Mobile Money: OTC versus Wallets

This post launches a series which examines the business choices involved in balancing the extremes of over-the-counter (OTC) transactions and electronic wallets when it comes to making mobile payments.

In countries as diverse as Paraguay, Ghana, Pakistan, and Bangladesh the emergence of mobile money is marked by a high proportion of over-the-counter (OTC) transactions. Unlike a customer-managed electronic mobile wallet, OTCs occur when senders or receivers do not use their own accounts. OTC transactions instead occur when customers transact in cash with an agent who executes the electronic payment on their behalf.

In some cases OTCs are part of a planned business strategy, often as a way to reach customers who are unable to use wallets due to onerous account opening requirements or technical limitations. In other cases OTCs have emerged unexepectedly, with customers and agents pursuing them on their own.

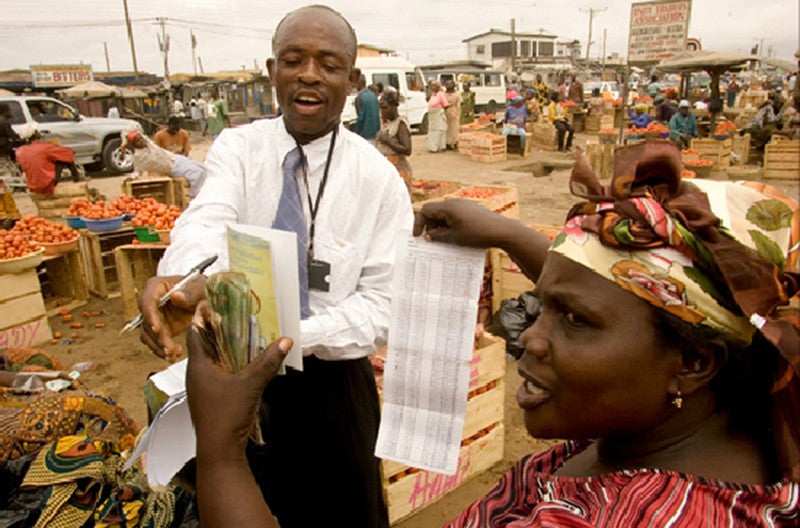

Gaeten Dery goes to clients where they work, making it more convenient and cost effective for them to make payments.

Gaeten Dery goes to clients where they work, making it more convenient and cost effective for them to make payments.

Photo Credit: Ron Londen

Whatever the reasons for the rise of OTCs, this behavior presents short- and long-term business choices. The use of OTCs challenges businesses to be clear about where electronic wallets and OTCs fit. Opinions vary across the industry, and include the following, among others:

- OTCs are likely to replace (even displacing or cannibalizing) wallets, allowing for much faster uptake by new businesses but reducing customer stickiness and never really replacing cash.

- OTCs ought to be offered before wallets as a carefully sequenced service. Businesses may benefit from introducing OTCs first and then carefully orchestrating a transition to wallets. Some argue that this is a natural process that can be managed, others argue that such transitions are unlikely and therefore OTCs present a threat to eventual wallet development.

- OTCs may complement wallets and thrive when each is offered side-by-side. There may be some users or clients who only want wallets and others who only want to use OTCs.

The subsequent posts in this series will be dedicated to exploring these questions in addition to more generic debates on the benefits and risks of OTCs and wallets and specific country experiences. For example, in Ghana, a particular mobile phone deployment offering wallets has had an unexpectedly high early use of OTCs by clients. In Pakistan, EasyPaisa has intentionally offered OTCs to attract off-network clients and activate the agent network. In Bangladesh, the early deployment of mobile money has opened a lot of accounts but still experiences significant levels of OTC use. What do these experiences reveal? Why are OTCs prominent in some markets? What lessons are businesses learning about the best way to manage a balance of OTC and wallet use?

To frame this seven-part blog series we have established some generic definitions for consistency:

E-money wallets are electronic accounts which clients can manipulate directly to send payments to other wallets or merchants.

An OTC transaction, in contrast, occurs when clients do not use their own wallets but instead hand cash to agents who execute transfers on behalf of senders and receivers.

Between the extremes of wallets and OTCs there are a range of different use patterns. For example, there are direct deposits where senders do not use their accounts but make a deposits directly to a recipient's account via an agent. However, this blog series will zero in on how to balance delivery between the extremes of OTCs and wallets and the business choices faced in the process. While there are relevant and important regulatory issues around AML/CFT (anti-money laundering/combating the financing of terrorism) practices which are naturally a part of the wider consideration, this blog series will focus on the business implications and not stray too far into the regulatory considerations.

---- The author is part of the technology and business model innovation at CGAP

Comments

It is a very good informative

It is a very good informative and analytical writing. specially for those associated to MF sector. But there is one thing still left, which could describe the analysis of any probable service wherein an MFB/MFI may associate/sync themselves with an already established channel between a (commercial bank+MNOs).

Any how the author really deserves the appreciation for such a nice work done.

This blog rightly describe

This blog rightly describe the scenario of Branchless banking.In my opinion gap between OTC and m-wallet transactions has some local perspective.e.g in Pakistan OTC transactions are more than the direct m-wallet transaction because people need "cash" for their routine buying and selling .Only a few even a very few merchant outlets hav the facilty to receive funds in electronic form.Therefore people have to rely on the agent who gives them the "cash" and later that agent approach the nearest bank for refund or bank's correspondent approches him.

Secondly people due their low literacy level either dont know or dont trust m-wallet transaction and prefer to have a "physical" guarantee in form of an agent whom they know personally.e.g despite receiving a SMS alert they insist to stamp the receipt .

OTC may prevent the country

OTC may prevent the country from achieving a cashless/lite economy, though it permits access to payment services. Besides that, there is a risk of laundering a huge sum of money every day if such practice continues. therefore, the agents become accomplices or victims of fraudulent activities

Add new comment