were far too many MFIs to profile than we had room for. Of course, this is a good situation to be in, but our research still highlights many of the challenges MFIs have in taking advantage of the m-banking momentum all around us.

Before we get into the technology options for MFIs, let’s share some of the paper’s main findings. First, there is no evidence that MFIs or their customers are driving the development of m-banking. MFIs that are successfully leveraging m-banking tend to be in countries where an m-banking service is already widely used. In such markets, particularly Kenya, MFI customers may even expect or demand their MFI to offer m-banking as a repayment option. Further, benefits of m-banking services to MFIs largely depend on the success of the existing m-banking service itself. In markets where m-banking is strong, MFIs and their customers can more easily benefit. In markets where m-banking is struggling to get off the ground, MFIs and their customers will have a harder time benefitting. Irrespective of the success of the m-banking service being leveraged, there is no real evidence of MFIs reaching customers in new geographies or lower income segments through m-banking.

Second, typical concerns from MFIs about m-banking, namely how it will affect group dynamics and repayment rates, how management information system (MIS) reconciliation will occur, and how customers and staff will adjust to new payment options, have all proven to be manageable by MFIs that now have several years of experience using m-banking in their operations.

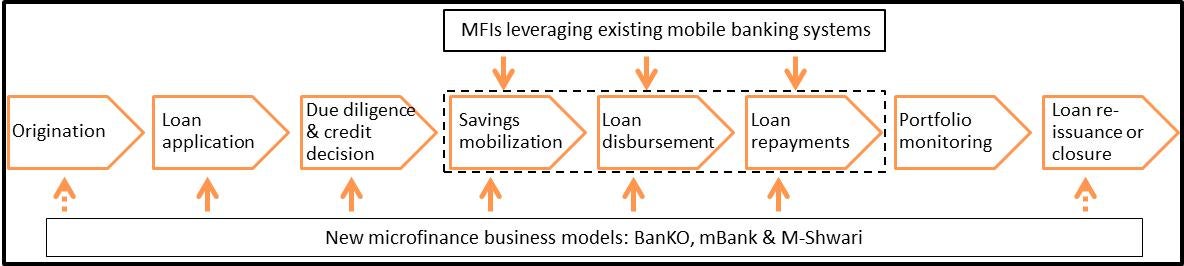

Lastly, one of the biggest recent advances in the intersection between microfinance and m-banking has come from new microfinance business models that leverage mobile phones and agents for loan applications, customer due diligence, and credit decision-making. The figure below shows how some of these new business models are integrating m-banking into their business processes, beyond loan repayments, loan disbursement, and savings mobilization.

So how do MFIs in markets with existing m-banking systems leverage this infrastructure?

MFIs tend to pursue one of two distinct strategies, each with different implications for the level of investment required and functionality offered to customers. The first strategy involves simply using the bill pay functionality of the existing m-banking provider and its agent network to facilitate loan repayments and/or savings mobilization, or the bulk payments functionality to facilitate loan disbursements. In this arrangement, the MFI uses its own bill pay code just like a water or gas company would use its own code to receive bill payments through mobile money. This strategy is the quickest way for an MFI to leverage m-banking and requires the lowest level of investment since the MFI can import the data and do manual reconciliation. An MFI can also choose to invest in “middleware” that automates the process of uploading and reconciling the repayment data from the m-banking platform into the MFI’s MIS, estimated in Kenya to cost between US$10,000 and US$20,000.

The second strategy involves the MFI investing in technology that links customers’ m-wallets to their MFI accounts. This allows customers to access their MFI accounts via their mobile phones and to move money between the two. The MFI leverages the agent network of the existing m-banking provider to facilitate cash-in and cash-out transactions into the customer’s m-wallet and subsequently into the MFI account. In a relatively mature m-payments market like Kenya where several technology companies compete to provide these services, an MFI with a robust MIS would need to invest between US$50,000 and US$100,000 to pursue this option. A number of MFIs have transitioned over time from pursuing the first strategy to pursuing the second, allowing for more functionality between customers’ m-wallets and their MFI accounts.

But enough of the theory. Our paper is full of real-life examples of MFIs using these two different options, and subsequent blog posts will look at a few of these MFIs in more detail. Specifically, we will explore evidence of the benefits of m-banking for MFIs and their customers, and discuss how new microfinance business models are innovating across the business process.

Add new comment