It's Time to Listen to the Voice of the Consumer

An exciting cadre of innovative and entrepreneurial firms are using advanced data analytics on non-traditional data sources in an attempt to significantly alter the economics of targeting, assessing and extending credit to underserved customers in emerging markets. Other contributors to this blog series have framed the opportunity in this space, and have outlined their reasons for excitement and caution.

At Omidyar Network, we believe this emerging space, credit-scoring consumers via advanced analytics on non-traditional (sometimes ‘big’) data sources, has tremendous potential for expanding the boundaries of financial inclusion. Done right, it can deliver cheaper, better financial services to underserved consumers in emerging markets. It can also lower the cost to score and serve otherwise excluded segments, such that they gain access to formal services.

Photo: Marco Simola

A couple of examples drawn from our portfolio help illuminate this point:

- Cignifi leverages pre-paid mobile call record data (e.g. call and SMS frequency, caller network, call duration, top-up payment patterns, etc.) to enable their partners (financial institutions and mobile operators) to better segment customers, determine credit scores and intelligently target a broader customer base with tailored products.

- Lenddo uses customers’ social media activity, networks and reputation as proxies to determine creditworthiness and accordingly extend them loans –both as a lender, and also in partnership with other lenders.

However, as with any nascent market, there is still enormous ferment, as these young firms experiment with models and markets, partners and consumer segments. For instance, compared to the finely-tuned credit scoring methodologies that credit bureaus have refined over the years, their algorithms are newer. We must allow them time to improve their scoring accuracy, both on a standalone basis, and in partnership with existing credit bureau scores. In the next few years, we should also expect questions about, and evolutions in, business models, including competition modes and partnerships, as well as the policy and regulatory landscapes.

Will these models succeed in delivering cheaper and better credit to underserved consumers in these markets? Will they lower industry cost-to-score and cost-to-serve such that otherwise excluded segments gain access to new services? The answer depends not only on these business models successfully delivering on their promise, but also on the surrounding ecosystem to strike the right balance between enterprise support and consumer protection.

Our contention is that the voice of the consumer is a critical input to striking this balance.

If the promise of these models is realized, we’ll have brought into the fold many consumers who are new to formal financial services; consumers whose opinions have probably not been taken into account to date. It is important to ask existing and prospective end-consumers of these ‘big data’ services about usage patterns and behaviors, and what drives these decisions. Likewise, we must seek to understand their aspirations for, and barriers to, financial security. In and of itself, the answers will be valuable in unearthing insights for future business models.

Nevertheless, this space also generates additional questions, operating as it does at the intersection of digital services, consumer data and financial products. Consequently, there isn’t a better time to start asking these questions about privacy and trust, about informed consent and exchange of information, about the perceived trade-off between protection and participation in the formal financial system.

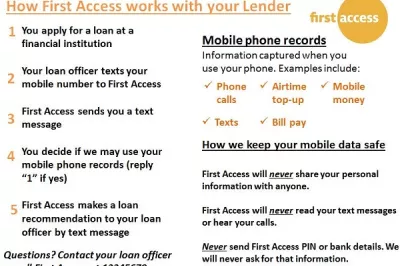

CGAP (in connection with First Access) has done some targeted work on understanding consumer attitudes to products, privacy and informed consent in Tanzania. Further research and evidence from a larger, more in-depth study of various demographic segments in markets where such services are already available can yield critical insights.

Omidyar Network is therefore commissioning consumer research in Kenya and Colombia to better understand:

- Who are the (potential) consumers of these services – what segments exist and how do their preferences differ?

- What are their financial and digital behavior and usage patterns? Why do they choose to use such ‘big data, small credit’ services?

- What are the current barriers to access (e.g. to credit)? What are the consumers’ aspirations from financial services?

- How do they assess the value proposition from this new set of offers? What concerns does it raise?

- Do consumers understand the tradeoff between the exchange of (often, private) information versus access to services (e.g. credit)? How do they decide what information to share, and with whom?

- What creates trust / lack of trust for consumers vis-à-vis financial institutions? What would increase this trust?

- Does it matter whether consumers know they are being scored? And do they understand the range of assessment criteria at play?

- What is their current impression of ‘big data, small credit’ services? What feedback do they have for these service providers?

The answers to these questions could have vast implications for the entrepreneurial and policy ecosystems of big data for financial inclusion. It should inform how we strike the right balance between ensuring consumer protection and recourse to grievances, on the one hand, and creating an enabling environment for innovations to scale profitably by serving customers, on the other. It should help us think about data exchange-and-use protocols that guard against discriminatory segmentation, and ways in which we can ensure that the collection and evaluation of data aligns with better financial choice and security for the consumer.

Many answers won’t be available today. As new consumers enter these markets and use these services, the value proposition from such services will evolve. Competition will result in new risks and possibilities.

So, we look forward to better understanding our end-consumers. We hope to learn much from this study, and in turn, convey what we have learned to our fellow stakeholders in this space so that we can engage in a dialogue on how big data can promote financial inclusion.

Add new comment