Financial Inclusion in Myanmar: 10 Things You Should Know

Few countries in East Asia get more attention than Myanmar these days. Since 2011, the country has embarked on a major reform of its political and economic system, including the removal of barriers to foreign investment and a more flexible exchange rate. Investors, third party payments companies, donors and NGOs are rushing into one of the last “untouched” major markets in the region. The financial inclusion ecosystem has moved rapidly, and since CGAP and the IFC co-published their diagnostic in early 2013, the landscape has continued to evolve. Here are a few things that you may want to know about financial inclusion in Myanmar.

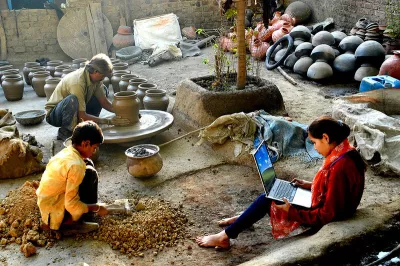

1. Did you know that more than half of the 60 million inhabitants of Myanmar work in the agriculture sector and that agriculture provides some form of livelihood to over 70 percent of the population? Poverty is quite high at 25 percent of the population and Myanmar ranks 149 out of 186 countries on the Human Development Index.

2. Did you know that that less than 20 percent of the population has access to formal financial services? Most people use informal ways to save (e.g. gold), to borrow (e.g. friends and money lenders) and to transfer money (traditional agents). A couple of state owned banks, such as Myanmar Agriculture Development Bank and the Myanmar Economic Bank are engaged in financial inclusion, but commercial banks focus on the upper segment of the market.

3. Did you know that microfinance was an early priority for the new government, and that the parliament issued a Microfinance Law in November 2011? Several elements of the law directives and instructions do not follow global good practices, such as the capped interest rate spread and the very low minimum capital requirements, but some revisions are expected.

4. Did you know that 177 microfinance institutions had received a license to operate as a microfinance institution from the Myanmar Microfinance Supervisory Enterprise by May 2013 and this number has continued to increase? Most of them are very small organizations with less than a thousand clients, and only a handful of MFIs have a chance to reach significant scale in the future. The largest operator, PACT Global MFIs, is serving over 500,000 clients and has worked in Myanmar since 1997.

5. Did you know that global leading providers, such as ACLEDA Bank, have also received licenses to operate as MFIs in Myanmar? Other global champions such as Basix and ASA are expected to follow soon. Such a development will help Myanmar learn from global champions and hopefully help the industry move from a “microcredit” focus towards a full financial inclusion ecosystem that provides diverse financial services needed by the poor.

6. Did you know that the telecommunication sector is in full transition? While the sector was dominated by a state-owned monopoly for the past few years, two international mobile operators - Norway’s Telenor and Qatar’s Ooredoo - have been selected to get licenses, now that a new telecommunication bill has been issued. They will compete with two state-owned operators (Myanmar Posts and Telecommunications, or MPT and the Yatanarpon Teleport Co (YTP).

7. Did you know that mobile phone penetration is around 11 percent? According to GSMA, Myanmar is one of the third least penetrated mobile markets in the world. This will change fast with the government target of 75-80 percent of mobile phone coverage by 2016. Telenor has committed to cover 83 percent of the country for voice and 78 percent for data after five years. And Ooredoo has committed to reaching 84 percent for both voice and data.

8. Did you know that mobile banking could play a major role for Myanmar to leapfrog financial inclusion? As was the case in Kenya, the provision of payments and savings to the poor by mobile phone could significantly accelerate financial inclusion. Telenor, Oreedo and the national MNOs are interested to launch mobile banking. Telenor expects to have 70,000 points of sale for SIM cards and Ooredoo has planned 240,000 points of sale. These points of sale could become “branchless banking agents”. In addition some banks such as the Cooperative Bank of Myanmar are testing agent banking.

9. Did you know that the Central Bank is developing new regulations to foster mobile banking? In July 2013, the Central Bank of Myanmar became autonomous from the ministry of finance after the Law of the Central Bank was passed in government. A key responsibility of the central bank is payments and mobile banking.

10. Did you know that many international donors and investors are supporting financial inclusion in Myanmar? UNDP started funding microfinance projects in the mid-90’s, and was followed by several other agencies through the LIFT trustfund. Bilateral agencies such as DFID and USAID have been particularly active in recent years. The World Bank Group (IFC and the World Bank) are supporting the regulatory framework and good practices in the industry, and UNCDF is completing a MAP diagnostic.

Comments

The blog provides useful

The blog provides useful information about the financial inclusion initiatives and various bottlenecks to be faced in Myanmar.

The banking regulator and commercial banking sector both are at an evolving stage which can lead to MFI capture as in many areas banking policies are yet to mature, especially in deposit taking.

Roll out of mobile banking offers interesting possibilities as it can ride the roll out of telecom networks without any legacy issues.

Myanmar people deserve a better future and if the financial inclusion helps them in increasing entrepreneurial expansion, it will be good for the economic growth of Myanmar and Asian region.

Great analysis of the status

Great analysis of the status quo. Regulation may turn out to be the most important factor for successful financial inclusion in Myanmar in the coming years.

Great Blog Eric,

Great Blog Eric,

Myanmar is the place to be

Actually the MMSE has now licensed 189 MFIs. Given that the MF law was just passed 25 months ago would seem to make Myanmar one of the most dynamic MF environments in the world.

The MAP supply and demand diagnostic guided by the government and UNCDF has given a wealth of information which will culminate in setting the ground work for a financial inclusion road map. If Myanmar plays its cards right it wont be long before it will catch up with many of its ASEAN neighbors in financial inclusion and development.

Thanks Eric for excellent

Thanks Eric for excellent analysis very useful for those glancing at Myanmar’s Financial Sector. I would also like to share my comments.

Still majority of the commercial banks are serving upper segment of the market. But two private banks have started their microfinance services in the rural areas. I think others prefer to wait and see.

Co-op sector should also not be left out when we foresee Myanmar’s microfinance sector. About 40% of licensed MFIs are co-op societies. There are more than 2,000 co-ops providing microcredit services in Myanmar. Out of them only 76 were licensed for microfinance services. In addition, the Central Bank has issued banking license to Myanmar Microfinance Bank for the wholesale loan to the MFIs while the majority of Board of Directors are from the co-op societies. This bank can be major competitor for the financial service investors.

LIFT-fund has allocated USD 40.74 million for the financial inclusion in Myanmar and committed to continued support to microfinance industry in Myanmar (www.lift-fund.org).

Very Useful Information

Very Useful Information

Thank you very much for providing very useful information about the county situation and specially on microfinance sector in Myanmar.

shabbir Ahmed Chowdhury

Advisor, Training

Institute of Microfinance

Bangladesh

wow, this really a good blog

wow, this really a good blog for me to deeply know how the banking sector in Myanmar.

but could anybody give me a hint about how to get more accurate and detail information about the banks in Myanmar? e.g. Annual report of KBZ and CB bank... thanks in advance!

Dear Daphne, thanks for your

Dear Daphne, thanks for your kind comment. You may want to take a look at the recent GiZ report on the financial sector. http://star-www.giz.de/starweb/giz/lit/servlet.starweb?path=giz/pub/pfl…

Warm regards

Eric

The potential for SHG"s to

The potential for SHG"s to play a major role in rural Mynamar as happened in India should not be forgotten by donors . The worse scenario is capture of market by commercial micro finance. Commercial micro finance with high interest rates should focus on small business and leave the poor to co-ops and SHG's. Then eventually these borrowers can move to commercial rates . SHG's have the important added potential of socially empowering people.

Add new comment