Price Sensitivity and the New M-Pesa Tariffs

Last week Safaricom set consumers in Kenya abuzz with the announcement of significant reductions in their person-to-person (P2P) mobile money transfer fees for transactions of Ksh1,500 (approximately $17) and below. Safaricom has heavily promoted the reductions, including full page adverts in national newspapers (a comparison of the new and old rates is available online).

M-Pesa newspaper advertisement

M-Pesa newspaper advertisement

Sample full page advertisement from a Kenyan newspaper. Photo Credit: Rafe Mazer

Many commentators have noted that this is likely a direct response to the highly competitively priced tariffs on P2P mobile money transfers that Equity Bank announced it would offer through its new MVNO subsidiary Finserve. Equity proposes a charge of 1% of the transaction value, capped at a maximum of Ksh25. This demonstrates that increased competition, or even the perceived threat of it, can create welfare benefits for consumers. Safaricom itself has noted that transaction values in the range of the fee decreases account for 65% of their transaction volume, and so the benefits of these changes could be large for lower-income P2P consumers as a whole.

While Safaricom has reduced their charges on low-value P2P transfers, they have also raised them on higher value P2P transfers by as much as 82%, likely an attempt to make up for the lost revenue from the reduction in low-end P2P rates. But this only works if consumers sending higher value transfers maintain their usage rates – or at least don’t overly reduce their transactions – as a result of the increased fees. In reality this may not be a bad assumption by Safaricom. In one experiment, mentioned in the book Scarcity, that tested shoppers’ willingness to travel greater distances to save money on appliance purchases, researchers found that wealthier consumers tend to think in terms of savings relative to the cost of an item, while less wealthy consumers focus on the actual monetary value of the savings. In this scenario, consumers were given the option to drive an extra thirty minutes to save $50 on an appliance priced at either $100, $500 or $1,000. The study was run in both a high-income and a low-income community. The results found that 54% of shoppers in the high-income community would travel the extra 30 minutes to save on the $100 appliance, but only 39% and 17% of them would do so on the $500 and $1,000 appliances, respectively. By contrast, 76% of shoppers in the low-income community would travel to save on the $100 appliance, and more importantly 73% and 87% would still travel the thirty minutes to save $50 on the more expensive appliances. With this in mind, let’s revisit those old versus new M-Pesa P2P tariffs.

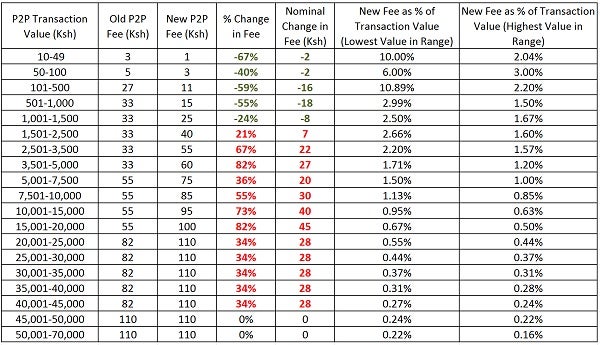

M-Pesa tariffs

M-Pesa tariffs

While the data is not perfectly linear, the nominal change in fees is generally higher for the larger value transactions (the values in red). These increases are also relatively high as a percentage of the old P2P fees, ranging from 21% to 82%. On the lower-value transfers (the values in green), we also see significant reductions in P2P fees that range from 24% to 67%, although lower nominal reductions in charges than the higher value transactions.

The last two columns show a different interpretation of these changes in prices - how the new prices relate to the amount to be transferred. Here one can draw parallels to the case of the appliances - those consumers (generally wealthier) sending large-value transfers could be expected to have only a moderate reaction to the increase in P2P fees, since they remain a small fraction of the amount they are sending (M-Pesa is also a much more convenient way to send large amounts of money than alternatives such as courier service or with a friend or family member, which certainly influences price sensitivity as well). In this way, it seems like M-Pesa’s strategy of using the fees from high-value transactions to make up for losses of fees from low-value transactions could work.

Two points are less certain. First, how will consumers sending low values react to the reduced fees, which are large in relative terms, but low in nominal value? Second, what might happen around the point of inflection where the change in fees shifts from a 24% reduction when sending Ksh1,500 to a 21% increase in the fee when sending Ksh1,501? Are consumers price aware and price sensitive when using M-Pesa? If so, one should expect a spike in transfers at or just below Ksh1,500, and a sharp decline in transfers just above Ksh1,500.

Understanding consumer engagement and behavior, transparency, price sensitivity and the potential for new entrants are just some of the important aspects of the competition dynamics in mobile financial services. Understanding the role that the competitive environment and, equally importantly, competition policy play in the development of mobile financial services is clearly important for promoting financial inclusion, as evidenced by Safaricom’s sharp reduction in prices after Equity’s MVNO, and their recent abolishment of agent exclusivity clauses. CGAP is currently undertaking an analysis to better understand the relationship between competition and financial inclusion, encompassing demand-side themes such as price sensitivity, provider-side themes such as market shares and the partnerships between firms, and the regulatory environment, and will be sharing more research on this and other related areas of competition in mobile financial services in the coming months.

Add new comment