Using Mobile Banking for New Microfinance Business Models

CGAP research published earlier in 2013 posited that the lines between microfinance and mobile banking are beginning to blur:

Mobile banking has facilitated a new approach to microfinance by using the mobile phone, customer usage data and agents for loan applications, customer due diligence, and credit decision-making. The microfinance culture has begun to merge with the m-payments culture to provide much more than what microfinance services or m-payment services can offer alone. M-banking is also facilitating new partnerships between unlikely players that each brings areas of expertise that have the potential to deliver innovative financial services to the unbanked.

Our own institution, BanKO in the Philippines, represents a new type of business model that has emerged over the last few years as these two industries have begun to directly intersect.

Indeed the mobile phone is a critical component of BanKO’s strategy. When we first started our retail microfinance loan operations in 2010, we used loan officers similar to what traditional MFIs use. But this soon proved to be too labor-intensive and too costly. We knew that our business model wouldn’t hold up if we had to do traditional house visits for loan due diligence.

Instead, we decided to sign up new customers to accounts that bundle savings, insurance and eventually credit. Account opening takes place at agent locations where the agents are certified to perform “know-your-customer” (KYC) registration, allowing customers to leave with a fully- activated electronic wallet and an ATM card after a 10-15 minute registration process. Actual account activation subsequently follows after the registration is approved by the bank. Because we haven’t invested in a huge branch network, the agent network is a critical component of our model.

We spent considerable time at the start of our retail operations establishing an agent network. At first, we had planned to rely primarily on GCASH agents. BanKO is a three-way partnership among Bank of the Philippine Islands, Globe Telecom, and Ayala Corporation, so the link to GCASH - a mobile wallet service available to Globe customers - made sense. But we soon realized that not all GCASH agents would be able to handle the liquidity needs of BanKO customers. So we began to sign up our own agents through partner outlets.

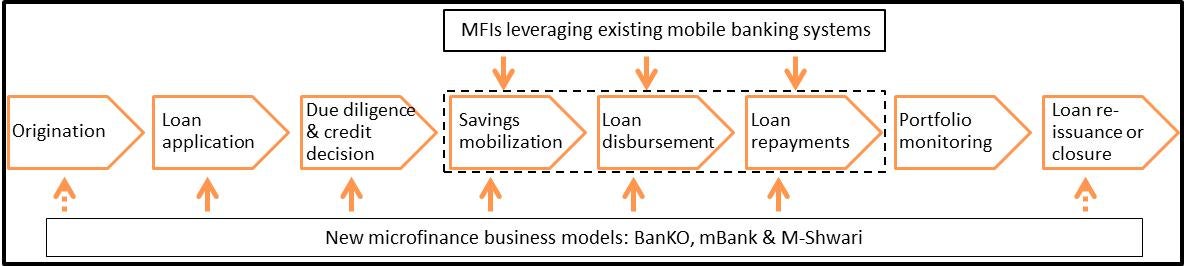

As the CGAP Focus Note points out, what makes BanKO and several other new businesses like mBank and M-Shwari different from most of the MFIs profiled in the paper is the way we have begun to leverage m-banking at many more points along the microfinance business process, as illustrated in the graph below.

What does this mean in practice? In BanKO’s case, we use m-banking to facilitate remote customer registration at agent locations. We use transaction histories as a key tool for carrying out due diligence and underwriting loans. Our business model is based not just on loan balances but also on transaction volumes and savings.

But ultimately the main differentiation comes from the cost effectiveness of our operations. We rely on just over 200 employees for 400,000 customers. Our retail loans are provided on average at 2.5%-3.0% per month on a declining balance which is slightly below market for microloans.

BanKO is starting to blur the lines between microfinance and mobile banking. It is still very early days in our own business and for similar business models in general. But we have already begun to see good results from our work and we have learned a lot along the way. Exciting innovation can happen when elements of these two worlds begin to merge.

Read more about our work and that of many of innovative MFIs in CGAP’s Focus Note Microfinance and Mobile Banking: Blurring the Lines?

Add new comment